Today, all eyes are on the Federal Reserve as Americans await the central bank’s latest interest rate decision.

We think that some big market moves are in store – and that a $7 trillion panic could hit stocks as soon as this afternoon. But it won’t be the decision itself that sparks the stampede.

That’s because everyone already knows what the Fed will say: ‘We’re staying the course.’ The central bank is widely expected to hold interest rates steady. No hikes or cuts; no surprises. And the press release? Probably just a slightly revised version of March’s memo, with all the same hedged language we’ve come to expect from Powell & Co. Nothing shocking there, either.

But that doesn’t mean that today’s Fed meeting won’t ignite a fire on Wall Street.

In fact, we believe it could set the stage for a historic rally in what we’re calling the “MAGA 7” (“Make AI Great in America”) – seven stocks sitting squarely at the intersection of Trump-era policy priorities and the unstoppable AI revolution.

But if today’s interest rate decision is likely to be a nonevent, what would cause such major shockwaves to ripple through the market?

The post-announcement press conference.

Will the Fed Signal a Rate Cut Today?

When Board Chair Jerome Powell takes to the mic later today, he’ll offer clues on what the Federal Reserve plans to do at its next meeting, in June. And that’s when he could unleash a new wave of market volatility.

Why? Because with the data turning sour, it’s becoming clear that the U.S. economy will soon need help.

For one thing, the labor market is showing signs of growing weakness. Though the national unemployment rate remained steady at 4.2% in April, it is moderately higher than January 2023’s 3.4% low. As of the week ended April 26, initial weekly jobless claims have risen to 241,000, the highest in two months. And continuing claims have jumped to 1.9 million, their highest since November 2021.

Additionally, consumer confidence – considered the bedrock of American economic optimism – has cratered to levels we haven’t seen in years. The Conference Board’s Consumer Confidence Index has fallen to 86, its lowest reading since May 2020. And its expectations index, which reflects consumers’ short-term outlook, dropped to 54.4 – the lowest since October 2011.

We’re also seeing a notable shift in consumer spending… which drives about 70% of U.S. GDP. While things don’t seem dire (yet), data from Fiserv’s Small Business Index shows that consumers are prioritizing essential goods and services as discretionary spending slows.

Now companies across the board are beginning to sound the alarm. McDonald’s (MCD), Marriott (MAR), Amazon (AMZN), Starbucks (SBUX), and more have all warned about slowing demand alongside their recent earnings results.

This economy is sick. Rate cuts are the remedy. And whether we get those rate cuts or not depends on what Powell says this afternoon.

If the Federal Reserve Hints at Easing, Markets Could Surge – Fast

If the Fed Board chair closes the door for rate cuts in June, stocks could tumble fast. But if he opens it, the markets will breathe a sigh of relief – and risk assets should soar.

We think that, fortunately, the latter is most likely.

After all, this has been and continues to be a data-driven Fed. And the data suggests a cut should come soon.

