I know this might sound crazy, but today could be even worse than it is. The poor revenue guidance during yesterday’s earnings report from Meta Platforms (META) put stocks on a negative footing, then this morning’s GDP report piled on bad news. But it was Mark Zuckerberg’s comments about AI that trouble me most.

(I won’t have the opportunity to fully discuss the GDP report, but I’ll state that the combination of GDP well below expectations coupled with a Core PCE Price Index above expectations raises the specter of stagflation. I hope tomorrow’s release of the Fed’s preferred PCE Core Deflator proves otherwise.)

Although META’s $4.71 adjusted EPS beat consensus estimates of $4.55, we’ve come to learn investors look much deeper than EPS, especially for closely watched companies. Think about this: if roughly 80% of S&P 500 (SPX) beat their estimates in any given quarter, why don’t that many routinely rally after their earnings. Better than expected EPS is now to be expected, so it behooves investors to look at other metrics in a more granular manner.

In the case of META, investors focused on two key negatives: lower second-quarter revenue guidance (a range of $36.5-$39 billion, putting its $37.75 midpoint below the estimate of $38.3 billion), and continued willingness to spend on areas like mixed reality and artificial intelligence. In theory, a modest revenue miss shouldn’t lop 10% off the value of a stock, but when that stock has performed spectacularly well and sports a highly premium valuation, there is little room for disappointment.

It was the latter issue that caught my attention, along with many other market participants, though perhaps for different reasons. The issue about spending on mixed reality brought back unpleasant memories of 2022’s swoon when investors were chagrined about META’s expensive and underwhelming foray into virtual reality. But there was one aspect of Mark Zuckerberg’s commentary that struck me as particularly ominous for the recent AI-fueled rally:

And I also expect to see a multi‐year investment cycle before we’ve fully scaled Meta AI, business AIs, and more into the profitable services I expect as well.

I consider this as saying the quiet part out loud. If META is spending billions on AI development and does not expect to see profitability from those investments for several years, then what hope do most other companies have? We all got very excited about the potential benefits of artificial intelligence in a wide range of activities, but unless the time and money spent on developing AI tools yields bottom line results, it is entirely possible that the hype will have outpaced the reality.

Those of us who remember the internet bubble should find some familiarity with this concept. The internet was viewed as life-changing and earth-shaking, AND IT WAS! But it took years for the initial hype to morph into real-world productivity for a wide range of companies. And don’t forget that two companies that came to dominate wide swaths of the internet, META and Alphabet (GOOG, GOOGL), didn’t yet exist during the height of that mania. Artificial intelligence could well prove as consequential as the internet, but Zuckerberg’s comment should raise concern that investor expectations might once again be outpacing the actual progress.

In light of META’s double-digit debacle this morning, we should take a quick look at how the options market is now pricing in earnings for Microsoft (MSFT) and GOOG this afternoon. Both are now reflecting a sizeable amount of risk aversion – more than we saw last quarter or even yesterday.

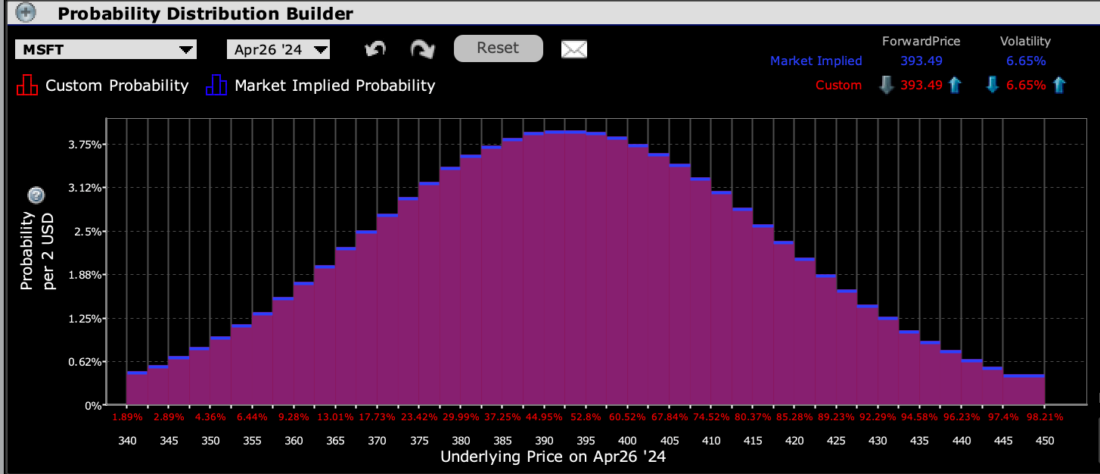

In the case of MSFT, the IBKR Probability Lab shows a fairly symmetrical distribution centered around the current at-money value:

