Key Takeaways

Arabica coffee prices have experienced unprecedented volatility, with futures surpassing $4.30 per pound on February 10, marking the 13th consecutive record-setting session1. This surge is attributed to a confluence of climatic challenges, speculative trading activities, and inherent agricultural cycles.

Speculative trading and market volatility

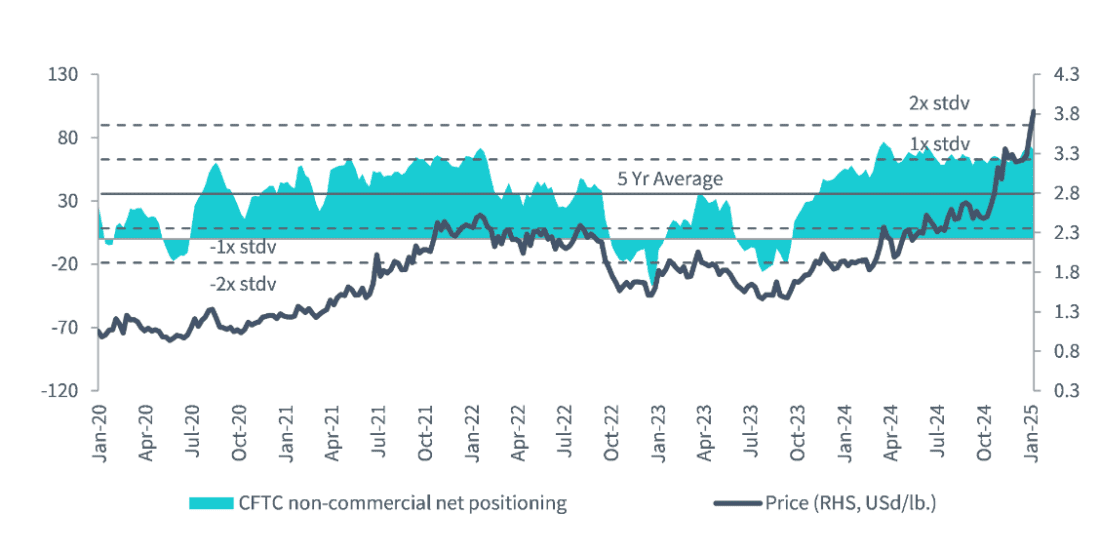

The recent price escalation is significantly influenced by speculative trading. Increased margin requirements by the Intercontinental Exchange (ICE) have led traders to liquidate short positions, intensifying upward price momentum. The ICE raised margins by 10% to $10,410 per Arabica contract, nearly double from a year ago, requiring an initial daily payment of around $62,000 to trade 100 metric tons of Arabica2. This financial pressure has prompted some traders to exit the market, further reducing liquidity and amplifying price fluctuations. Over the past year, short positioning has declined by 64% while long positioning has risen only 1%3. Net speculative positioning is currently more than 1 standard deviation above the 5-year average evident from the chart below.

Figure 1: Net speculative positioning Arabica coffee futures

Source: Commodity Futures Trading Commission, Bloomberg, WisdomTree as of 4 February 2025. Historical performance is not an indication of future performance, and any investments may go down in value.

Drought conditions in Brazil

Brazil, the world’s leading Arabica producer, has faced prolonged drought conditions since April 2024. These adverse weather patterns have significantly impacted coffee trees during their critical flowering stage, leading to concerns over reduced yields for the 2025/26 harvest. The drought-induced stress on coffee plants has been a primary driver behind the escalating prices.

