Stocks are now up for eight consecutive sessions as this morning’s rally is being driven by well-received big-tech earnings and the White House reporting trade deal progress with major allies, including South Korea, Japan and India. The light at the end of the tunnel comes at an opportune time, considering that markets and the economy would benefit greatly from several cross-border agreements alongside a GOP taxation package. Furthermore, shareholders can increasingly look forward to a Fed cut or two in response to the third day in a row of softer-than-expected labor market data. Tuesday it was JOLTS, Wednesday ADP, and today it’s unemployment claims. Economists and traders alike are indeed wondering if tomorrow’s nonfarm payrolls will also disappoint, but weaker figures in the short term are likely a result of the elevated uncertainty from the Trump presidency’s first 100 days and can reverse strongly against the backdrop of policy achievements from the Oval Office coinciding with a looser Federal Reserve. The assortment of potential positive developments has investors embracing their risk-on playbooks with equities and cyclical commodities catching strong bids while folks increase their exposures to greenback futures and forecast contracts. They are trimming defensive plays, however, by reducing holdings of Treasuries across the curve, safe-haven metals and volatility protection.

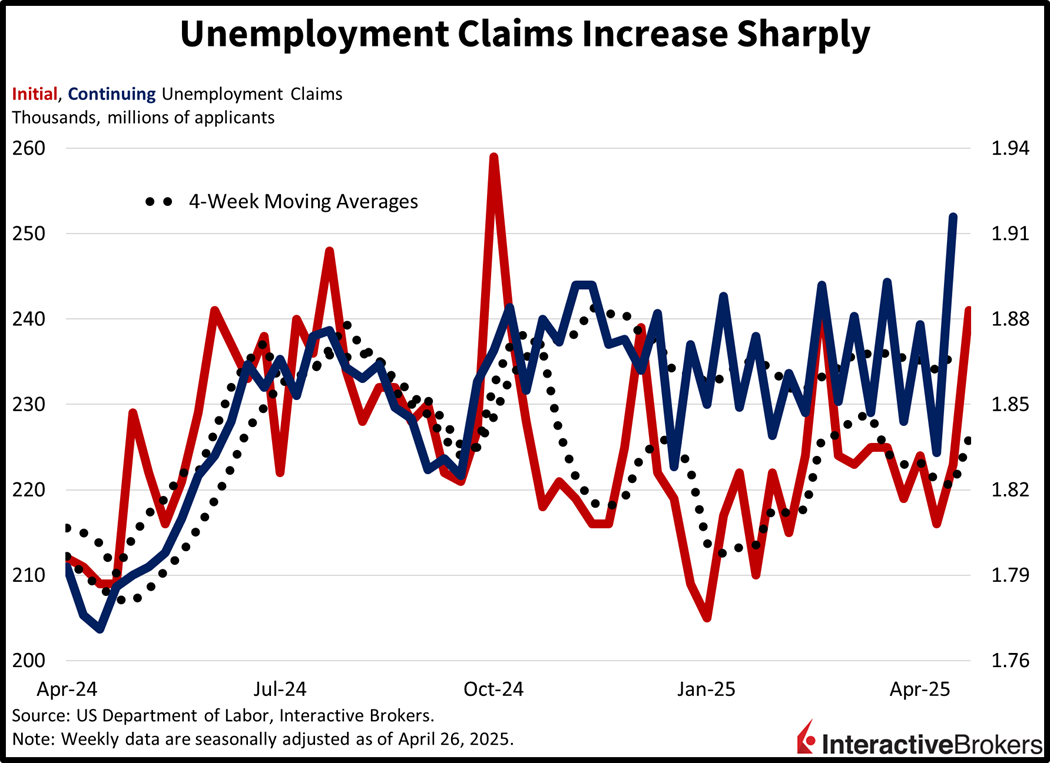

Unemployment Claims Were Worse Than Expected

Continuing unemployment claims hit the highest level in over three years and initial filings for unemployment benefits also climbed, according to data released this morning. Requests for continued unemployment payments grew to 1.916 million for the week ended April 19, exceeding the 1.860 million expectation as well as the 1.833 million from the preceding seven-day period. Initial claims, furthermore, rose to 241,000 for the week ended April 26, significantly above the projected 224,000 and the 223,000 from the previous time span. The increases contributed to higher four-week moving trends across both segments, lifting from 220,500 and 1.862 million to 226,000 and 1.868 million.

