Editor’s note: “Brace Yourself for More Stock Market Turmoil Ahead” was previously published with the title “Painful Stock Market Chaos: You Ain’t Seen Nothin’ Yet” in April 2025. It has since been updated to include the most relevant information available.

If you’ve felt confused, frustrated, or downright sick to your stomach watching the stock market this year, you’re not alone. This has been one of the ugliest, most volatile, and whiplash-inducing starts to a year that Wall Street has ever seen…

Indeed, since January, we’ve endured:

- A 10% correction in the S&P 500 within 20 trading days (between February and March)

- An even more violent 10% drop in just two days in early April – something that’s only happened five other times in the past 100 years, all during moments of crisis like the Great Depression, Black Monday, and 2008’s Great Recession

- One of the biggest single-day rallies ever when markets exploded higher on a hint of tariff relief

- On April 10, the Dow Jones Industrial Average popped 7.9%, its biggest single-day gain since March 2020. The S&P 500 surged 9.5%, its biggest single-day gain since 2008. And the Nasdaq soared 12.2%, notching its second-best day ever.

- A post-winning-streak slump to begin the first-quarter earnings season, with all three major indices closing in the red.

- And most recently, the market soared in one of the most impressive upward thrusts in history. After closing higher for the fourth straight day, the Nasdaq was up 6.7%, the S&P popped 4.6%, and the Dow rose 2.5%, triggering some ultra-rare and ultra-bullish technical buy signals…

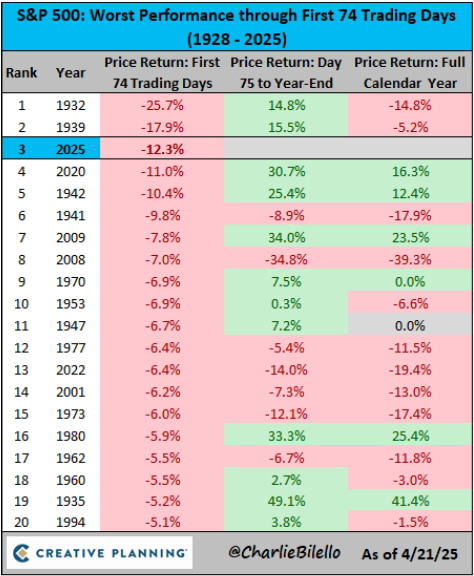

In fact, while the market recovered over the past few trading days, just last week, it was tracking for its third-worst year on record after dropping more than 12% in the first 74 trading days.

The only years that had worse starts? 1932 and ‘39 – when the U.S. was crawling through the Great Depression.

Things got that bad this year.

And if you’re wondering what caused this mess in the first place, well, you probably already know the answer…

“Liberation Day.”

How ‘Liberation Day’ Unleashed Stock Market Mayhem

It may have a positive implication, but “Liberation Day” offered no reason to celebrate.

That was the day that U.S. President Trump detonated an economic bomb of sorts, igniting one of the most aggressive, sweeping trade wars in our history.

He enforced tariffs on nearly every U.S. trading partner that were so big, many thought they would completely freeze global trade.

Consumer confidence cratered. Treasury yields surged. Widespread panic ran rampant on Wall Street.

Since then, chaos has been the norm:

- China fired back, imposing tariffs on 128 products it imports from America, including a 25% tariff to aluminum, airplanes, cars, pork, and soybeans, as well as a 15% tariff to fruit, nuts, and steel piping

- Trump responded by hiking tariffs on China even more to 125%

- Then the White House paused tariffs levied against our trading partners – excluding China – while still hiking Chinese tariffs even more

- The U.S. then exempted electronics from those ultra-high China tariffs, with talk of possible auto part exemptions as well

- All the while, the White House claims that the U.S. is having great talks with other trading partners but without any tangible trade deals to show for it

- And while trade tensions do seem to be simmering down, the White House is apparently opening probes to potentially launch a new set of tariffs on semiconductors and pharmaceuticals

It feels more like we’re watching a political soap opera instead of a functioning market.

Everyone – from billion-dollar hedge fund managers to Main Street investors – is flying blind.

But here’s the thing…

As painful as it’s been… and as confusing and volatile as it still is…

This may be nothing compared to what’s coming.

Protect Your Portfolio from the Coming Stock Market Shock

Today, roughly $7 trillion is parked in money‑market funds, earning about 4.5% while investors wait for better opportunities to pop up.

In other words, we’re all waiting for a catalyst that could be the pin that pops the “cash bubble,” unleashing a violent rotation back into stocks – what we’re calling The 2025 Summer Panic.

In fact, I’m so confident that this big event scheduled to take place very soon – May 7 to be exact – is virtually guaranteed to trigger huge moves in the market.

It has been almost 30 years since investors last saw the same one‑two punch of this bullish signal and a breakthrough technology platform. Back then it was the internet. Right now it is artificial intelligence.

When that cash stampede begins, history suggests it will not dribble in slowly. In 1997, the same signal we’re seeing today sent money‑market balances down 8% in a single quarter and ignited a two‑year melt‑up that minted millionaires.

I believe the setup is even stronger now. And on May 7, the $7 trillion sitting in cash could rush toward the very companies building America’s AI‑powered future.

That’s why, just last night, I hosted a special market briefing to reveal exactly what’s coming, why it could hit in just a few days, and how you can protect yourself… and even profit.

Because in every moment of panic, there is opportunity – if you know where to look.

Don’t wait until after the headlines hit. Get ahead of the incoming chaos, and position yourself before everyone else does.

Catch the replay of this summit while it’s still available.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Questions or comments about this issue? Drop us a line at langofeedback@investorplace.com.