Shares of app monetization company AppLovin (APP 2.72%) soared 45.2% higher during February, according to data provided by S&P Global Market Intelligence. On Feb. 14, the company reported lovely financial results for the fourth quarter of 2023, solidly outpacing expectations on the top and bottom lines. This accounted for the majority of the gains for AppLovin stock during the month.

Prior to its earnings report, AppLovin’s management had guided for Q4 revenue of $930 million at the most. But in Q4, the company generated revenue of $953 million, up 36% year over year and far ahead of expectations.

It’s not just that AppLovin beat expectations; it’s how it did it. The company largely generates revenue from its software business that helps app companies grow and monetize their users. The software is powered by the new version of its artificial intelligence (AI) software.

AI stocks are the hottest on the stock market right now. AppLovin’s outperformance in Q4 demonstrated that it too is a top AI stock, which is why its jump higher was so pronounced.

A surprisingly great year for AppLovin

As of this writing, AppLovin stock is up 500% from the start of 2023 — remarkable returns over the last 14 months. Investors previously questioned whether the company could truly grow its software revenue as the app economy cooled down and its peers struggled.

It’s safe to say AppLovin has answered its doubters. In 2020, the company had software revenue of just $207 million. In 2023, it had software revenue of over $1.8 billion.

AppLovin also generates revenue from first-party apps. But this isn’t the focus of the company. The focus is on software. And the benefit of software is that it’s high margin.

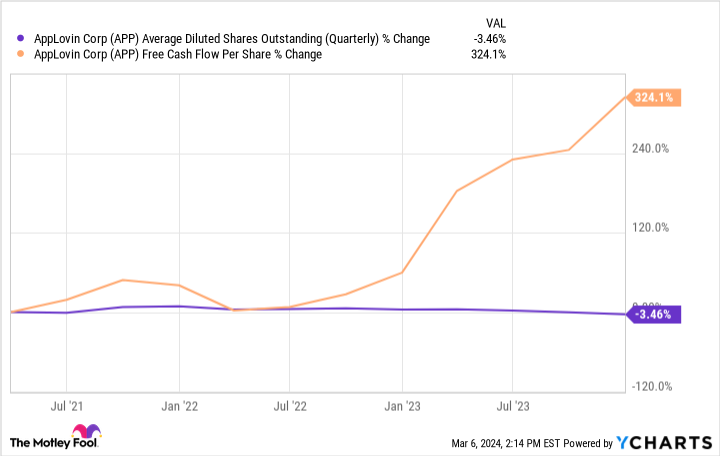

In 2023, AppLovin had free cash flow of $1 billion — quite good for a company with a market cap of just $22 billion as of this writing. And management has used some of the profits to repurchase shares. This means that AppLovin’s per-share free-cash-flow growth has been great, as the three-year chart below shows.

APP Average Diluted Shares Outstanding (Quarterly) data by YCharts

What’s next for AppLovin

For the first quarter of 2024, AppLovin expects to generate revenue of $955 million to $975 million, which would represent 34% to 36% year-over-year growth. However, because AI is driving growth in its software business, higher-margin software revenue is increasingly accounting for a larger share of the mix.

Therefore, AppLovin expects at least a 50% margin for adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) compared to a 38% margin in the prior-year period.

With ongoing revenue growth and margin expansion, things still look good for AppLovin and its shareholders as 2024 gets going.

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.