Shares of Nio (NIO 3.85%) shot more than 15% higher to start the trading day today. There wasn’t any specific announcement from the Chinese electric vehicle (EV) company, but there was good reason for the excitement nonetheless.

Nio’s American depositary shares didn’t hold all of that gain, but were still higher by 5.9% at noon ET on Tuesday.

A brighter market environment

Nio stock has had a rough start to 2023. Today’s jump is one of the only positive market days for it this year; the stock is still lower by 30% year to date. Much of that decline was due to macroeconomic factors. Even though Nio has started exporting its EVs to Europe, most of its sales are still in China.

The Chinese economy has been sputtering. But reports today said that the government plans to bring more than $275 billion from state-owned offshore accounts back into its own stock market to stimulate domestic markets. The stimulus package is also said to include local funds for investments in China.

Nio has partnered with a state-owned manufacturer to develop and grow its factories for years. And the Chinese government has been steadfast in its support for growth in the EV sector. So it makes sense that investors would see that the potential added investments are beneficial to Nio.

A competitive business

The EV business is highly competitive in China. Tesla has cut prices numerous times there to boost sales, and China’s BYD has even surpassed Tesla as the largest EV seller in the country.

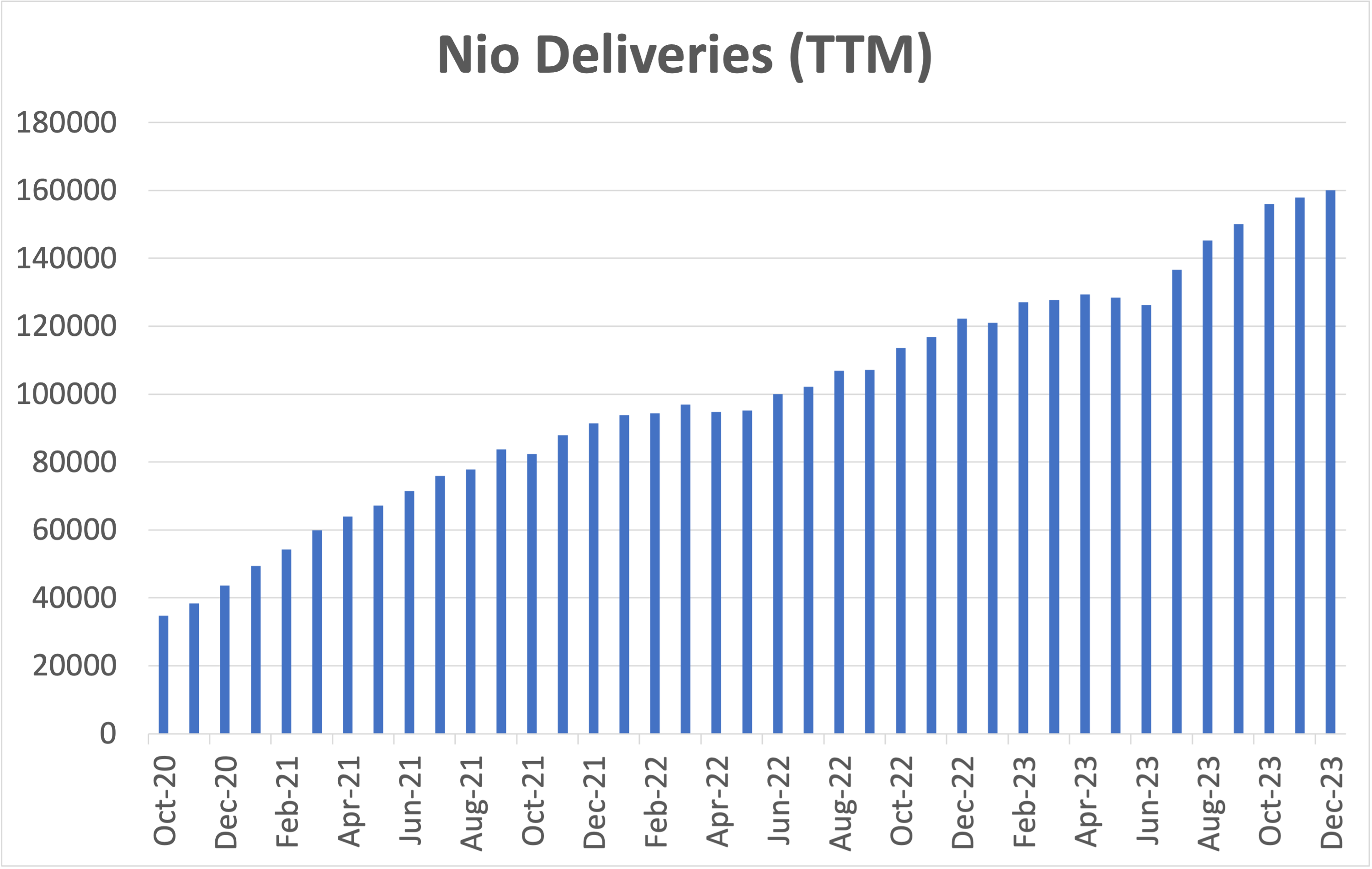

But Nio is also gaining ground. It has steadily grown unit sales, as this chart of its trailing-12-month (TTM) EV deliveries shows.

Data source: Nio. Chart by author.

Nio will need to keep that growth going to compete with its bigger rivals. But the government supports the market, and Nio shares are still hovering near their three-year lows, even after today’s jump.

The stock remains a risky bet, but one that could pay off nicely as the Chinese government continues to bolster its economy and the EV sector.

Howard Smith has positions in BYD, Nio, and Tesla. The Motley Fool has positions in and recommends BYD, Nio, and Tesla. The Motley Fool has a disclosure policy.