A billionaire’s investment goals are often noteworthy, but investors should consider their own situation before buying the same stocks.

Investors often like to follow the investment advice of billionaires. The moves of such famous investors as Warren Buffett receive significant press coverage and can sometimes be a helpful source of stock ideas.

However, investing is not so simple, and Bill Ackman‘s top two investments serve as an example. In his fund, Pershing Square Capital Management, Ackman invests 36% of his portfolio in two well-known restaurant stocks. Yet, each has followed its own path and may serve different purposes — which investors should understand.

The top two positions

The top two holdings of Pershing Square are Chipotle Mexican Grill (CMG 2.41%), accounting for 18% of the portfolio, and Restaurant Brands International (RBI) (QSR 1.03%), which is about the same percentage.

The massive position in Chipotle will likely not surprise most investors. The fast-casual restaurant chain has risen approximately 135-fold since its 2006 IPO. It pulled off its regional-to-international expansion by offering healthy, delicious food at an affordable price.

Ackman’s fund first bought this stock in the third quarter of 2016. If one assumes Pershing Square paid about $400 per share for the stock, its value has increased by around 7.5 times during that time. Hence, analysts are less likely to question this investment decision.

However, the position that may bring more questions from some investors is Pershing Square’s choice of Restaurant Brands’ stock. It encompasses four well-known chains — Burger King, Popeye’s, Firehouse Subs, and Tim Horton’s.

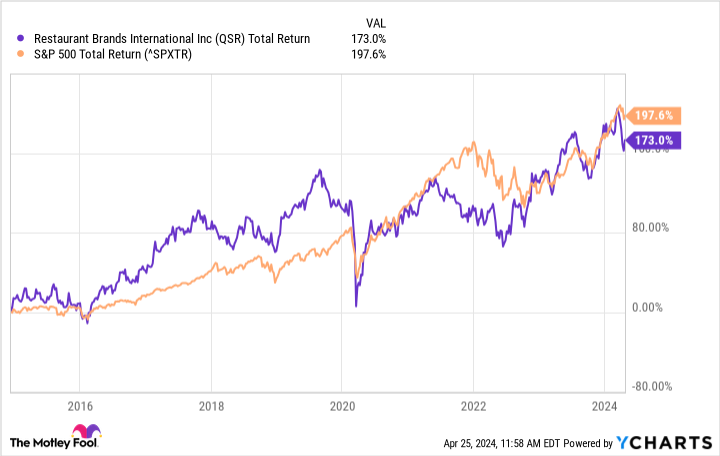

This is a longer-term holding for Pershing Square, which bought these shares in the fourth quarter of 2014, around the time of its IPO. Investors may wonder why Pershing Square continues to hold it since it has underperformed the S&P 500 during the 2020s. Remember that the top restaurant chains are often popular investments. Investors have long sought safety, returns, and dividend income in such names as McDonald’s and Starbucks.

Restaurant Brands also outperformed the S&P 500 for most of the 2010s. Considering that past performance, it likely built loyalty among some investors, including billionaires like Bill Ackman. Nonetheless, considering that it has yielded lower returns more recently, one might wonder why Ackman’s fund continues to hold.

Why Restaurant Brands in 2024?

The answer may lie in investment goals. Wealthy investors place a greater emphasis on investing to preserve wealth. From a middle-class perspective, a bank account insured up to $250,000 through the FDIC might meet this requirement. However, when one has billions to manage, insured bank accounts are not much of an option.

Hence, one might turn to stocks, real estate, art, commodities, and other investments. In this case, Restaurant Brands stock serves this purpose well. Even if it fell short of some benchmarks, investors should remember that the stock has risen over time. From an overall perspective, it is also not far behind the S&P 500’s total return.

QSR Total Return Level data by YCharts

Furthermore, RBI pays an annual dividend of $2.32 per share. That 3.25% dividend yield is well above the 1.4% S&P 500 average return. Since the payout has risen every year since it began the dividend in 2015, the rising cash return amounts to a significant bonus for staying in RBI stock.

Should I invest like Bill Ackman?

Investors should invest like Ackman only if they share his goals. Like Ackman, most investors want growth, and in that vein, a large position in Chipotle makes a lot of sense. However, wealthy investors also have an impulse to preserve wealth, and their vehicles for that purpose differ from those of the middle class.

Hence, growth investors are right to look at the investment choices of Bill Ackman and other billionaires, but they should keep their own needs and goals in mind before seeking to copy them.

Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chipotle Mexican Grill and Starbucks. The Motley Fool recommends Restaurant Brands International. The Motley Fool has a disclosure policy.