IBKR Probability Lab for MSFT Options Expiring April 26th

Source: Interactive Brokers

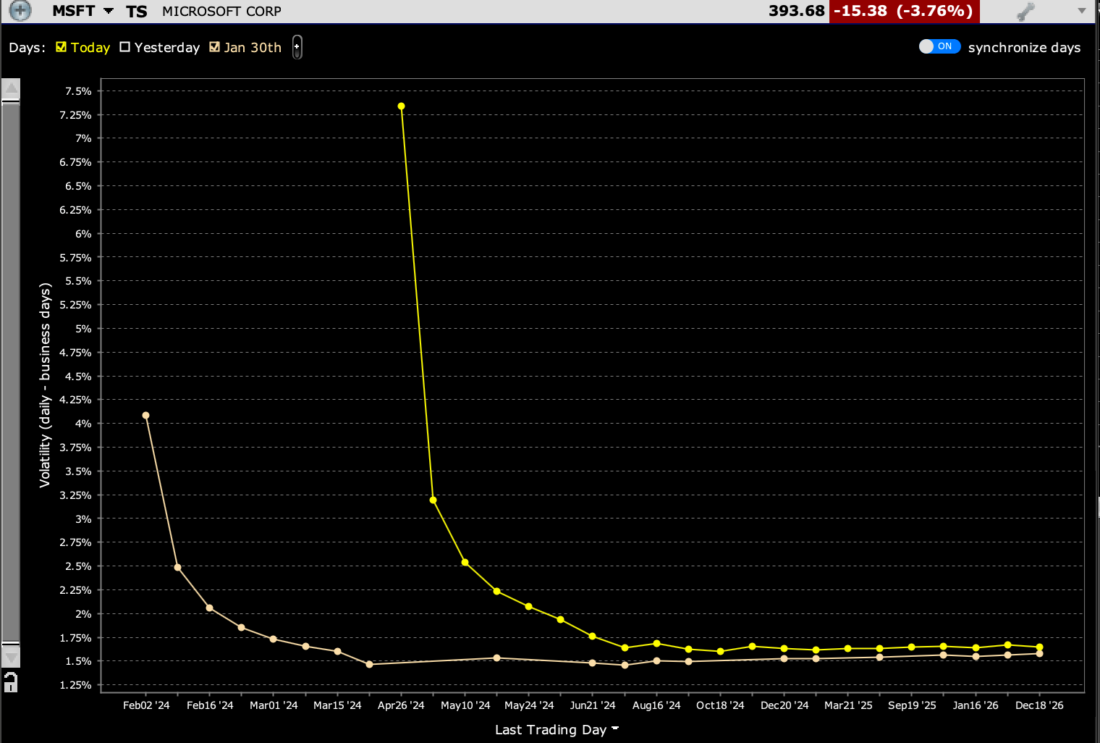

Implied volatilities for near-term options are quite elevated, implying a roughly 7% post-earnings move when about 4% is normal for MSFT. Note the increase above last quarter:

MSFT Term Structure of Volatility, Today (right), January 30th, 2024 (left)

