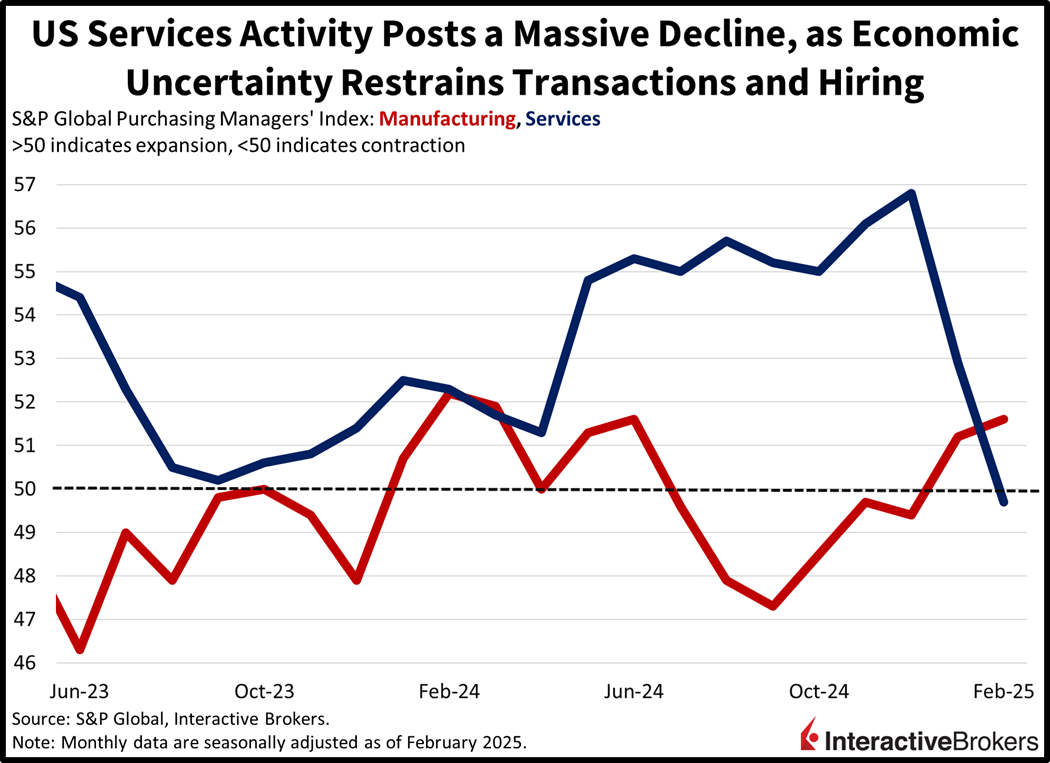

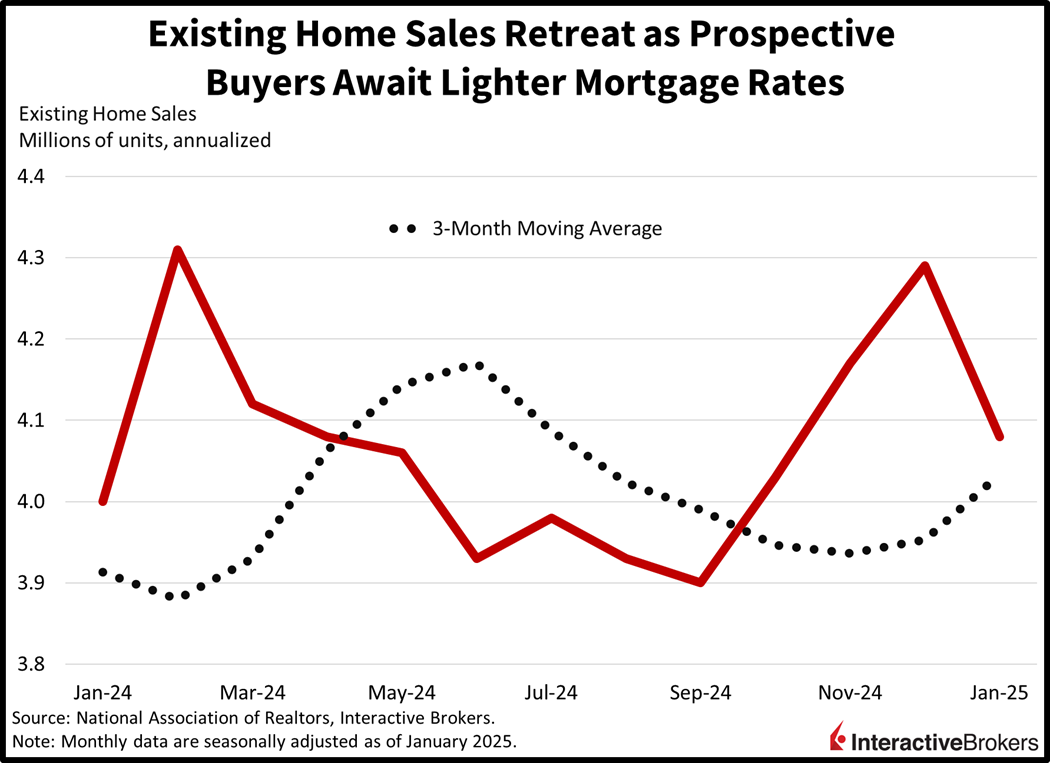

Another fresh round of data releases reflecting a slowing economy is weighing on stocks and generating bull-flattener movements across the yield curve. More specifically, investors are embracing the long-end of the Treasury complex due to the possibility that the strongest economic reports of the current cycle are behind us, incentivizing traders to lock in those rates before they potentially drift south. This morning’s data, furthermore, featured the first contraction in services activity in over two years, a significant development considering that the pivotal area comprises roughly 70% of the US economy. GDP can grow alongside a slipping manufacturing sector, but not if services buckle. Furthermore, existing home sales offered little hope for a real estate recovery as elevated financing charges and costly properties are hampering affordability for prospective buyers. Households are also feeling pressured by the vast uncertainty ahead, as illustrated by UMich’s downward revision to consumer sentiment in light of worsening current conditions, dampened expectations for the future and loftier long-term inflation projections. Trade concerns, immigration restrictions and cost pressures are commonly cited as reasons that consumers and businesses are shifting their behaviors.

Services Sectors Tank

Economic conditions decelerated further this month, according to the Flash Purchasing Managers’ Indices (PMI) from S&P Global. The services sectors, which have been the reliable forces driving activity this cycle, posted a huge miss, registering a contraction of 49.7. The figure marked a 25-month low and arrived below the pivotal contraction-expansion threshold of 50. It also came in beneath the median estimate of 53 and January’s 52.9. Weighing on servicers were weak ordering and job cuts as well as declining sentiment, which was driven by government spending reductions, tariff uncertainty, geopolitical tensions and immigration restrictiveness. Furthermore, servicers didn’t pass on higher input costs to customers in efforts to maintain revenues, which resulted in compressed margins despite the savings from reduced headcounts. Loftier input charges were driven by food, compensation, materials and tariff related increases.

