Artificial intelligence (AI) has been the most important investment theme over the last few years. Yet not all companies involved with the development of this technology will turn out to be great investments.

One good way to protect your portfolio is to focus on businesses that can generate above-average cash flows sustainably. That’s because, in the long run, the stock market discounts future cash flows of businesses in an extremely efficient manner, though that may not be necessarily true over the short term.

Here are two companies catering to the AI theme: one of them rode the coattails of the initial exuberance associated with the technology, while the other has been steadily transforming itself into a vital cog in the AI infrastructure supply chain.

Axcelis Technologies: Slowing revenue growth

Axcelis Technologies (ACLS 0.78%) manufactures and sells ion implantation equipment, which is used to fabricate semiconductor chips and memory. It’s been a winner for investors, gaining more than 400% over the past five years. It’s also down more than 40% since its highs last summer. What happened?

While ion implantation is an integral part of chip manufacturing, it’s a crowded field. Axcelis is facing competition from Applied Materials and other international companies. What’s more, silicon wafer shipments declined globally in 2023 after three years of growth. Axcelis’ revenue growth slowed to 22% in 2023, after growing almost 40% annually in the three years prior, signaling lower demand for its products.

Axcelis’ largest market, making up 60% of revenue last year, is manufacturers of power devices — critical components that deliver and control power from the battery pack to the propulsion system in electric vehicles (EVs). AI investors are watching the company because management says up to 13% of revenue could be generated from the fabrication of advanced logic chips in the next two years, up from the current 1.3%. But given Axcelis’ overall decline in revenue growth, that might end up a modest addition to overall value.

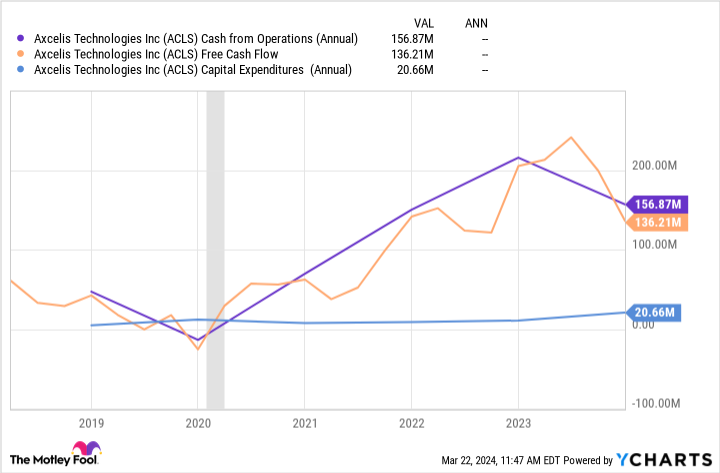

The real question is: How does this turn of events affect Axcelis’ ability to generate sustainable cash flow? Not very positively. As business has slowed down, inventory is backing up. That’s one reason why cash from operations fell to $157 million in 2023, coming in below reported net income ($246 million) for the first time since 2019. Because it’s a capital-intensive business (selling equipment to semiconductor manufacturers), the company’s capex requirements have remained steady, thus squeezing free cash flow available to shareholders.

ACLS Cash from Operations (Annual) data by YCharts.

While Axcelis’ electric vehicle base is expanding globally, its growth is also fraught with unpredictability. Axcelis’ ion implantation equipment can only see growing demand so long specialized semiconductor manufacturers and fabrication plants are expanding. That initial, above-average demand may well be over.

Axcelis’ price-to-earnings ratio has fallen from nearly 32 last September to 15 at recent prices. That may look cheap, but only if the company can reaccelerate growth. That’s not guaranteed.

Dell Technologies: Built for lasting success

Over the last decade since Dell Technologies (DELL 4.85%) returned to the public markets, management’s stated aim has been to reward shareholders via dividends and share buybacks. It doesn’t matter which technology trend is at the forefront, Dell has always managed to deftly position itself in the value chain, be it in personal computing, public cloud, data infrastructure, or now, in artificial intelligence.

Such a mindset from management has seen the company capture a solid 31% market share in mainstream servers by 2022, up from 21% a decade before. And that’s precisely what helped Dell position itself to capture growth in the proliferation of AI technology. The demand for AI-optimized enterprise servers has just started, and Dell already has $2 billion in backlog orders just for its servers. Over the past decade, Dell accounted for 43% of new revenue for the entire server market, greater than its next four competitors combined.

More importantly, the global addressable market for Dell’s infrastructure solutions is now expected to grow 7% annually until 2027, according to management. That alone gives ample opportunities for growth, including its memory and storage solutions. It’s then no surprise that the market was salivating as it bid up Dell stock by nearly 200% in the last 12 months.

In the consumer segment, which is its personal computing (PC) and peripherals business, Dell has once again positioned itself where it can derive the greatest value by selling mostly commercial and premium consumer PCs. Despite falling PC sales globally, Dell generated higher revenue per unit volumes sold, which makes this business structurally superior to competitors in the PC market. This way, Dell is again positioning itself to capture demand in an AI-enhanced PC growth cycle.

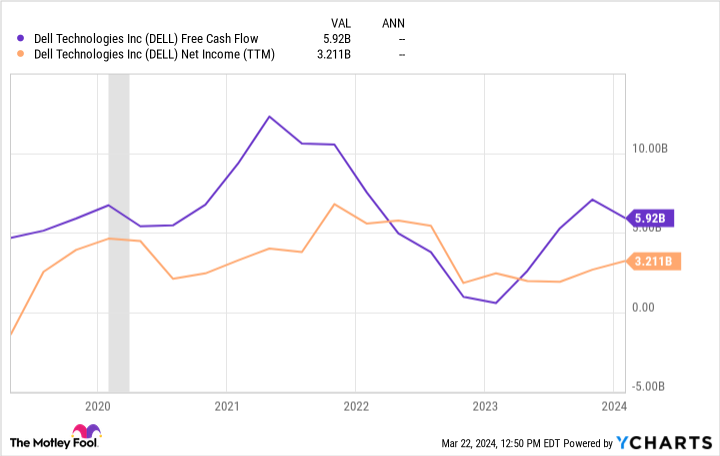

But in order to see why Dell is a cash cow, one just has to look at its free cash flow. Except for a short hiatus, its free cash flow has always exceeded its net income over the last five years, a rare feat among bigger companies, thanks to its disciplined working capital management.

DELL Free Cash Flow data by YCharts.

In addition, Dell started paying out dividends last year, and management aims to increase per-share dividends by 10% annually until 2028. Income investors looking for a stable dividend stock, but also want a piece of an AI play, would need to look no further than Dell.