A blockbuster Jobs Friday report is sending stocks toward a nine-day winning streak as Wall Street receives reassurance that the economy is on solid footing. Major benchmarks have recovered from the sharp losses following Liberation Day that briefly sent indices into bear market territory. Driving the current enthusiasm are signs that we are turning the page on a difficult aspect of the Trump policy agenda, namely cross-border commerce. And as the White House is nearing deals with major allies, this morning’s news of Beijing lightening its confrontational stance against Washington is adding fuel to the fire. Investors are now beginning to focus on the more positive components of the administration’s plans, which include lighter taxation, milder regulations, affordable energy prices and incremental progress on manufacturing onshoring. In consideration of the backdrop, folks are envisioning a landscape of little inflation, persistent employment growth, robust business investment and continued consumer spending that when taken together are supportive of expanding corporate earnings and softer borrowing costs. Traders are reaching for risk assets hand over fist by scooping up shares in every sector, cyclical commodities and forecast contracts while they trim exposures to the greenback, Treasuries and volatility protection instruments.

Labor Market Strength Persists

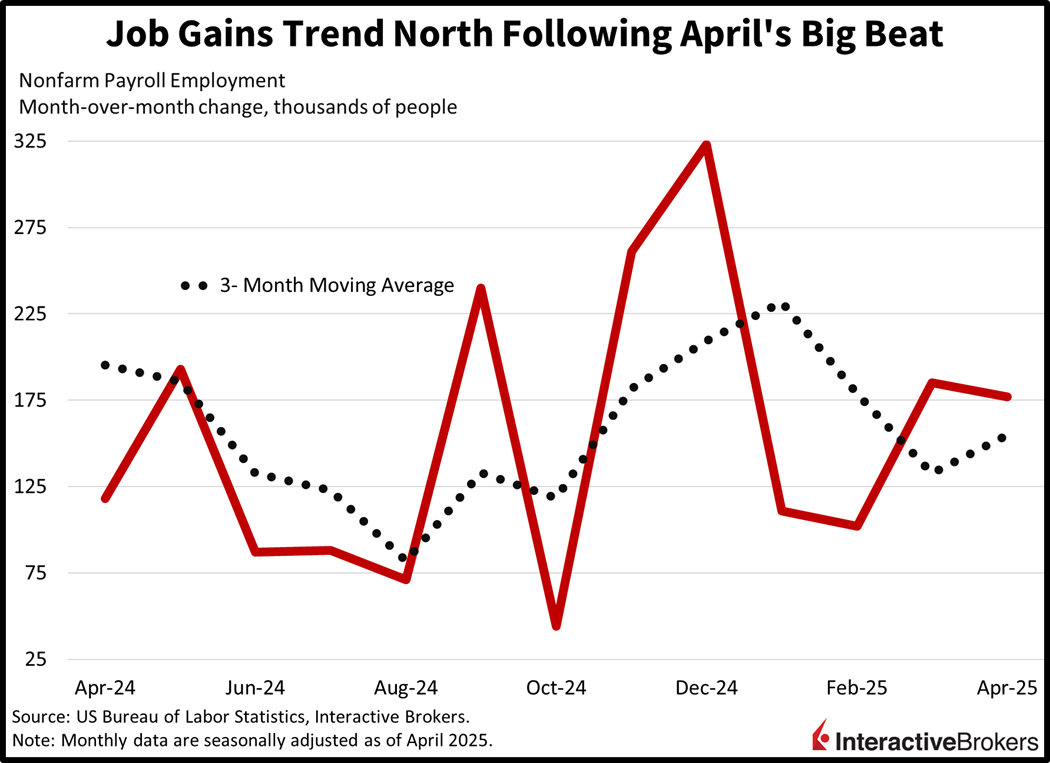

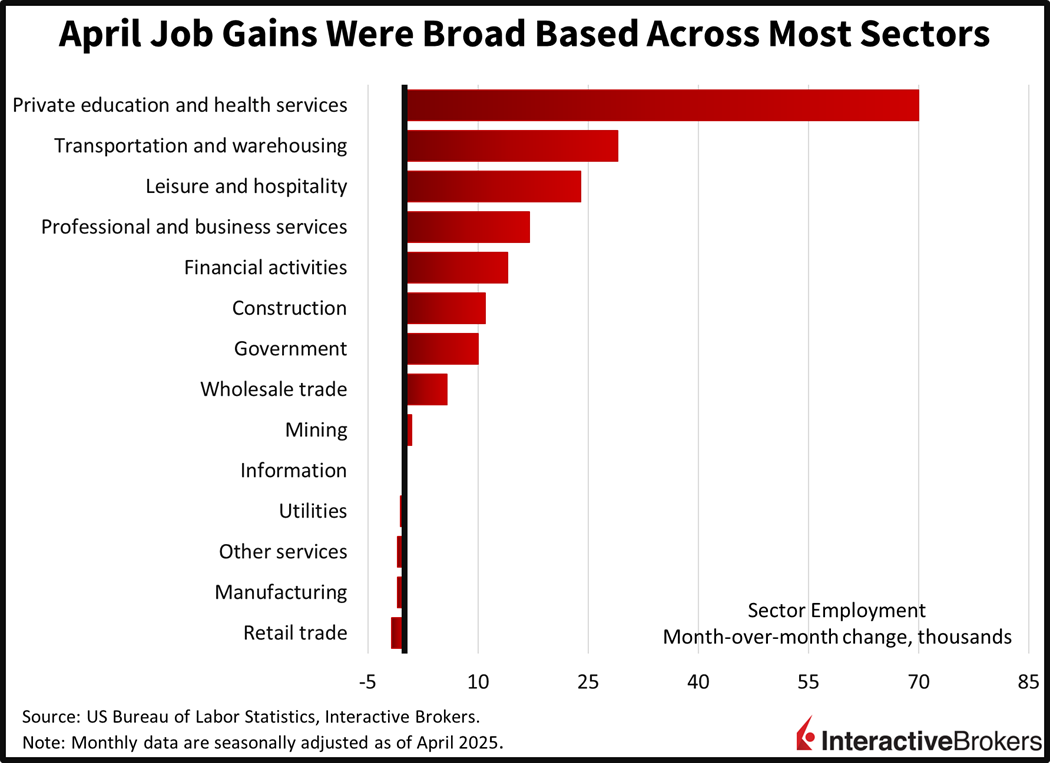