But Manufacturing Picks Up

In contrast to the recent trend of strong services and weak goods activity, the manufacturing sector posted an eight-month high while extending its expansion. The manufacturing PMI came in at 51.6, above the 51.5 projected and the 51.2 in January. Contributing to the upside beat were gains in transactions, production, worker rosters and prices. But many respondents cited that the stronger activity was due to the front-running of tariffs, as good producers are trying to maximize activity prior to the potential measures being enacted. Moreover, cost pressures were elevated from both the input and sell sides, as industry participants reconcile with the possibility of a significant resurgence in goods inflation.

Housing Affordability Derails Closings

Home purchases slowed last month as rising prices and elevated mortgage rates kept prospective buyers out of the market. The pace of existing home sales declined 4.9% month over month (m/m) to 4.08 million seasonally adjusted annualized units (SAAU) despite projections calling for 4.12 million. December’s figure came in at 4.29 million while January’s drop was driven by both the single-family category and condominium and cooperative segment slipping 5.2% and 2.4% m/m, respectively. Additionally, three out of four regions posted weakness with the West, South and Northeast seeing the pace of closings fall 7.4%, 6.2% and 5.7% while the Midwest was unchanged. Despite an increase in inventory to 1.18 million, first-time home buyers represented only 28% of January transactions, after a year in which the share of those purchases tanked to the lowest level ever recorded. The median price climbed 4.8% year over year (y/y) to $396,900, the 19th consecutive month of y/y gains.