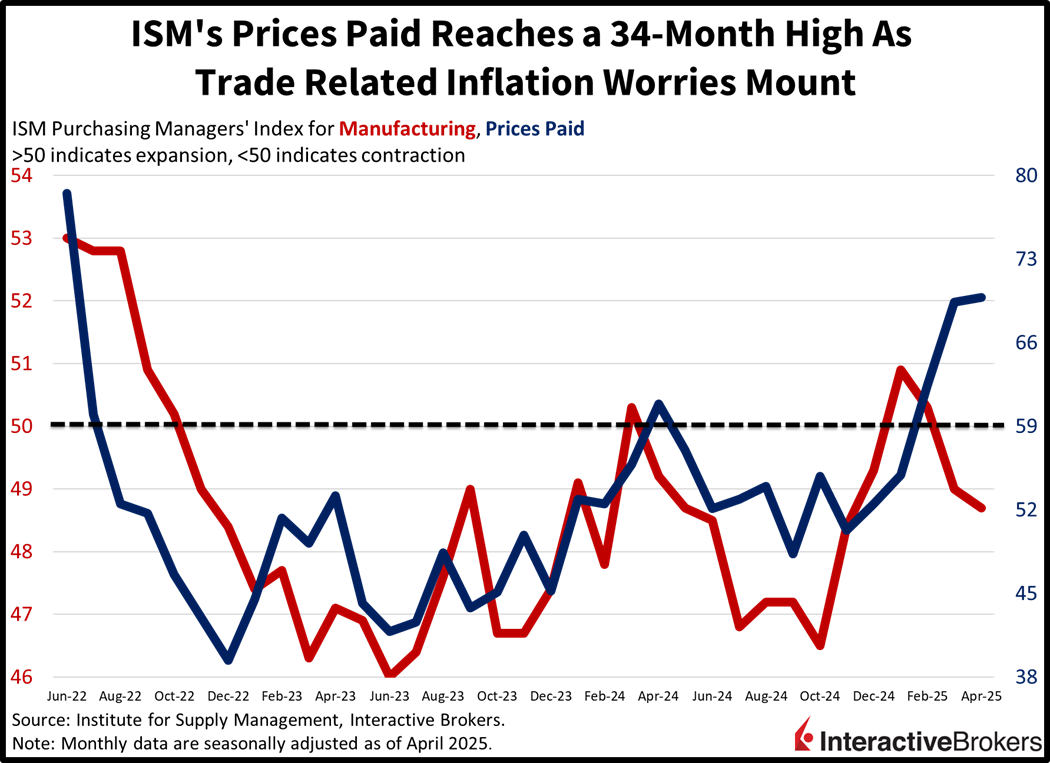

Manufacturers Report Further Weakness

Manufacturing conditions softened modestly last month, a result of an uncertain economic environment, according to the Institute for Supply Management’s (ISM) Purchasing Managers’ Index. April’s PMI score of 48.7 missed the contraction-expansion threshold of 50 but did better than the anticipated 48. March was slightly higher at 49. Goods producers focused on trimming backlogs amidst the absence of new order momentum and persistent price pressures last month. Production volumes, employment, export and import levels all contracted during the period. But prices rose at a brisk pace, extending deep into growth territory at 69.8, an acceleration from the prior print’s 69.4.

March Construction Outlays Fell

Construction spending retreated in March as investments for residential and commercial properties declined even as capital expenditures for new single-family homes and apartment buildings grew. The 0.5% m/m decline in overall outlays, which include new developments as well as renovations, additions, installations, etc., missed projections expecting a positive 0.2% figure and arrived beneath February’s 0.6% growth rate. Excluding the 0.4% drag from housing, the nonresidential segment dropped a sharper 0.5% in broad-based fashion, including lodging, office, commercial, health care, highways, etc.

