Yesterday, we took our customary look at market pricing in Tesla (TSLA) options ahead of that company’s earnings. Options traders once again failed to fully anticipate the post-earnings volatility – roughly 8% was priced in, not the double-digits that we see this morning – and I wavered in my contrarian (correct!) view about the likely direction of the stock afterwards.

It’s a good thing for the TSLA faithful that this is the rare company that can miss on almost every financial metric yet still rally. Revenues fell short, coming in at $21.3 billion, below the $22.3 billion estimate, and down -8.7% from last year. Adjusted earnings per share (EPS) missed too, with the $0.45 result coming in well below the $0.52 consensus estimate. Cash flow was a stunning -$2.53 billion, when +$441 million was expected.

With results like these, any normal company would get shredded. But TSLA is not now, nor has it ever been, a normal company.

Instead, TSLA rose about 9% in aftermarket trading even before Elon Musk’s conference call began. No one knows better than Elon Musk that TSLA investors have always been firmly focused on the future. Thus, when the Chairman continued to stoke enthusiasm about a robotaxi and acknowledged that, contrary to reports, TSLA would indeed be focusing on the widely anticipated new entry-level car, that was the sort of buzz that put the stock price into ludicrous mode.

As I was writing yesterday’s piece, something nagged at me. For the first time in several quarters, there appeared to be some actual risk aversion priced into the options. When there was little concern ahead of earnings, the stock fell -9% or more after four consecutive reports. My gut was telling me that there was an awful lot of bad news priced in. I wrote about it – twice – but didn’t trust the courage of my convictions:

Bearing in mind that we advocated for TSLA’s ouster from the Magnificent Seven ahead of January’s earnings report, I now have a nagging contrarian belief that a significant amount of bad news may already be priced into the stock, even if there is a precarious lack of support down to the $100 level.

The contrast between the relatively sanguine view that the options market held last quarter and the more normal view held today are what leads me to the potential for a contrarian bounce today. I don’t believe that is the base case and would feel far more confident in that view if the options market showed true nervousness and the stock’s technical picture was less dire. The psychology surrounding TSLA has become increasingly gloomy, something unfamiliar to the long-time faithful. It will be up to TSLA’s chief executive and chief evangelist to restore positive sentiment to his investors.

“Don’t fight your gut” is as important as “don’t fight the tape” or “don’t fight the Fed.” If your instincts are good, trust them.

I don’t regret not buying the stock or call options. I have very strict trading restrictions, and since the idea occurred to me after those restrictions were already in place for the day, I simply couldn’t. But I strongly regret that I didn’t fully trust a gut feeling that nagged at me. Years of trading experience taught me that when sentiment gets too overwhelming in one direction or another, the result is usually the opposite of consensus. I regret not being more emphatic about that in yesterday’s piece.

Now let’s take a quick look at today’s key earnings report: Meta Platforms (META). This stock has indeed lived up to its billing as a member of the Magnificent Seven, up about 37% year-to-date, with much of that performance coming from a 20% jump after the company’s last earnings report on February 1st. Considering that performance, along with the fact that META is the sixth largest component of both the S&P 500 and NASDAQ 100 indices (assuming we combine the weights of both classes of Alphabet (GOOG, GOOGL)), this is clearly an important result.

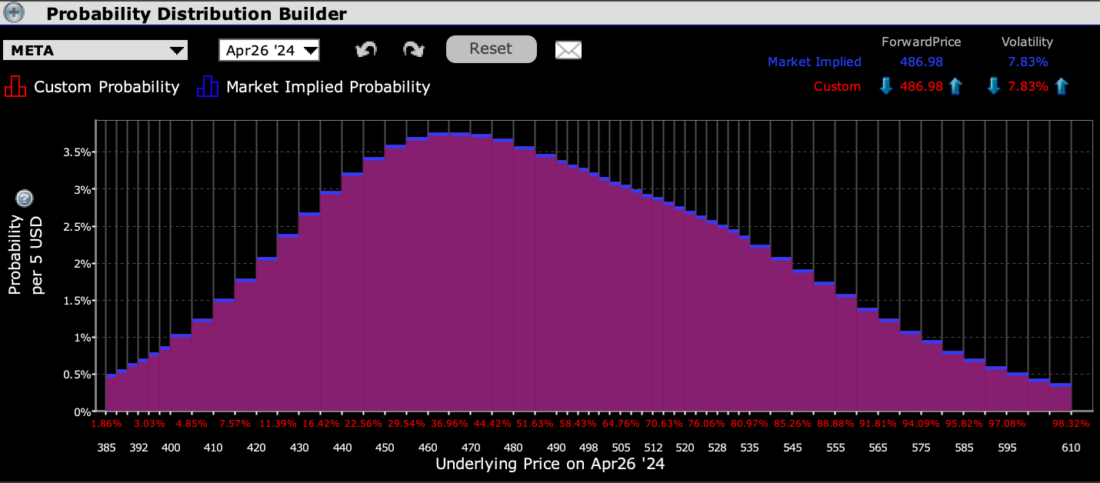

The IBKR Probability Lab shows some slight risk aversion, with the peak probability showing for options in the $475 range, below the stock’s current $485 price:

IBKR Probability Lab for META Options Expiring April 26th

Source: Interactive Brokers

At-money options are pricing roughly 9% daily moves for the rest of the week. That is below the long-term average of 8%, but well below last quarter’s 20.3% move. These levels are commensurate with those seen ahead of that blockbuster report:

META Term Structure of Volatility, Today (right), February 1st, 2024 (left)

Source: Interactive Brokers

Although we see the aforementioned bump in implied volatilities slightly below the current level, the skew for options expiring this week is rather flat for options roughly 20% above and below the current price.

META Implied Volatilities by Strike, Options Expiring April 26th (top), May 17th (middle), June 21st (bottom)

Unlike yesterday, I don’t come into this afternoon’s META results with a strong feeling one way or the other. That seems to be the case for the options market as a whole. There is some modest risk aversion priced into near-term options, but traders are hardly willing to disregard the potential for a repeat of something approaching last quarter’s post-earnings performance.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the “Characteristics and Risks of Standardized Options” also known as the options disclosure document (ODD) or visit ibkr.com/occ