Let’s be honest, folks. Out of the 500 companies in the S&P 500, only a few really can really swing the market with an earnings report or a product announcement.

For example, we’re in the heart of earnings season right now. And with 180 S&P 500 companies on deck to report earnings this week, there were only four of those “big deal” companies that both Wall Street and I had our eyes on: Apple Inc. (AAPL), Amazon.com Inc. (AMZN), Meta Platforms, Inc. (META) and Microsoft Corporation (MSFT).

Since these companies make up four of the “Magnificent Seven” stocks, we’re talking about a lot of influence on the market. The other three are Alphabet Inc. (GOOGL), NVIDIA Corporation (NVDA) and Tesla, Inc. (TSLA). (We covered Alphabet’s and Tesla’s earnings in a Market 360 last week – and NVIDIA will announce earnings on May 28.)

These stocks have been the powerhouses that have typically driven the S&P 500 during earnings season. In fact, they currently account for about 30% of the S&P 500 and nearly half of the NASDAQ 100’s market cap, so naturally, these stocks can impact the broader market’s performance.

Now, the first few months of the year were not friendly to this group of stocks. Just look at the chart below…

With all seven companies down in 2025, these earnings reports will give critical insight into what has been plaguing them – whether there are any signs of hope for a turnaround. So, in today’s Market 360, let’s dig into the four big earnings announcements this week and review the market’s reaction. We’ll also take some time to look at what my stock grading system says about each company – and how you find the best stocks for this earnings season and beyond.

Meta Platforms, Inc.

After Wednesday’s market close, Meta Platforms announced a strong first quarter.

Earnings climbed nearly 37% to $6.43 per share, up from $4.71 a year ago. Revenue rose almost 16% to $42.31 billion. Analysts expected $5.21 earnings per share on $41.36 billion in revenue, so profits came in more than 23% higher, and sales beat forecasts by about 2%.

A big part of the boost came from ads. Meta’s ad impressions – how often people saw ads on Facebook, Instagram, and other platforms – rose 5% from a year ago. And the average price per ad went up 10%. More users are also logging on. Daily active people rose 6% to 3.43 billion.

CEO Mark Zuckerberg also touched on the trade tensions during the earnings call. He said the company is in a good spot to handle any bumps in the economy.

For the second quarter, Meta forecasts revenue between $42.5 billion and $45.5 billion. The company is doubling down on its AI investments, too. It now plans to spend between $64 billion and $72 billion in 2025 – more than its earlier estimate of $60 to $65 billion. Most of that money will go toward building new data centers to power its growing suite of AI tools.

Microsoft Corporation

On Wednesday, Microsoft said its revenue hit $70.1 billion – up 13% from last year and ahead of the $68.44 billion analysts expected. Earnings came in at $3.46 per share, beating the $3.22 that Wall Street was looking for. That’s an 18% jump from a year ago.

The cloud business was the star of the show. Its Intelligent Cloud revenue totaled $26.8 billion. Within that, server products and cloud services revenue increased 22%. and Azure Cloud – Microsoft’s cloud platform – did even better, climbing 33%.

While other companies are sounding the alarm about tariffs, Microsoft didn’t dwell on it. But the big question is… are those big bets on AI paying off?

Well, AI services added 7 points to Azure’s 33% growth last quarter – the biggest boost yet. Microsoft is also rolling out AI tools like Copilot across its apps, and demand from big customers is picking up fast.

Microsoft is going all-in on artificial intelligence. Earlier this year, CEO Satya Nadella said the company plans to invest $80 billion in data centers during fiscal 2025. And this past quarter, capital spending came in at $16.75 billion, up nearly 53%.

The company also issued guidance for revenue between $73.2 billion and $74.3 billion for the next quarter, above the consensus estimate of $72.3 billion.

Amazon.com, Inc.

On Thursday after the bell, Amazon reported results that fell short of expectations.

Earnings increased 62% year-over-year to $1.59 per share. Analysts were expecting $1.36 per share. Revenue rose 9% to $155.67 billion, topping estimates for $155.12 billion.

But after digging a little deeper, Amazon’s cloud computing unit, Amazon Web Services (AWS), disappointed Wall Street. This closely watched (and highly profitable) segment brought in $29.27 billion in revenue, a growth of 17%, but just shy of expectations of $29.42 billion.

I should note that Amazon also said it’s launching a new agentic AI group. This group will build software for AI-powered tools called “agents.”