Consumer Sentiment Revised South

Consumer sentiment was worse than initially reported earlier in the month, according to this morning’s revision from the University of Michigan (UMich). The headline was adjusted south from 67.8 to 64.7, while the current conditions and consumer expectations components also fell to 65.7 and 64 from 68.7 and 67.3. Inflation expectations over five years, startlingly, moved up from 3.3% to 3.5%, the highest level since 1995, three decades ago.

Economic Fears May Be Short-Lived

Mounting evidence points to consumers and businesses shifting their attitudes in response to a landscape that could change materially in coming months. The adjustments in conduct are particularly problematic since the US economy is conditioned to constantly experience household outlays, capital investments and government expenditures, areas that are indeed poised to slow without a revival of clarity. But President Trump’s strategy is to “shake things up” and get things and people moving as a means to gain policy wins and achieve a better economy in the medium- and long-terms. In conclusion, however, the administration should consider lightening up the rhetoric to preserve the economic cycle, maintain subdued unemployment and sustain buoyant capital markets. The statements are making economic actors nervous and are weighing on their activity.

International Roundup

Eurozone PMI Remains Barely Positive

The eurozone maintained steady but barely positive economic growth this month, according to this morning’s HCOB Eurozone Composite Flash PMI result of 50.2, which matched the consensus forecast and the preceding month’s score. While signaling growth, it remained only slightly above the contraction/threshold level of 50. In a positive development, the manufacturing slowdown moderated with the segment’s PMI climbing from 46.6 in January to 47.3, exceeding the forecast of 46.9. Despite surpassing expectations, manufacturing recorded its 23rd-consecutive monthly decline. Additionally, during the January and February timeframe, the services area expansion slowed, with the sector’s PMI falling from 51.3 to 50.5 and missing the estimate of 51.5. Employment this month declined with job losses in manufacturing hitting a four-and-a-half year high. They were only partially offset by growing services payrolls. Net losses occurred in Germany and France while other countries added workers. In other highlights, input price prices rose at the fastest pace since April 2023 and output prices increased across the eurozone. Services accounted for this development with selling price inflation hitting a 10-month high.

Australia Output Accelerates Marginally

Australia’s composite PMI climbed from 51.1 in January to 51.2, the fifth-consecutive month of private sector expansion. The overall services PMI climbed from 51.2 to 51.4 while the manufacturing gauge changed from 50.2 to 50.6. While services hit a six-month high, the manufacturing result was the strongest in 27 months. One area of weakness was manufacturing output, which fell from 50.5 to 50.1.

Japan PMI Also Strengthens

Japan’s manufacturing and services PMIs from Jibun Bank both strengthened marginally this month, but factory activity continued to contract. The broader composite version of the PMI moved from 51.1 in January to 51.6. The manufacturing index climbed from 48.7 to 48.9 but missed the forecast of 49.0, while services rose from 53.0 to 53.1. Conversely, business confidence for the next 12 months sank to its lowest level since January 2022 with entrepreneurs expressing concerns about labor shortages, inflation, and economic malaise domestically.

Japan’s headline and core Consumer Price Index, furthermore, accelerated from 3.6% and 3.0% in January to 4.0% and 3.2% y/y. Analysts expected core inflation of 3.1%. Cost pressures were sustained by strong holiday shopping.

UK Shoppers Perk UP

Optimism about the UK economy received a boost with retail sales climbing 1.7% m/m in January, surpassing estimates for a meager 0.4% gain. Transactions on a y/y basis climbed 1.0% compared to 2.8% in December. The m/m result is a strong reversal from December’s 0.6% decline. According to the Office of National Statistics, household food purchases grew while tobacco and alcohol volumes also expanded. Non-food sales weakened, falling 0.6%. In a related matter, UK consumer confidence climbed marginally to -20 this month compared to -22 in January. Falling interest rates contributed to the increase, while fears of potential tariffs limited improvements in sentiment.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.