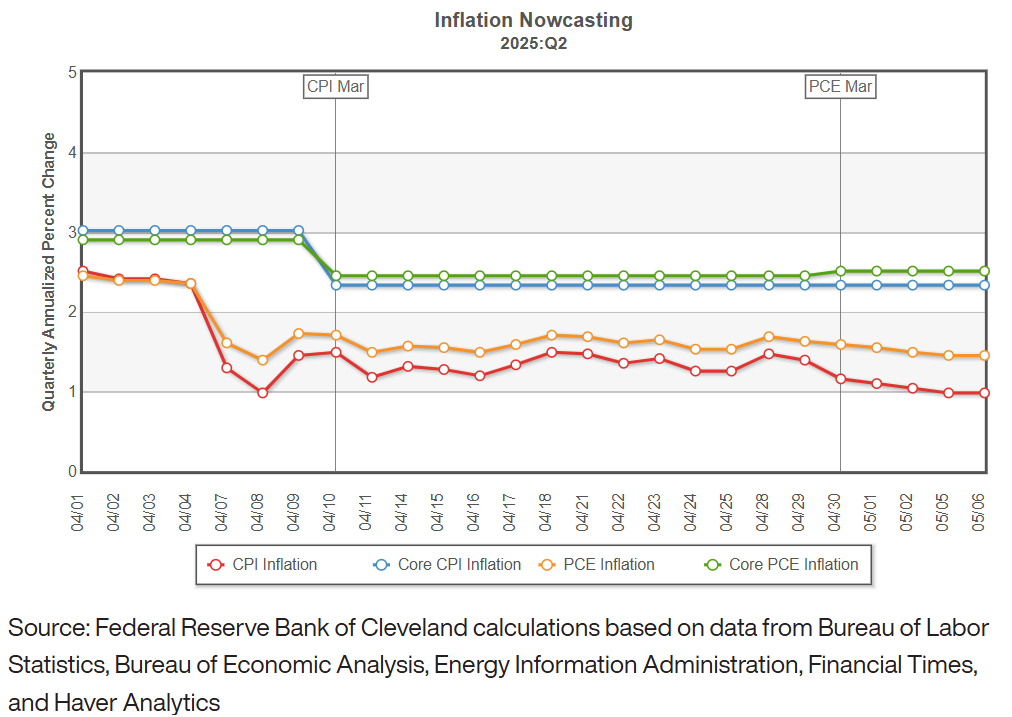

Real-time inflation metrics are sitting right around the Fed’s 2% target.

The Cleveland Fed also expects CPI and PCE to both come in at 2.2% in May.

Meanwhile, as we mentioned, jobless claims have spiked to their highest levels since 2021. And consumer sentiment – measured by both the Conference Board and University of Michigan – has taken a nosedive.

This isn’t ambiguous. It’s a red-alert signal flashing across the dashboard.

And historically, Powell has listened to warning signs like these.

He also listens to the markets – especially the bond market.

As of now, the 2-year Treasury yield has fallen to 3.8%, well below the Fed’s current 4.25% policy rate. This is a clear message that the Fed is behind the curve and that rate cuts are overdue.

Powell has acted swiftly when this divergence has happened in the past. In 2019, when the 2-year yield dropped below the Fed rate in May, a cut came in July. In 2024, the same thing happened in July, and then the Fed cut in September.

So, in other words, history suggests a cut is coming by June.

And if Powell even hints at that today, stocks could surge…

Especially the right stocks…

Which brings us to the “MAGA 7.”

The MAGA 7: AI Stocks Positioned for a Federal Reserve Pivot

We think our seven “Make AI Great in America” stock picks are not just beneficiaries of AI progress. They’re ground zero for the seismic shift in how America thinks about technological leadership, national security, and industrial policy.

In our view, these companies live in the sweet spot where the Trump administration’s trade and industrialization priorities overlap with AI’s exponential growth curve.

And as such, if today’s Fed meeting marks a turning point for monetary policy, they could be the biggest winners over the next few months…

Because when rates fall, growth stocks rise – and AI stocks in particular tend to rip higher during Fed-fueled rallies.

We saw it in 2020 and late 2024. And we could see it begin again today.

That’s why I urge you to check out my recent presentation centered on this incoming tidal wave.

In it, I reveal the seven AI stocks that I believe could soar in the aftermath of today’s Fed meeting. These are the companies perfectly positioned for 2025’s biggest macro pivot – from high rates and trade-war turmoil to rate cuts and AI-powered reindustrialization.

I’ll also explain how Trump’s agenda ties directly into these stocks and why the MAGA 7 may be the single most important investment theme of the next 18 months.

So, catch that presentation now before the Fed’s meeting this afternoon…

Because while most investors are watching to see what the central bank decides… we’re waiting to see how much money we can make when it does what it must do.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Questions or comments about this issue? Drop us a line at langofeedback@investorplace.com.