Progressives will maintain that the planet is on track to burn up, but realists will see an unfolding positive story. Transitioning our energy systems is incredibly expensive, slow and inflationary.

JPMorgan just published research (The Energy Transition: Reality check needed) acknowledging this and calling for a reset.

No big company says anything about energy without approval from its senior executives. It’s hard to think of a more highly charged topic. Forecasts that don’t assume “Zero by 50” are immediately seized upon by climate extremists as absence of fealty to the UN’s goal. BP handed off their Statistical Review of World Energy, probably after concluding it offered climate critics a soft target.

Wall Street banks like JPMorgan are voluminous publishers of investment and economic research. Jamie Dimon can obviously peruse only a tiny fraction of this output. But you can be sure he read this one given the sensitivity of the topic. Moreover, you can assume he broadly agrees with its conclusions. He has recently been critical of the Administration’s pause on new LNG permits, and has said it’s impractical to think we can suddenly stop using fossil fuels, which currently provide 82% of the world’s primary energy.

Combined with other moves, such as withdrawing from Climate Action 100+, it shows that the bank is taking a pragmatic, realistic approach. In his annual letter Dimon said, “One of the best ways to reduce CO2 for the next few decades is to use gas to replace coal.”

JPMorgan’s Reality Check research estimated that coal to gas switching could reduce emissions by as much as 17%.

We think this is not just another piece of Wall Street research but reflects JPMorgan’s pragmatic assessment of the energy transition and their role in it. Jamie Dimon has called the Department of Energy’s pause on new LNG permits “enormously naive.”

Jamie Dimon is the adult in a room full of juvenile climate extremists.

Russia’s invasion of Ukraine pushed energy security up the policy agenda for western Europe. The pandemic boosted government spending, leaving less fiscal room to fund the transition, and the inflation that followed pushed up interest rates. These three factors have rendered objectives that were already barely reachable now implausible.

Reality Check has many other useful insights. Just the planned solar and wind buildout to 2030 will take 0.5% of global annual GDP. The energy required would emit 207 million tonnes pa of CO2, equivalent of Argentina, assuming today’s energy mix of 82% fossil fuels.

This type of analysis heralds a more practical approach built around what’s possible versus the fantasies of climate extremists. It means more demand for natural gas, to the benefit of US producers and the associated infrastructure that supports them.

Wells Fargo’s Midstream Energy Weekender suggested that the sector is due to reprice higher. Their favored metric of Enterprise Value/EBITDA (EV/EBITDA) is at 8.2X. Five years ago it was around 11X, and performance since then has been good. To put these figures in context, if EV/EBITDA improved by one turn (ie 8.2X to 9.2X) that would equate to a roughly 20% price appreciation since pipeline companies are typically financed with 50% debt.

Wells Fargo also noted, “a growing realization that a confluence of factors could drive significant growth in US natural gas demand over the next 5+ years.” LNG exports, increased domestic manufacturing and demand from AI centers were the reasons cited. As regular readers know, we have long argued that natural gas infrastructure assets are cheap.

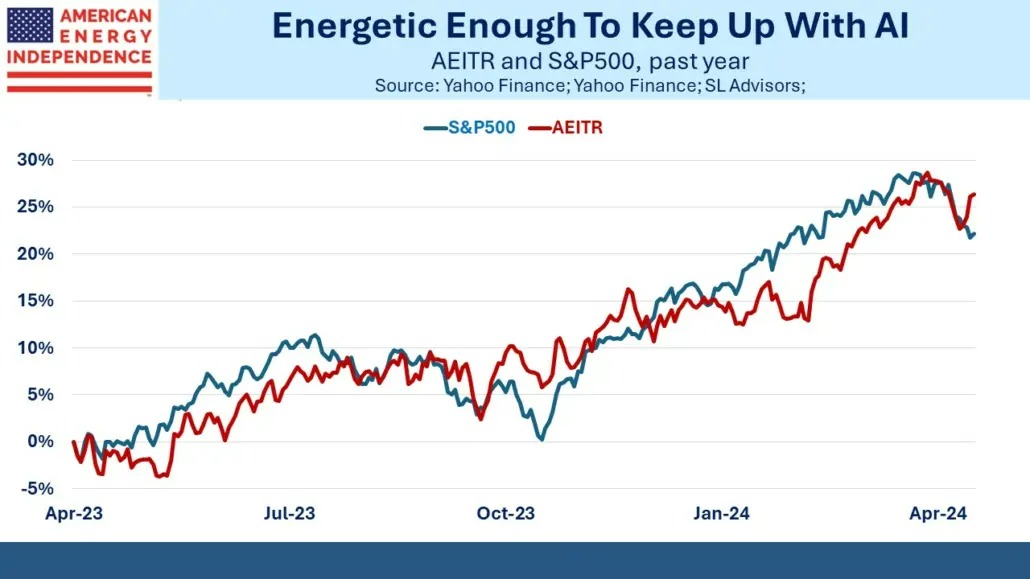

There are signs that investors are beginning to act on this opportunity. Over the past year the American Energy Independence Index (AEITR) has kept pace with the S&P500’s AI-fueled run and last week moved ahead. YTD the AEITR is +10% vs the market’s +5%.

Tesla’s stock price continues to adjust to the new reality of declining EV demand. A couple of weeks ago an Uber driver in a Kia EV with 14% battery charge remaining said he loves his car. Charging only took about 30 minutes and he could usually find a charging station within 30 miles. After dropping me at the airport he was planning to do just that.

Robert Bryce reminds us that Stanford University’s futurist Tony Seba forecast in 2014 that “By 2025, gasoline engine cars will be unable to compete with electric vehicles.” Seba predicted that Internal Combustion Engines (ICEs) would be obsolete by 2030. Tony Seba is a soft target.

Your blogger will shortly be buying a new car. I’m not opposed to an EV – they work well as golf carts for example. But the inconvenience of charging, the waiting time involved and range anxiety demand a price discount to an equivalent ICE in my opinion. Around 25% would be enough to induce me to buy one. The market’s not there yet although it’s heading in that direction. So I’ll be buying a conventional car.

—

Originally Posted April 24, 2024 – Adults Are Taking Over The Energy Transition

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Disclosure: SL Advisors

Please go to following link for important legal disclosures: http://sl-advisors.com/legal-disclosure

SL Advisors is invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from SL Advisors and is being posted with its permission. The views expressed in this material are solely those of the author and/or SL Advisors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.