You’re going to be hearing a lot more about AI agents soon, folks. These are programs that can act on their own to complete tasks instead of just answering questions like a chatbot. For example, an AI agent could read your emails, summarize them, schedule a meeting and then send invites – all without being told what to do for each step.

Now, Amazon projected revenue between $159 billion and $164 billion and operating income between $13 billion and $17.5 billion. Both of those were slightly below analyst estimates. The company is also navigating tariff-related challenges, with CEO Andy Jassy emphasizing efforts to maintain low prices and adapt to potential impacts.

Apple, Inc.

Apple earned $1.65 per share in its second quarter of fiscal year 2025. That’s up 8% from a year ago and slightly ahead of analyst estimates for $1.63. Revenue came in at $95.36 billion, up 5%, and just above analyst’s expectations for $94.75 billion.

Digging a little deeper, iPhone sales rose about 2% year-over-year to $46.8 billion, topping forecasts. Mac and iPad sales also both beat estimates, bringing in $7.9 billion and $6.4 billion, respectively.

Apple’s increasingly important Services business continues to soar, bringing in $26.6 billion, up 12% and just shy of expectations for $26.7 billion in revenue.

As for the elephant in the room: tariffs. When asked about potential impacts, CEO Tim Cook kept things vague. Apple didn’t offer specific revenue or earnings guidance for the June quarter, either. But Cook did warn the company expects a $900 million hit from tariffs – a signal that trade tensions are starting to show up in the numbers. To help offset that, Apple is moving more iPhone production to India and expects most U.S.-sold units will be made there by 2026.

Closing Thoughts

Now, following these earnings, Meta and Microsoft opened 7.8% and 9.1% higher, respectively, on Thursday. Meanwhile, on Friday, following their lackluster numbers, Amazon was roughly flat, while Apple was down by about 3.75%.

Overall, it was a mixed bag for these Big Tech companies. But I think there are two key takeaways here. First, the impact of tariffs on these companies is compound and complex. These reports cover the period before Trump effectively challenged China to a trade war, so we should continue monitoring things. Second, the AI Boom is still on, folks. In fact, it continues to gain steam.

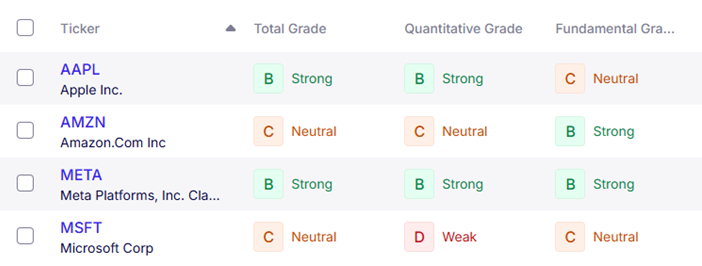

So, are any of these four stocks good buys right now? Let’s take a look at what my stock grading system has to say…

Apple and Meta receive a B-rating, which makes them a Buy. However, Amazon and Microsoft earn a C-rating, which makes them a Hold. I should also note that both have weak ratings for their Quantitative Grades, which tells us that institutional buying pressure is dwindling in both.

In other words, my system is telling us that Apple and Meta are worth considering, while investors should be cautious about Amazon and Microsoft.

What My System Is Flagging Now

Now, each of these companies has had a hand in some of the incredible innovations we’ve seen over the past few years. And each one of them has created a fortune for investors.

Thanks to my system, I’ve had a front-row seat. In fact, it identified each one of these companies before they became mega-cap household names.

And now, my proprietary system is lighting up in a whole new way. It’s pointing to a powerful economic shift unlike anything I’ve seen in my four decades on Wall Street.

You see, an unprecedented economic force is reshaping America’s financial landscape at breathtaking speed.

On the good side, it’s creating extraordinary wealth opportunities. On the bad side, it’s causing a systemic elimination of careers once considered “secure.”

And this transformation isn’t just affecting a single industry or sector – it’s fundamentally altering the very foundation of our economy.

That’s why I’ve prepared this brand new video that explains exactly what’s happening, why it matters to you and, most importantly, what specific actions you need to take now to ensure you’re positioned on the right side of this historic wealth divide.

I strongly encourage you to take some time out of your day and watch this immediately.

Click here to watch my special briefing now.

Sincerely,

Louis Navellier

Editor, Market 360

The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

NVIDIA Corporation (NVDA)