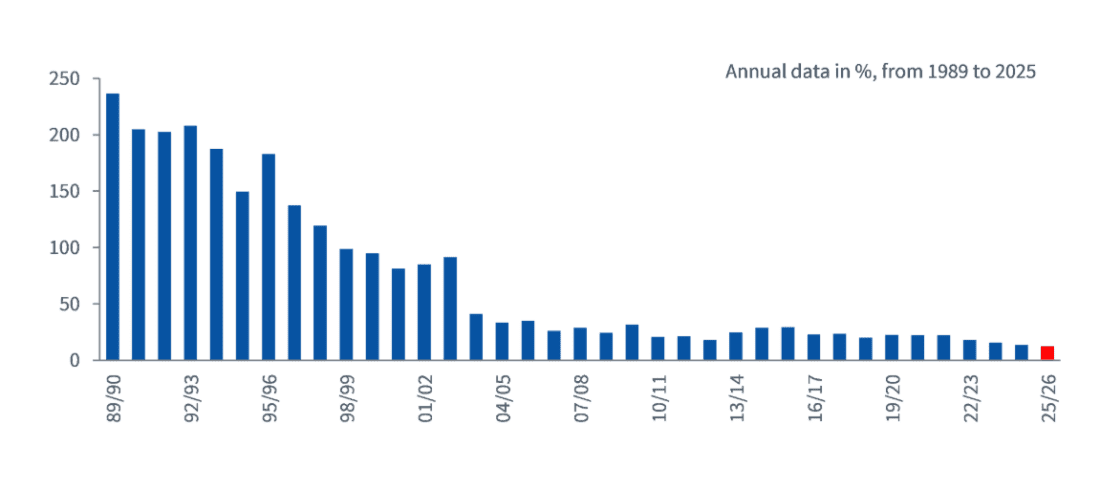

According to the latest estimates by the United States Department of Agriculture (USDA), Brazil’s 2024/25 total coffee production is forecasted at 66.4mn bags4. Brazil’s coffee exports hit record highs in 2024 as they expanded their share of the global market, filling a gap left by other large producers such as Vietnam and Indonesia. According to USDA, ending stocks in 2024/255 are expected to be 1.24mn bags, marking a 26.4% decline versus 2023/24. As of 2025, the global coffee stocks-to-use ratio stands at approximately 12.42%, reflecting a constrained supply scenario6.

Figure 2: Coffee stocks-to-use ratio reflects a constrained supply scenario

Source: United States Department of Agriculture, WisdomTree as of 31 December 2024. Historical performance is not an indication of future performance, and any investments may go down in value.

Biennial bearing cycle

Arabica coffee plants exhibit a biennial bearing cycle, characterised by alternating years of high and low yields. The 2024/25 season was an ‘on-year’, typically associated with higher production. However, due to the prevailing drought, even this ‘on-year’ did not meet expected output levels. Looking ahead, the 2025/26 season is an ‘off-year’, which traditionally yields lower production. Coupled with the current climatic challenges, this cyclical downturn is anticipated to exacerbate supply constraints, further influencing price trajectories.

La Niña phenomenon

The La Niña event, characterised by cooler-than-average sea surface temperatures in the central and east-central Pacific Ocean, has been in effect since January 2025. Historically, La Niña influences global weather patterns, often bringing drier conditions to South America. The National Oceanic and Atmospheric Administration (NOAA) projects a 66% chance of La Niña persisting through February-April 2025, with a transition to neutral conditions likely by March-May 20257. The phenomenon could lead to lower temperatures and frost in Southeast Brazil, intense rains in Indonesia and Colombia, and increased risks of tropical storms and hurricanes in Central America. In Southeast Brazil, lower temperatures and greater risks of frost threaten coffee crops. Indonesia may experience harvest delays or interruptions due to more intense rains, especially in Sumatra. Vietnam experiences negative temperature anomalies during the phenomenon, but their impact on yields remains uncertain. In Colombia and Guatemala, more intense rainfall can damage trees or increase susceptibility to disease.

Regulatory impact

The European Union’s Deforestation Regulation (EUDR) aims to curb imports of commodities linked to deforestation, including coffee. Originally set for enforcement by the end of 2024, the regulation’s implementation has been postponed by one year to December 2025. This delay offers producers additional time to adapt to stringent traceability requirements. Despite the postponement, the impending regulation has already influenced market dynamics, with European importers accelerating purchases to build inventories ahead of the compliance deadline. This pre-emptive buying has contributed to tightening global supplies and escalating prices.

Market outlook

While current prices reflect immediate supply concerns, market analysts anticipate potential easing in the longer term. A Reuters poll suggests that Arabica coffee prices could decline by approximately 30% by the end of 2025, contingent upon improved weather conditions and a resultant rebound in production8. However, this projection is predicated on the assumption of favourable climatic developments and the absence of unforeseen disruptions. In summary, the Arabica coffee market is navigating a period of significant volatility, driven by climatic adversities, speculative trading, and inherent agricultural cycles.

—

Originally Posted February 27, 2025 – A brewing storm for Arabica coffee

1 Bloomberg as of 19 February 2025.

2 Reuters as of 12 February 2025.

3 Commodity Futures Trading Commission from 6 February 2024 to 4 February 2025.

4 Coffee stocks-to-use ratio sourced from USDA reports.

5 Ibid.

6 United States Department of Agriculture as of December 2024. The stocks-to-use ratio is a critical metric in the coffee industry, representing the proportion of ending stocks relative to total consumption

7 National Oceania and Atmospheric Administration as of 13 February 2025.

8 Reuters Poll as of 13 February 2025

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.