The US labor market strengthened broadly last month, according to this morning’s Employment Situation report from the Bureau of Labor Statistics. The 177,000 headcount additions blew past the median estimate of 130,000 and was slightly lighter than the downwardly revised 185,000 from March. The private education/health services, transportation/warehousing and leisure/hospitality segments drove the big beat, adding 70,000, 29,000 and 24,000 positions. All other gaining sectors expanded rosters by 17,000 and less. Meanwhile, a reduction in the federal government’s roster was totally offset by increases in the state and local components. Conversely, retail trade, manufacturing, other services and utilities trimmed workforce totals by 1,800, 1,000, 1,000 and 600. The information category came in unchanged.

Unemployment Rate Is Unchanged

The 4.2% unemployment rate held steady as expected and depicted continued tightness in employment conditions. Other positive developments included a gain in the total labor force and its percentage of participation. Average hourly earnings decelerated to 0.2% month over month (m/m), the slowest pace in 20 months, while forecasters estimated an unchanged tempo of 0.3%. Projections called for an increase in the annualized compensation figure to 3.9% year over year (y/y), but it remained equal to March’s 3.8% change. Slower paycheck growth is welcome from an inflation perspective, but it is a modest headwind to consumer spending.

Factory Orders Increase

Factory orders expanded in March as momentum for durable goods purchases overwhelmed the sluggish non-durable segment. Transactions grew 4.3% m/m, slightly missing the 4.5% expectation but accelerating from the 0.5% February rate. The 9.2% gain in durables was partially offset by a 0.3% decline in non-durables.