Source: Interactive Brokers

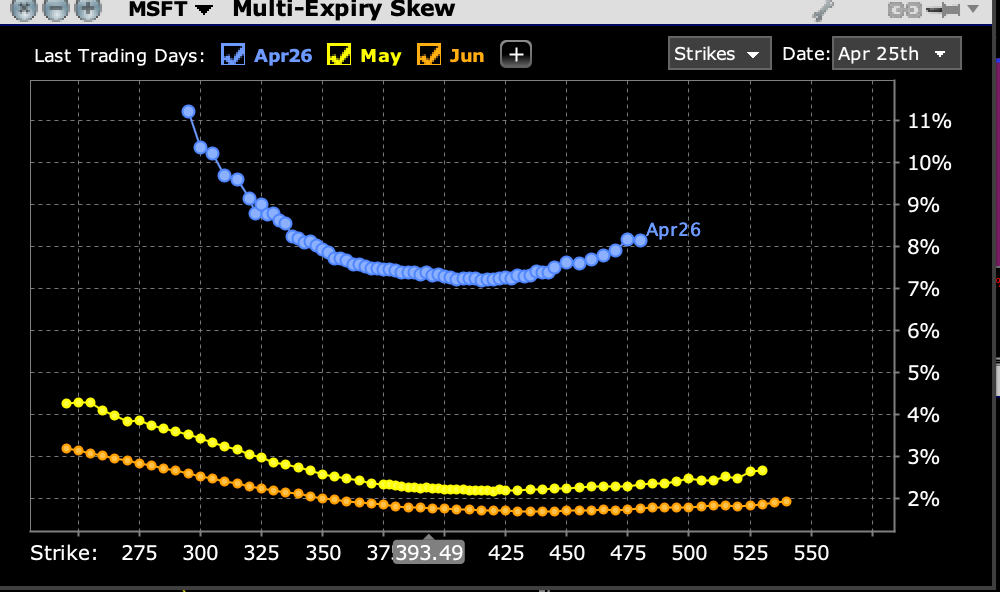

Skews for near-term options show a fair amount of risk aversion:

MSFT Implied Volatilities by Strike, Options Expiring April 26th (top), May 17th (middle), June 21st (bottom)

Source: Interactive Brokers

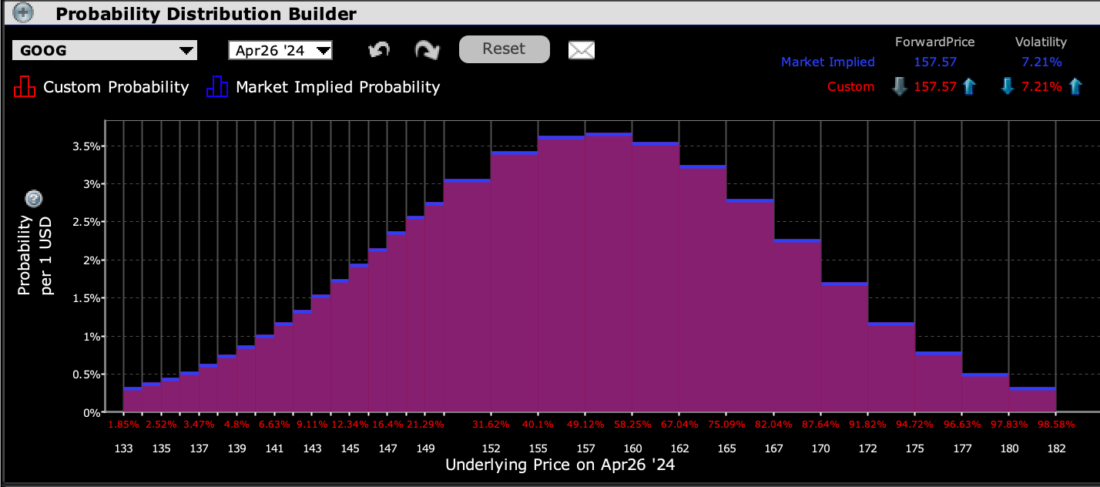

The probability distribution for GOOG is slightly more asymmetric, with the peak just above the current level:

