Why the Return of Manufacturing May Not Mean What You Think

Made in the USA.

It’s a powerful phrase that evokes powerful images.

Booming factories.

Rows of hardworking men and women in overalls.

Small and medium-sized towns thriving as American industry provides loads of good-paying jobs.

Those images are rooted deep in our national memory. When things were built in the USA, we didn’t just compete … we led the world.

President Donald Trump promises to bring that feeling back. His economic agenda is pouring billions into reshoring American manufacturing.

When he speaks about this, many people imagine a new era of American industrial strength.

But if there is one thing that always stays the same in this world, it’s that everything is always changing.

This isn’t the same world it was in the late 20th century when American manufacturing dominated the global economy.

But we can still revitalize the refrain of “Made in the USA” if we are willing to acknowledge the world’s realities today.

I’m going to talk about some of those today, and why an upcoming catalyst could set this new wave of American manufacturing in motion. For savvy investors, this will unleash an abundance of new opportunities.

Three Reasons Why Robotics Will ‘Make it in the USA’

For “Made in the USA” to mean something again it won’t be humans doing the work. It will have to be robots.

That’s the simple conclusion of our tech investing expert, and Cal Tech trained economist, Luke Lango.

But you don’t have to be a trained economist to reach this conclusion. Even a cursory look at the math provides a compelling story.

There simply aren’t enough Americans willing, or able, to fill manufacturing jobs anymore – not at wages that can compete globally and not at the scale we need to reignite American manufacturing.

Let’s start with the population issue. Here’s Luke explaining the math.

As of today, fewer than 2 million Americans are filing for unemployment benefits. Meanwhile, the president’s reshoring goals imply replacing tens of millions of overseas manufacturing jobs.

China has more than 100 million manufacturing workers.

India has about 20 million.

Vietnam has more than 10 million.

That is 130 million to 150 million manufacturing jobs in just three Asian countries, many of which feed U.S. supply chains. Yet the United States cannot staff its existing plants, never mind an expanded industrial base, without automation.

Then there is Americans’ seeming reluctance to do these jobs. Here’s Luke again:

The United States offshored manufacturing work for a reason. The positions are difficult, often dangerous, and generally not the kind of roles in which young Americans see a future.

A recent Cato Institute survey captured the mismatch:

80% of respondents say the nation would be better off if more people worked in manufacturing.

Only 20% say they would be better off working in a factory.

And finally, there’s the economic reality: Robots are just plain cheaper.

Luke again:

- Minimum wage in China averages about $300 a month.

- Vietnam: roughly $200.

- India: below $200 in many regions.

- U.S. federal minimum wage implies more than $1,200 a month, and factories often pay far more.

U.S. labor is four to six times as expensive as most Asian labor. That math doesn’t pencil out unless companies deploy AI-powered machines that don’t take breaks, benefits, or paid time off.

The conclusion is self-evident – the future of American industry will be built by machines.

The new workers of the 21st century will be robots, automation systems, and AI-powered factories. That rapidly emerging shift is creating one of the most explosive opportunities since the dawn of the internet.

It All Started With Covid

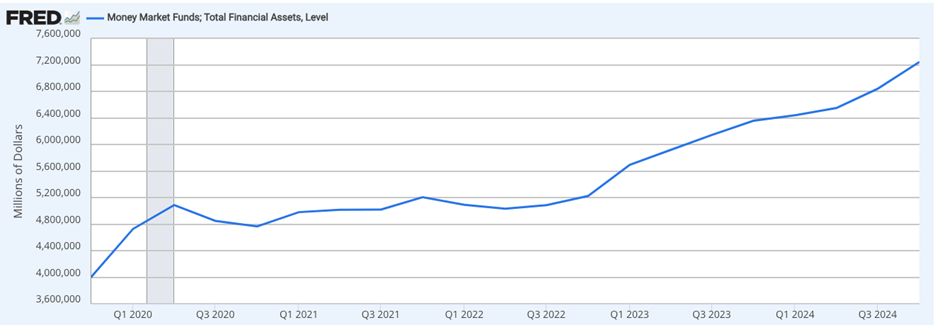

A historic wave of cash – nearly $7 trillion – is sitting on the sidelines in money market funds.

Why did this happen? It all started in 2020.

Here is Luke explaining how this stockpile of cash developed.

With the stock market being so unpredictable, between the Covid Crash in 2020 and the Market Crash in 2022…

A lot of folks started moving their money into cash and money market accounts.

It seemed like the safest bet, right?

The markets were like a roller coaster, and nobody wanted to lose their hard-earned money chasing stock gains.

And once the Fed started hiking interest rates…

This trend accelerated aggressively.

We witnessed a staggering $2 trillion being pulled out of the stock market and tucked away into money markets in the past couple years alone.

Everyone suddenly decided that cash was king…

And that only pumped more air into what I’m calling a “cash bubble.”

All that money is poised to flood into the markets after a critical signal next week – May 7, to be exact.

Those who act now could ride the surge of America’s new industrial revolution — and potentially turn modest stakes into life-changing wealth.

Luke explains it all in a free event he held earlier this week – the 2025 Summer Panic Summit. The presentation answers a lot of questions about what the new manufacturing boom in American will look like, and how investors can benefit.

I’ll let Luke have the final word.

President Trump is set to ignite a $7 Trillion overnight shock to the markets as soon as this week. The decisions you make in the next few days could be what makes or breaks your financial future for years to come… Please prepare before May 7th.

You can catch the replay by clicking here.

Enjoy your weekend,

Luis Hernandez

Editor in Chief, InvestorPlace