Equities Stage Broad Rally

Animal spirits are dominating markets and every major domestic equity benchmark is gaining more than 1%. The Russell 2000, Nasdaq 100, S&P 500 and Dow Jones Industrial gauges ae advancing 1.8%, 1.4% 1.3% and 1.1% with all 11 major components in the green. Financials, technology and industrials are leading the bulls; climbing 1.8%, 1.7% and 1.6%. Treasurys and the greenback are getting trimmed, however, with the 2- and 10-year Treasury maturities changing hands at 3.81% and 4.31%, 11 and 9 basis points (bps) heavier on the session. The Dollar Index is losing 61 bps despite loftier borrowing costs, meanwhile, and is depreciating relative to all of its major counterparts, including the euro, pound sterling, franc, yen, yuan, loonie and Aussie tender. Commodities are tilted bullishly with gold, copper, lumber and crude oil up 0.6%, 0.6%, 0.3% and 0.2% while silver declines by 0.7%. Crude oil is limiting gains ahead of tomorrow’s OPEC + meeting where anecdotal evidence suggests that Riyadh will try to influence cartel members to increase supplies.

When Will the Winning Streak End?

Subdued price trends, solid consumer spending and an improved outlook on trade point to a winning streak that can continue extending. Moreover, the Fed is in a position to reduce short-term rates at its June meeting against this economic backdrop, with our prediction landscape offering a 40% probability of a cut in a little more than six weeks. The multiple consecutive sessions of bullish gains signal an investor community that is now looking ahead to the pro-growth policies of the Trump administration with the same enthusiasm that sparked the post-election day rally as well as February’s all-time high for the S&P 500 at 6147. We’re still roughly 8% away from that peak and continued positive developments from Washington and Wall Street shall have us back there by year-end. In contrast, however, a reversal of fortunes on the trade front, namely failures to secure deals that contribute to a reignition of inflationary pressures, could certainly temper the energetic sentiments and lead to some giveback.

International Roundup

Euro Area Inflation Stabilizes

Euro area inflation was steady last month with the preliminary Consumer Price Index (CPI) print showing costs rising 0.6% m/m and 2.2% y/y, matching the results from March, according to Eurostat. For the y/y metric, analysts anticipated a print of 2.1%. The Core CPI, which strips out the more volatile prices for energy, food, alcohol and tobacco, climbed 1% m/m, the same pace as March, but the y/y 2.7% gain exceeded the estimate of 2.5% and the preceding month’s 2.4% gain. Within the headline result, energy costs declined 2.3% m/m, but the service sector led gains with prices climbing 1.3%.

Euro Area Unemployment Rate Is Stable

The March euro area unemployment rate of 6.2% was unchanged from February but slightly higher than the estimate of 6.1%. In the year ago period, the unemployment rate was 6.5%. During March of this year, the total number of unemployed individuals increased by 74,000 from the preceding month and 340,000 from one year ago.

Hong Kong GDP Accelerates

Hong Kong’s gross domestic product (GDP) grew 2% quarter over quarter during the first three months of 2025, according to an advance estimate. The pace picked up from the 0.9% in the fourth quarter of 2024 and was the strongest result since the first quarter of 2023 when the economy expanded 3%. On a y/y basis, GDP expanded 3.1% compared to the 2.5% pace in the last three months of 2024. Within this metric, exports of goods grew 8.7% followed by the 7.4% increase of goods imports. As a major re-exporter, imports have a positive impact on the country’s growth. Exports and imports of services, furthermore, grew 6.6% and 6.2%. Conversely, private consumption declined 1.2% and was the only major category that contracted.

But Shoppers Curtail Spending, Again

The value of retail sales in March declined 3.5% y/y in March, but the contraction moderated from the 13% drop in the preceding month. In a statement, the Hong Kong government explained that increased uncertainty regarding the global economic outlook and changes in consumption patterns have challenged spending. Economic weakness in mainland China has also trimmed the volume of tourism. The strengthening of Hong Kong currency, furthermore, resulted in more shoppers buying items abroad. Within Hong Kong, clothing, footwear and allied products transactions dropped 10.4% y/y after tanking 14.7% in February. The category of jewelry, watches, clocks and valuable gifts, which sank 13.5% in the second month of the year, recording a 3.9% drop for March.

Trade War Dings Singapore Manufacturing

Singapore’s 19-month streak of manufacturing expansion ended in April, with the Singapore Institute of Purchasing and Materials Management (SIPMM) PMI Index falling from 50.6 in March to 49.6. A level of 50 is the contraction/expansion threshold. First-time new orders, factory output and employment all declined.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.