After a week that completed nine straight days of stock market gains, it seems difficult to suggest that the coming one will be more consequential. Yet any week that features an FOMC meeting has the potential to offer significant fireworks. Throw in a significant set of Treasury auctions, and one might expect some additional volatility. So far, though, the market says, “not really.”

The key highlight for the week is of course Wednesday’s FOMC meeting and Chair Powell’s ensuing press conference. Market expectations are for no action – Forecast Trader and CME FedWatch both show only a 6% likelihood for a cut – but there is no shortage of potential drama that can occur. We recently received a superficially ugly GDP number and a generally solid jobs report amidst plunging crude oil prices. It will be critical to hear which pieces of data weigh more and less heavily in the committee’s decision-making.

If I were able to ask a question at the presser, mine would be, “if the two parts of the dual mandate appear to be in conflict, which might you favor?” Despite the solid rise in Nonfarm Payrolls and an unchanged Unemployment Rate, there are aspects of the labor market that appear to be deteriorating. Might the current set of relatively quiescent price pressures allow the Fed to cut rates under those circumstances?

Instead, does Powell want to risk cutting rates while the tariff situation remains unsettled? Remember, barring some deals, the 90-day moratorium ends in early July. There is an FOMC meeting on June 18th. I doubt that the Fed has the stomach to cut rates before there is certainty regarding any tariff-related pressures. That is the sort of move that could torch a Fed Chair’s legacy. Furthermore, Powell does not seem at all inclined to give into the President’s haranguing him about lowering rates.

Taken in combination, this is why we see Forecast Trader and CME FedWatch both showing odds that preclude cuts in June, and that July is no longer considered a certainty. The FOMC statement and comments from Powell should give us a better read on the respective likelihoods.

In the meantime, we will get important clues about international investors’ willingness to buy US Treasuries. I am writing this just ahead of today’s 3-year note auction, which will be followed by a 10-year auction tomorrow and a 30-year auction on Thursday. Although there are persistent concerns about foreign investors being net sellers of US assets, the last time these bonds were auctioned, the results were better than feared.

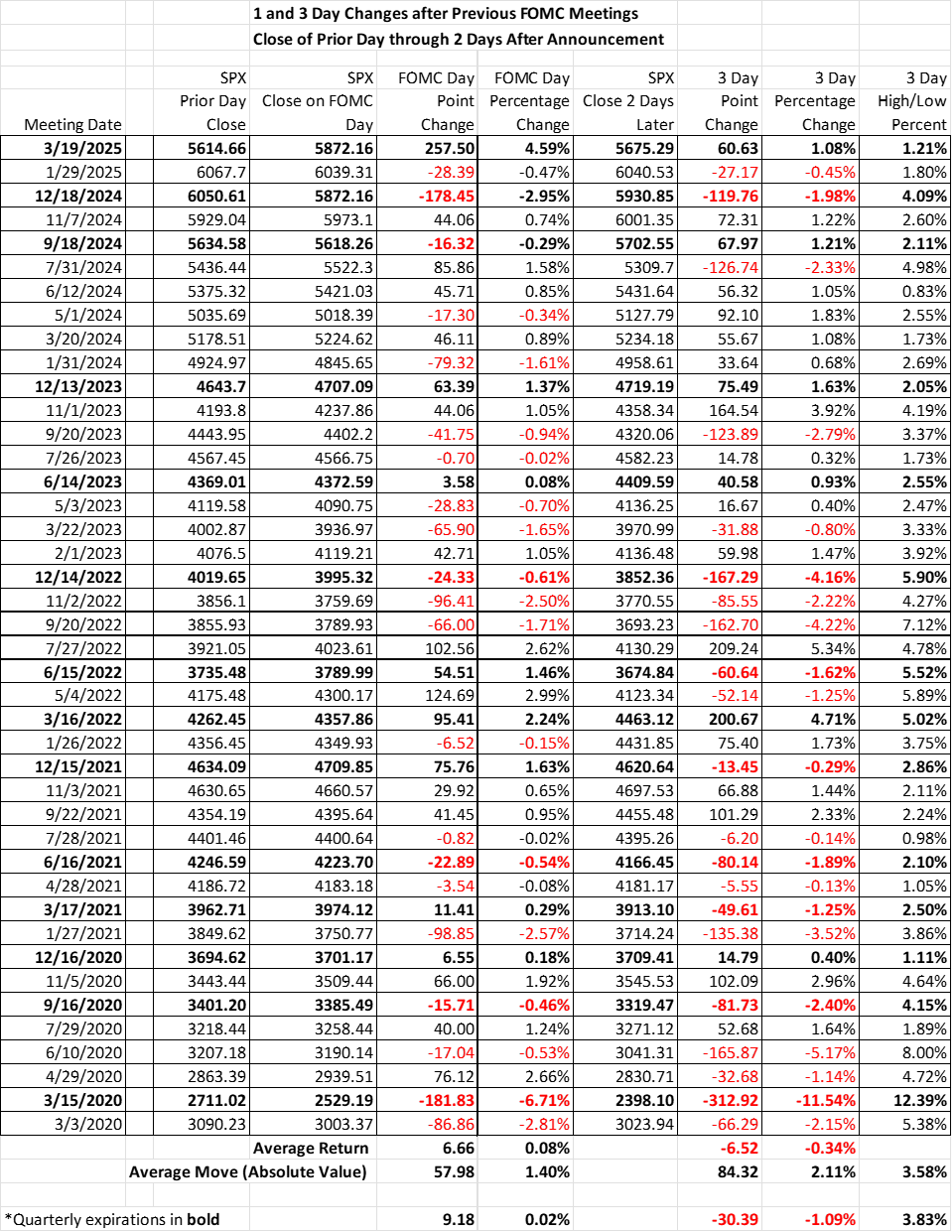

Despite stocks adhering to their now usual pattern of selling off early, then garnering strength as the morning passes, we are still not yet in positive territory as I write this. It’s tough to maintain a 10-day winning streak. Then again, it was rare enough to get the 9-day streak that culminated on Friday. Much will rely on traders’ views on the 3-year auction, and frankly, whether they care if the results aren’t to the bond market’s liking. But as we noted last week, we still see relatively steep skews on near-term S&P 500 (SPX) options. The general tone of the market seems quite sanguine, but under the surface there is some desire for hedging protection. Maybe it will actually be necessary, but as the following table shows, we haven’t seen major fireworks after the last couple of FOMC meetings. Will it be different this time?

Source: Interactive Brokers

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.