IBKR Probability Lab for GOOG Options Expiring April 26th

Source: Interactive Brokers

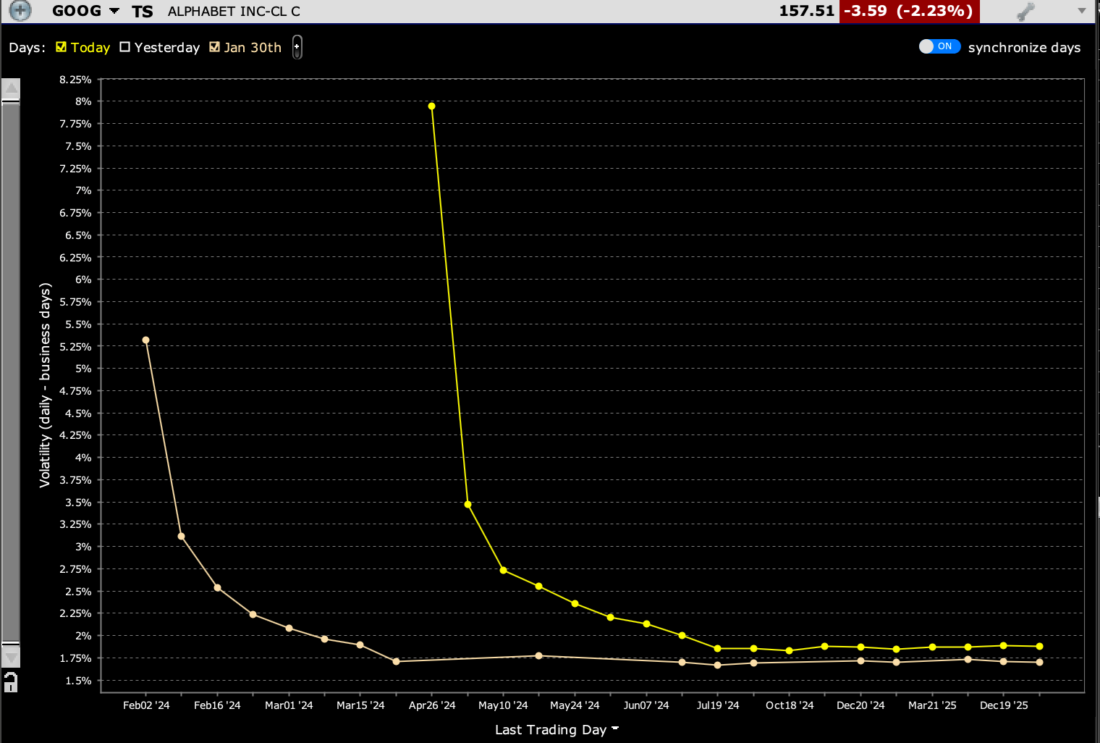

As with MSFT, at-money GOOG options are trading well above their historical average, at roughly 8% vs. about 5% average:

GOOG Term Structure of Volatility, Today (right), January 30th, 2024 (left)

Source: Interactive Brokers

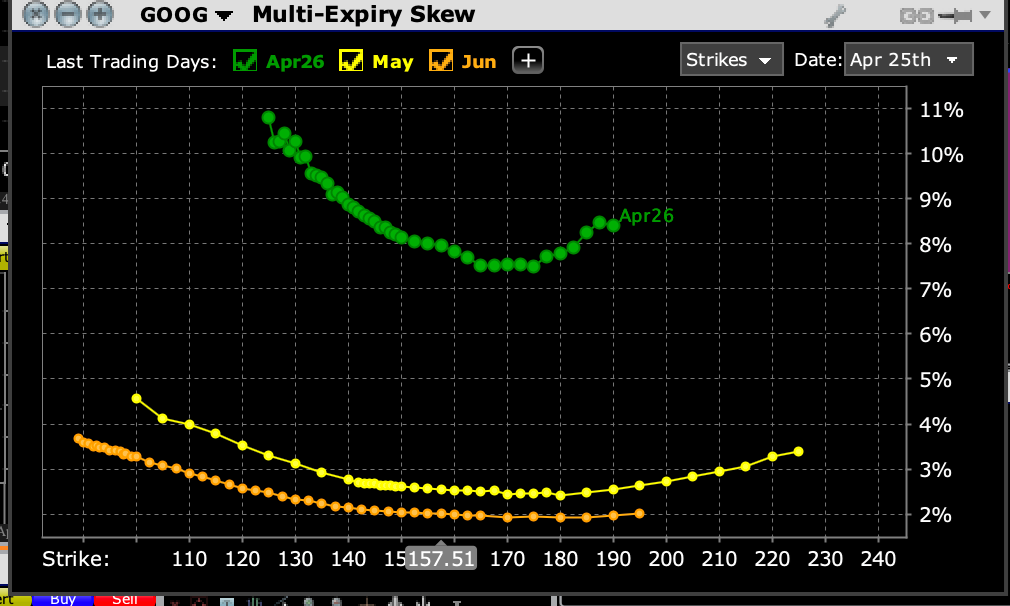

Finally, GOOG options are even more skewed than MSFT:

GOOG Implied Volatilities by Strike, Options Expiring April 26th (top), May 17th (middle), June 21st (bottom)

Source: Interactive Brokers

Bottom line, options traders in GOOG and MSFT have suddenly become far more risk averse. A double-digit selloff in a Magnificent Seven peer and a broad market dip will do that. We’ll see tonight and tomorrow if that extra risk aversion was warranted, and whether the bar was lowered sufficiently for these two key companies to surpass it.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the “Characteristics and Risks of Standardized Options” also known as the options disclosure document (ODD) or visit ibkr.com/occ