Market participants are delighted with the fact that headline payrolls arrived well below projections. Slower employment growth, alongside a tick-up in joblessness and softer wage figures are propping up Fed cut wagers. On the corporate earnings front, a big beat and buyback announcement from tech behemoth Apple is also supporting investor sentiment. A sizeable miss on ISM-Services, however, did disrupt a momentous morning rally as some traders dialed up odds of an economic downturn.

Payrolls Miss, Boosting Rate Cut Hopes

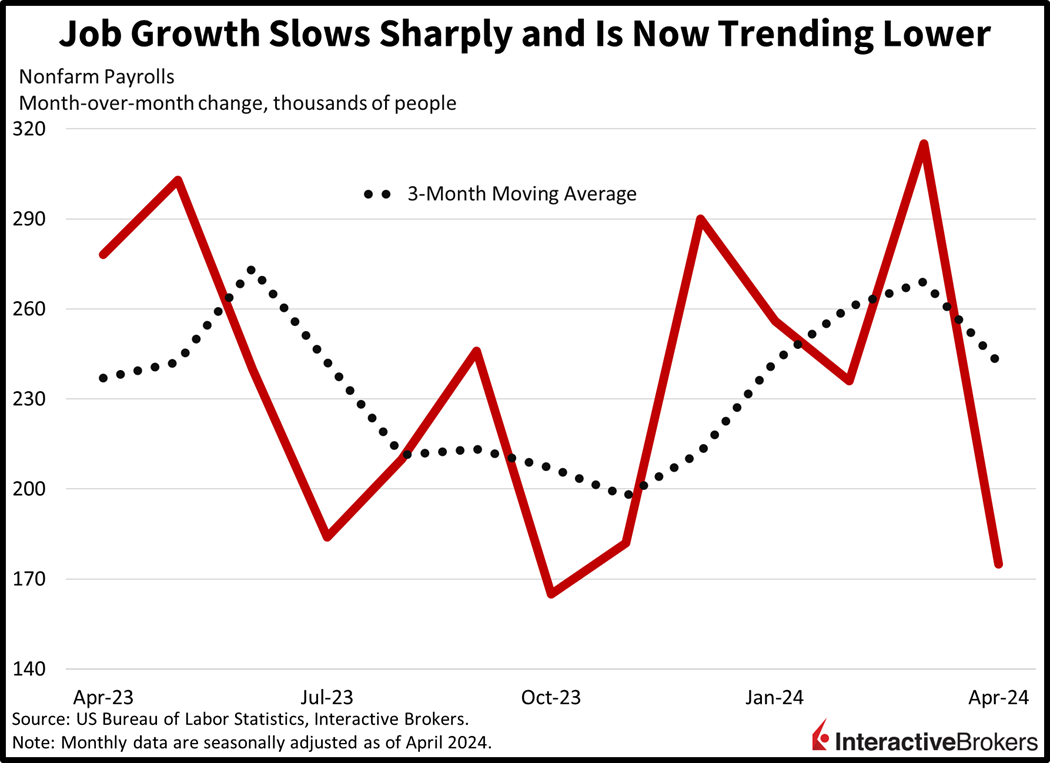

The US economy added 175,000 jobs last month, slowing down from March’s upwardly revised 315,000 while missing expectations of 243,000. In further signs of labor market deceleration, the unemployment rate shifted up 10 basis points (bps) to 3.9% while average hourly earnings ticked down 10 bps to 0.2% month over month (m/m). Economists expected both figures to arrive unchanged from the prior period. On a year over year (y/y) basis, average hourly earnings increased 3.9%, also 10 bps below projections but 20 bps lighter than the previous month.

One Sector Dominating Job Growth

April job growth was once again dominated by non-cyclical areas, with most of the month’s rise being driven by a climb of 95,000 from private education and health services. The transportation/warehousing and retail trade sectors also supported the elevation, with headcount additions of 22,000 and 20,000. All other expanding sectors brought in 10,000 net new employees or less. Weighing on the full picture were the information, professional/business services, and mining/logging segments, which saw rosters decline by 8,000, 4,000 and 3,000.

Employers Cut Hours

Further evidence that labor demand is cooling could be gathered from last month’s decline in the average hourly workweek. The hourly workweek declined to 34.3 from 34.4 in the month prior. Also, 87,000 people came off the sidelines to either begin working or looking for work last month, with the labor force expanding for the third consecutive month. The bump in the labor force did contribute to the rise in the unemployment rate, as the former figure serves as the denominator in the unemployment rate calculation. The labor force participation rate, however, did remain steady m/m at 62.7%, below its pre-pandemic level of 63.3%.

