What began as a promising rally quickly unraveled into chaos.

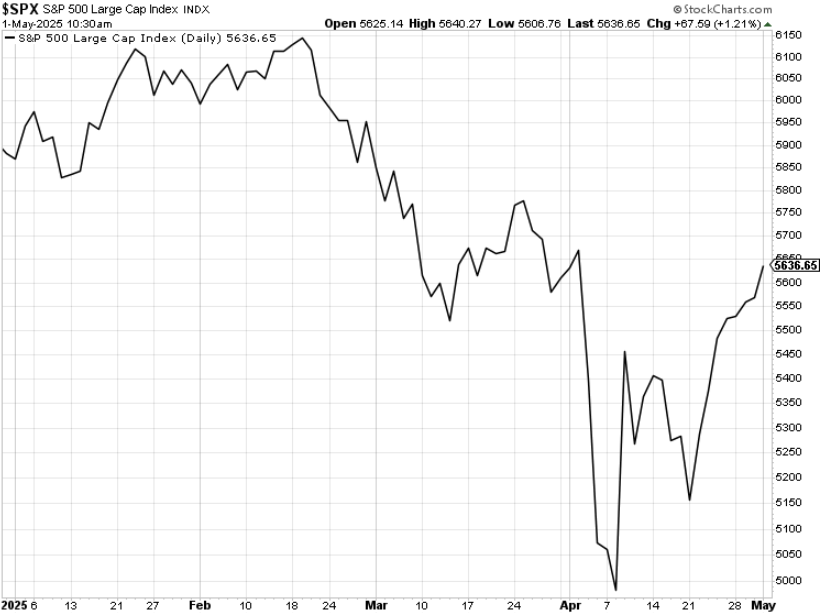

The stock market started this year on a high, locking in 3% gains in January. AI momentum was still red-hot. Chatter about President Trump’s potential tax cuts and deregulation were keeping hope alive. And for a while, it looked like we were heading into another bull market breakout.

Then came the trade war, and optimism gave way to panic.

In February, the White House launched its first tariff threats. Stocks dropped 10% in 20 days – one of the fastest corrections in modern market history.

Then April’s “Liberation Day” tariffs took center stage. Markets crashed again, falling nearly 20%. At one point in mid-April, the S&P 500 was on track for its third-worst start to a year in the past century.

It felt like the market was in meltdown mode. Some investors called it a slow-motion 1987 crash. Others feared it was 2008 all over again.

But just as quickly as things went south, they bounced back.

From Crash to Comeback: How the 2025 Trade War Sparked Stock Market Volatility

In a sudden shift, Trump walked back the harshest tariffs and paused reciprocal duties for 90 days. He exempted electronics from Chinese tariffs, then auto parts. The administration started talking about trade deals with Japan, India, the EU, even China. The rhetoric softened.

And markets ripped higher.

In the past three weeks alone, the S&P has surged nearly 12%. It’s been one of the fastest recovery rallies on record.

So… what happens next?

That’s the question every investor is asking. And most are looking for the answer in the wrong place, trying to game out the next step in the trade war.

Is a deal with Japan coming? Will China retaliate again? Will Trump rescind exemptions and hit the gas?

Important questions, no doubt – but ultimately, the wrong ones.

Because we believe the thing that’s going to move markets next isn’t the trade war at all.

Instead, what will send shockwaves through the market – as soon as next week – is something much, much bigger. And it’s tied to the most powerful force in the market today: artificial intelligence.

AI Demand Is Surging Despite Economic Chaos

Let’s zoom out for a moment.

Despite the threat of a global trade war, U.S. recession, or stock market meltdown, the AI Boom has been humming right along.

Just look at the data.

Last night, Microsoft (MSFT) and Meta (META) – two of the world’s most important AI companies – reported earnings. And those results showed that the AI Boom is accelerating.

Microsoft’s Azure cloud business (home to most of its AI services) grew 35% year-over-year last quarter. That’s up from 31% the quarter before – and the first acceleration in over a year.

Management said AI demand is so strong, it’s outstripping supply. The firm is investing more – a lot more – to meet demand for things like Copilot, GitHub Copilot, Microsoft Fabric, etc. It plans to spend approximately $80 billion on data centers in fiscal year 2025 to support those generative AI technologies.

Meta echoed the same sentiment. The number of advertisers using its AI creative tools rose 30%. Time spent on Facebook and Instagram is rising thanks to AI-powered feed improvements. And like Microsoft, Meta is spending even more on AI infrastructure to keep up with demand. In this latest earnings report, the company announced plans to spend between $64 billion and $72 billion on capital expenditures in 2025, a significant increase from previous estimates.

Let me be clear: These are trillion-dollar companies. They don’t hype things unless they have to. Both are saying that AI demand is soaring despite the trade war.

And they aren’t the only ones.

AI Stock Surge: TSM and Others Show the Way

A few weeks ago, Taiwan Semiconductor (TSM) – the world’s most important AI chip builder – reported robust earnings with strong guidance. It reported a 60% year-over-year increase in net profit for Q1 2025, approximately $11.12 billion and surpassing analyst expectations. The firm also anticipates that its AI-related revenues will double in 2025…

The broad takeaway? AI demand is growing right through the trade war.

We’re hearing the same thing from Lam Research (LRCX), Vertiv (VRT), Seagate (STX), Western Digital (WDC), ServiceNow (NOW), Alphabet (GOOG). The list goes on.

Folks, AI is not slowing down. If anything, it’s speeding up.

And that’s why I think investors are missing the forest for the trees right now.

While Wall Street is focused on the next tariff headline, they should be looking for the next AI catalyst…

Because we think something big is coming next week.

And it could spark a $7 trillion panic across the markets.

How to Get Positioned for the Coming AI Stock Breakout

This potential trillion-dollar panic isn’t about another tariff or trade deal. It has nothing to do with steel, aluminum, EVs, or semiconductors.

It involves something bigger – with the power to jolt the AI Boom into hyperdrive. And we think it could trigger one of the most powerful AI stock rallies we’ve ever seen.

Tonight, May 1, at 7pm EST, I’ll reveal everything about what’s coming during my urgent event, The 2025 Summer Panic Summit (by clicking the link, you’ll automatically RSVP to this event).

We’ll delve into:

- What this $7 trillion panic is all about

- What it has to do with Donald Trump

- Why it’s poised to potentially unlock generational profits in a very specific corner of the AI market

- And most importantly, how you can get positioned before it all goes down

I’ll reveal the seven unique AI stocks that I believe are perfectly positioned to soar as a result of this summer panic.

I call them the MAGA 7 stocks – Make AI Great in America. Thanks to the convergence of politics and technology, these small firms could be the biggest winners of the next big market shift.

If you’ve felt confused this year, overwhelmed by the headlines and whipsawed by the charts, you’re not alone. This has been one of the most unpredictable markets in modern history.

But I believe the fog is starting to lift.

The AI revolution is accelerating, and this $7 trillion shift could reshape markets within just a few days.

RSVP to The 2025 Summer Panic Summit now, and discover the seven AI stocks set to soar.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Questions or comments about this issue? Drop us a line at langofeedback@investorplace.com.