On Dec. 5, Shopify (SHOP 2.44%) Chief Operating Officer Kaz Nejatian took the stage for the company’s investor-day presentation. He noted how the company had worked hard for years to develop software tools to boost growth for its estimated 1.75 million merchants. But in the third quarter of 2022, it used these tools to stimulate growth for itself.

According to Nejatian, the strategy worked phenomenally.

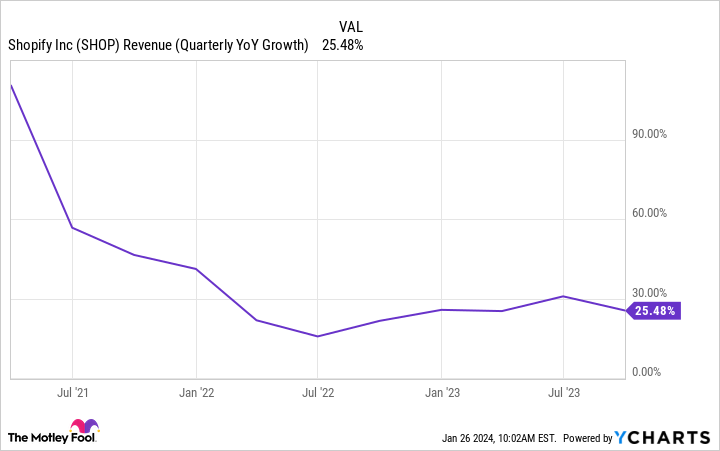

This might come as a shock to anyone who follows Shopify. After all, the company’s revenue growth rate has plunged in recent years. And some of its recent revenue gains are related to price increases, not necessarily the implementation of growth initiatives.

Data by YCharts.

Of course, there are different ways to measure growth, and there can be a temporary disconnect from revenue results. This is why 2024 is shaping up to be an important prove-it year for Shopify.

The number that caught my eye

In his presentation, Nejatian shared that Shopify logged a record 25 million free trials in 2023 (through October). This record amount of free trials was attributed to the aforementioned tools it turned on to broaden the top of its sales funnel.

Nejatian’s presentation also shared a chart that showed the number of merchants on its platform paying for a subscription, including those paying for a trial subscription. This chart had a clear inflection point where Shopify turned on its growth tools.

In short, more e-commerce merchants than ever gave Shopify a try in 2023. That’s a good start, but it makes 2024 a year with a lot to prove for the company.

According to Shopify, it only has about 10% of U.S. e-commerce market share right now. And its share is even lower in other countries. Therefore, the company should have no problem converting a good number of these trial-basis merchants into long-term customers. In theory, merchants will be compelled to stay once they’ve experienced Shopify’s platform.

Investors should watch for the company’s growth to pick up in 2024 based on the success of its lead generation last year.

What it means for shareholders

Shopify stock may be down more than 50% from its all-time high from late 2021. However, shares surged more than 120% in 2023, boosting its valuation significantly. In short, investors’ expectations are riding high once again.

Of course, there’s reason for optimism here. If trial users are converting to long-term paid users, then one would expect this to be reflected in the company’s growth rate for subscription revenue. Here’s how the first three quarters of 2023 have played out so far.

| Quarter | Q1 2023 | Q2 2023 | Q3 2023 |

|---|---|---|---|

| Subscription revenue growth rate | 10.7% | 21.3% | 28.9% |

Source: Shopify’s quarterly filings. Table by author.

However, there’s some distortion with these numbers. As mentioned, Shopify increased its prices in 2023 for its subscription plans — the smallest increase was 33% — so the jury is still out regarding how much of its growth is due to price increases and how much is due to attracting more subscribers.

This is why 2024 is so pivotal for Shopify investors. If subscription revenue growth continues surging, it’s proof that management’s growth engine is working. Furthermore, this would be confirmation the company can deliver growth that supports its lofty valuation.

On the flip side, if its subscription revenue growth stalls out, that could be a problem for Shopify. After all, the company generated leads in record amounts. Failing to convert them to long-term customers would either mean it’s generating low-quality leads, or its platform isn’t compelling enough for these merchants. Neither scenario is particularly encouraging.

Shopify has grown its trailing-12-month revenue almost 500% in just the last five years. This is a company that has proved itself before, and investors should give it the benefit of the doubt for now as 2024 gets rolling.

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Shopify. The Motley Fool has a disclosure policy.