Market Rally Extends to Eighth Day

Risk assets are gaining strongly today with all offensive equity sectors and major cyclical commodities achieving impressive upside. Every major domestic stock benchmark is advancing as the Nasdaq 100, S&P 500, Russell 2000 and Dow Jones Industrial gauges climb 2.2%, 1.6%, 1.3% and 0.9%. Technology, energy and utilities are leading from a component perspective and are increasing 2.7%, 1.6% and 1.5%. The defensive healthcare and consumer staples, down 1.4% and 0.4%, respectively, are the only segments losing on the session. A lift in inflation expectations following ISM’s elevated prices paid number is sending yields north, with the 2- and 10-year Treasury maturities changing hands at 3.65% and 4.20%, 4 and 3 basis points (bps) heavier. Signs of greater international collaboration alongside loftier interest rates are pushing up the greenback and its appreciating against all of its major counterparts, including the euro, pound sterling, franc, yen, yuan, loonie and Aussie tender. The Dollar Index is up 58 bps. Copper, crude oil and lumber are higher on better economic growth projections, but a lack of safe-haven demand is weighing on gold and silver, which are trimming 2.1% and 0.7%.

GDP Contraction Likely to Reverse in 2Q

Yesterday’s first-quarter GDP result was dragged down heavily by a surge in imports motivated by the April 2 Trump tariffs. But when considering the significant inventory that businesses have built up to front-run levies, the dynamic is poised to flip when we receive our look at performance in the second quarter, thanks to net-exports (exports minus imports) likely reversing from a relative headwind to tailwind. Meanwhile, other areas of this week’s report were strong. Consumer spending hung in there, business investment was astounding and the progress in fiscal conditions was welcome, although government expenditure reductions also hampered the headline. But the stock market now sees the pathway for growing earnings supported by a reaccelerating economy in the second half of this year. Indeed, investors have taxation relief, trade deals, rate cuts, lighter regulations, subdued energy costs, onshoring initiatives and the increasingly positive aspects of the Trump policy mix to be enthusiastic about in the coming months. The contraction to begin the year was nothing more than a mid-cycle adjustment amidst Trump bumps.

International Roundup

Bank of Japan Holds Key Rate

As expected, the Bank of Japan (BoJ) left its key interest at 0.5% yesterday, but it lowered its economic growth forecast in response to the ongoing trade war. The BoJ now expects 2025 gross domestic product (GDP) to expand only 0.5%, a considerable downgrade from its January expectation to grow at least 1.1%. It anticipates inflation this year to range from 2% to 2.5%. BoJ Governor Kazo Ueda said the adverse impact of the cross-border levies will eventually moderate as economies across the globe adapt to tariffs. Despite the lower projection, the central bank said it will continue to raise the cost of capital if its activity and price forecasts are realized.

While Shoppers’ Confidence Slips

The Japan Consumer Confidence Index sank from 34.1 in March to 31.2 last month. According to the Japan Cabinet Office, consumers’ perception of their overall livelihood dropped 3.6 points to 27.3. It was the largest drag on the headline result. Sentiment regarding job prospects descended by 3.5 to 35.7 while willingness to buy durable goods weakened from 27.3 to 24.2. Perceptions of employment declined by 1.3 to 35.7.

South Korea Trade Surplus Exceeds Expectations

South Korea’s trade surplus dropped from $4.92 billion in March to $4.88 billion last month, but the result exceeded the median estimate of $4.40 billion, pointing to the country’s commerce being more resilient than expected despite increased US tariffs. After climbing 3% year over year (y/y) in March, exports in April increased 3.7%, substantially better than the expectation for a 1.6% decline. Imports fell 2.7% y/y, a smaller contraction than the forecast for a 6.9% decline. In the preceding month imports were up 2.3%.

Shipments to the US were down 6.8%, with a sharp drop in automobiles and parts, but South Korea’s exports to China rose 3.9%. Exports to the European Union, furthermore, expanded 18.4%. Among products, semiconductor led, with exports climbing 17.2%.

Defense Team Pushes Exports Past Goal Line

Australia’s gold exports to the US during the first quarter of A$16.7 billion were three times higher than in the year-ago period as investors snatched up the previous metal as a defensive strategy during the escalating trade war. Gold fever, furthermore, resulted in Australia producing a A$4.1 billion trade surplus with the US. In the year-ago period, Australia reported a A$6.2 billion trade deficit with the US. More recently, the country’s overall March trade surplus of A$6.9 billion was significantly more than the median expectation for A$3.9 billion. Shipments to foreign lands climbed 7.6% m/m after declining 4.2% in February and imports retreated 2.2%, reversing a 1.8% gain in the preceding month.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.