Spurred by surging demand for servers to support artificial intelligence (AI) applications, Super Micro Computer (SMCI -1.70%) has become one of the market’s hottest stocks. The high-performance server specialist’s share price has rocketed nearly 300% higher across 2024’s trading alone, and it’s up a staggering 1000% over the past year. Most recently, the AI stock surged on news that it is being added to the S&P 500 index.

While the company’s business performance has ramped up dramatically, the stock’s incredible gains naturally raise valuation questions. Is it too late to buy this explosive AI stock, or is it on track to serve up even bigger wins?

What’s powering Supermicro’s massive stock gains?

It’s no secret that AI stocks are red hot, and Supermicro (as it’s commonly known) has benefited from the strong business results at Nvidia. Supermicro uses Nvidia’s graphics processing units (GPUs) in its high-performance rack servers, and excitement surrounding the GPU leader has helped lift the server specialist’s valuation. But it would be a mistake to dismiss the valuation gains as being purely hype-driven.

Supermicro has positioned itself as a one-stop shop for AI server solutions. That’s a great niche to occupy right now. The company’s technologies are used for processing and distributing information for software applications, and demand for its high-performance rack servers has surged in conjunction with the rapidly accelerating adoption of AI applications.

The company posted sales of $3.66 billion in its fiscal 2024’s second quarter, which ended Dec. 31. Revenue in the period was up 103% year over year. Meanwhile, non-GAAP (adjusted) earnings per share rose 71.5% year over year to $5.59 per share.

AI has pushed Supermicro into a new growth phase. The key question is how long this cycle will continue and whether or not the company’s valuations have become unreasonably stretched.

Strong growth is poised to continue in the near term

For its current quarter, Supermicro is guiding for sales of $3.7 billion to $4.1 billion, which would equate to year-over-year growth of between 188% and 219%. On adjusted earnings per share, it’s guiding for a range of $5.20 and $6.01. For comparison, the business posted adjusted earnings per share of $1.63 in fiscal 2023’s third quarter. Hitting the midpoint of its guidance range would mean growing earnings per share by 244% year over year.

Given recent demand indicators, it actually wouldn’t be surprising to see the company’s fiscal Q3 sales and earnings exceed the high ends of those guidance ranges.

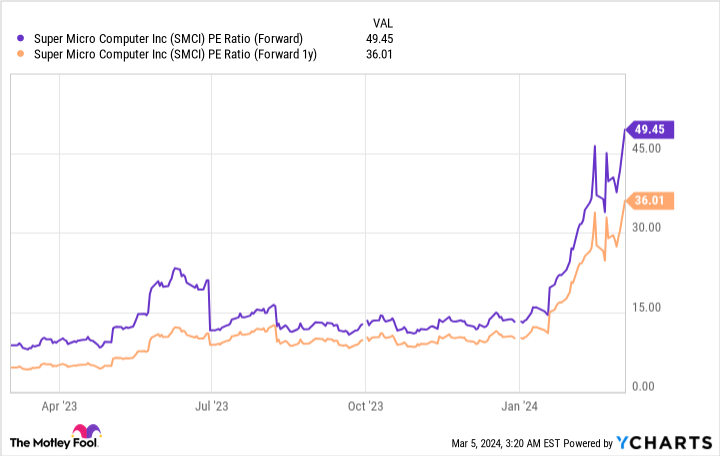

SMCI PE Ratio (Forward) data by YCharts.

Trading at roughly 50 times this year’s expected earnings and 36 times next year’s expected earnings, Supermicro is a growth-dependent stock. On the other hand, its current valuation actually looks cheap in the context of the business’s recent momentum.

Notably, Supermicro currently has a forward price/earnings-to-growth (PEG) ratio of roughly 0.55. Using next year’s projected earnings growth rate, the company has a one-year forward PEG ratio of approximately 0.68. For reference, a PEG ratio of less than 1 is generally viewed as a sign that a stock is undervalued because earnings are growing at a rate that can support a higher valuation multiple.

Of course, there is still some uncertainty about how the long-term demand trajectory for Supermicro’s offerings will shape up. Investors should understand that its incredible run-up has made the stock a much riskier investment, and it’s possible that the company’s future performance will fail to live up to the current elevated expectations.

Even so, the stars still seem to be aligning for Supermicro. While it’s reasonable to expect that demand for its server technologies will see cyclical moderation at some point, market conditions suggest that the company is poised to enjoy years of strong sales and earnings growth.

The overall artificial intelligence server market looks poised to continue growing at a rapid clip, and Supermicro appears on track to continue gaining market share. While its stock could see some volatile swings, it still has the makings of a worthwhile portfolio addition for AI-focused investors with above-average risk tolerance.

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Super Micro Computer. The Motley Fool has a disclosure policy.