ISM-Services Point to Economic Weakness

The Institute for Supply Management’s (ISM) Purchasing Managers’ Index (PMI) for Services also reflected decelerating conditions without being friendly on the inflation side, however. The ISM Services PMI for April declined to 49.4 from 51.4 while missing projections of 52. The headline figure narrowly missed the expansion-contraction threshold of 50, marking the first time south of 50 since December 2022. Weighing on the sector were employment and exports, with scores of 45.9 and 47.9. Offsetting the weakness, however, were prices, imports, new orders, backlogs and business activity, which came in at 59.2, 53.6, 52.2, 51.1 and 50.9. Survey respondents mentioned that conditions are slowing overall while price pressures and geopolitical conflicts are clouding the outlook. Staffing declines are persisting due to challenges replacing resignations and firms looking to preserve margins.

Apple Buybacks Offset Revenue Declines

Recent corporate earnings highlight the bifurcation of Apple’s products and services categories, persistent travel demand and growth in folks engaging in cryptocurrency trading and sports gambling. A few corporate earnings highlights are available below:

- Apple stock surged 6% after it announced that the board approved a $110 billion buyback, the largest buyback in US history, which offset the company’s decline in overall revenues and earnings y/y. Still, Apple exceeded expectations yesterday with second-quarter earnings per share (EPS) of $1.52 on revenue of $90.8 billion, beating the anticipated $1.50 and $90.3 billion. Product revenues did decline y/y but services growth helped to soften the blow. Both the product and services areas did beat expectations, however.

- Expedia revised guidance lower due to its rental brand disappointing, even as total bookings chugged along. Total gross bookings came in at $30.2 billion, 3% higher from the year-ago quarter. Expedia’s stock is currently down about 13%, though, as its Vrbo, a competitor to Airbnb, showed weak demand, which led to a decline in marketing efforts.

- Coinbase is currently down 2% on the session despite the company’s Q1 profits topping the highest mark in the past nine quarters, over $1 billion due to the Bitcoin spot ETF. The ETF attracted a whole new pool of investors, which increased global trading by 68% from the year-ago quarter. The company is also benefiting greatly from the recent price appreciation in Bitcoin and other cryptocurrency assets.

- DraftKings showed a 53% revenue increase y/y as the company continues to leap over regulatory hurdles, enabling its products to reach more users. Quarterly revenue came in at $1.175 billion, up from $770 million in the same quarter a year ago and surpassing analyst expectations of $1.124 billion. A key factor in revenue growth was the addition of Vermont and North Carolina in the first quarter of this year bringing the total number of states where it’s legal to sports bet to 38.

Risk-on Sentiments Prevail

Markets are rallying aggressively as incoming data points to a shorter journey across the monetary policy bridge. All major US equity indices are higher led by the tech-heavy Nasdaq Composite; it’s higher by 1.6%. The Dow Jones Industrial, S&P 500 and Russell 2000 benchmarks are not too far behind, sporting gains of 0.9%, 0.9% and 0.8%. Sectoral breadth is positive with all sectors trading higher except for energy and consumer staples; they’re lower by 1.1% and 0.3%. Leading the charge higher are technology, real estate and communication services which are gaining 2.6%, 0.9% and 0.8%. Energy is today’s laggard due to WTI crude trading lower by 0.6%, or $0.43 to $78.58 per barrel. The commodity is facing selling pressure as traders dial down their demand prospects on the back of weaker economic data. Copper is moving north by 0.6% as lighter rates are expected to prop up manufacturing while gold is shifting south by 0.4% due to a lack of demand for risk-off instruments. The dollar and yields are moving sharply lower as investors envision rate reductions sooner rather than later, with the greenback’s index down 35 bps to 104.97 while the 2- and 10-year Treasury maturities exchange hands as 4.81% and 4.51%, 7 bps lower on the session for each. The US currency is down versus all of its major developed market counterparts, including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian dollars.

September Marks the Cut

Today’s data releases are being celebrated by market players, who are rejoicing as rate watchers mark September as the month when the first rate cut will occur. Furthermore, current pricing is now pointing to 2 rate cuts from the Fed this year. I am still expecting just one rate reduction, as underlying economic fundamentals and the loosening of financial conditions are likely to support price pressures in excess of 2%. A patient central bank, however, which implicitly accepts above-target inflation, at least temporarily, is great for stocks, which benefit from an earnings-per-share boost, all else equal.

Visit Traders’ Academy to Learn More About Payroll Jobs and Other Economic Indicators

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.