Cummins Inc (CMI) recently launched an exchange offer for the separation of Atmus Filtration Technologies Inc (ATMU).

On February 14th 2024, Cummins Inc (CMI) announced it would commence an exchange offer to split off its remaining interest in Atmus Filtration Technologies Inc (ATMU). In May 2023, 19.5% of Atmus shares were sold via an initial public offering, with Cummins Inc retaining 80.5% of Atmus’ common stock.

According to the Cummins investor website[1], “the exchange offer is expected to permit Cummins shareholders to exchange all or a portion of their shares of Cummins common stock for shares of Atmus common stock at a 7% discount”.

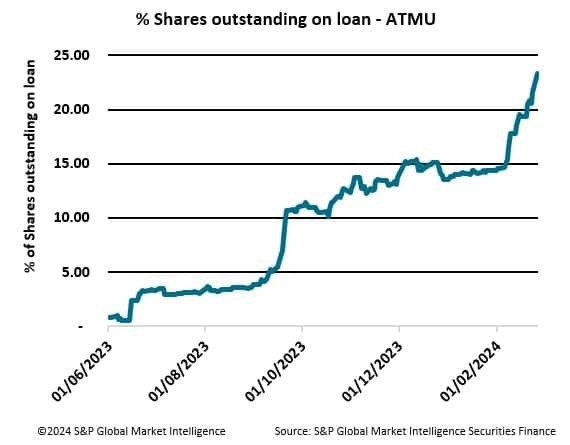

Since this announcement, borrowing activity has increased significantly in ATMU stock, reaching 23% of outstanding shares. The discount permitted by the exchange offer produces an arbitrage opportunity for investors.

S&P Global Market Intelligence Securities Finance data also shows that borrowing fees have spiked as a result of this strong increase in demand. Inventory in ATMU stock is dominated by a small number of lenders. The borrowing fee and the availability of supply is therefore likely to have a growing impact on investors ability to participate in this opportunity.

—

Originally Posted March 1, 2024 – Exchange offer in ATMU increases shares on loan.

[1] Cummins Launches Exchange Offer for Separation of Atmus Filtration Technologies Inc. :: Cummins Inc. (CMI)

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from S&P Global Market Intelligence and is being posted with its permission. The views expressed in this material are solely those of the author and/or S&P Global Market Intelligence and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Margin Trading

Trading on margin is only for sophisticated investors with high risk tolerance. You may lose more than your initial investment.

For additional information regarding margin loan rates, see ibkr.com/interest