A hot CPI report spurred a rise in long-term interest rates, hurting these three capital-constrained companies.

Shares of NextEra Energy Partners (NEP -6.23%), Lumen Technologies (LUMN -5.48%), and Tellurian (TELL -9.40%) all plunged today, down 5.7%, 5.1%, and 9.5%, respectively, as of 2:25 p.m. ET.

At first glance, these companies don’t appear to have much in common. NextEra is a yield-oriented entity that buys and holds renewable energy projects. Lumen Technologies is a broadband wireline company. And Tellurian is an aspiring liquefied natural gas export company.

However, all three have one thing in common: high levels of debt, or the need to raise more capital in the near future. Unfortunately, today’s inflation report is making refinancing or raising new capital much more difficult.

Capital-hungry businesses hate inflation

Today’s Consumer Price Index (CPI) report from March came in hotter than expected, reversing some of the optimism that inflation was on a glide path back to the Federal Reserve’s target of 2%. The month-over-month figure was 0.4% and the annual increase was 3.5%, ahead of analyst expectations of 0.3% and 3.4%.

Of course, it was known that energy prices had risen recently, but even the “core” CPI, which strips out volatile energy and food prices, also came in hotter than expected at 0.4% versus expectations of 0.3%.

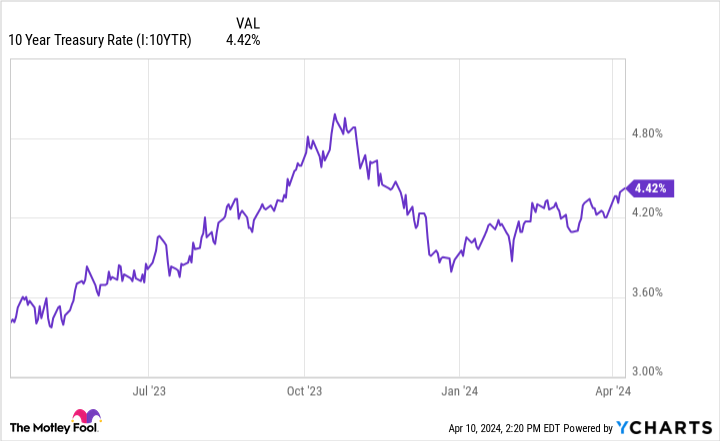

In response, the baseline for long-term bond yields, the 10-year Treasury bond yield, rose to 4.568% at its midday highs, its highest point on the year.

10 Year Treasury Rate data by YCharts

Many assets, from stocks to mortgages to other long-term bonds, are priced off the 10-year Treasury yield, so it’s no surprise the broader markets were down as their discount rates went up.

However, sticky inflation and rising interest rates are doubly bad for companies that either can’t raise prices, or that need to raise capital. Unfortunately, these three stocks each have elements of both.

NextEra Partners buys renewable projects from its parent utility, NextEra Energy (NEE -2.10%), then pays out the cash flows from those projects to unitholders. NEP’s revenue typically comes from long-term power purchase agreements with either fixed rates or rates with low annual increases over time. Moreover, as NEP pays out virtually all its profit as distributions, it constantly needs to tap the capital markets to finance new project buys. With rising rates, that becomes much more difficult, halting growth in its tracks, which is why the stock has sold off so hard over the past year.

Similarly, Lumen is a somewhat distressed, highly indebted company aiming to turn around its business under new CEO Kate Johnson. While there appears to be some positive progress on that front, Lumen is still experiencing declining revenue, combined with a near-$20 billion debt load. While the company did just strike a deal with its creditors to push out most of its maturities until 2029 and 2030, the rising rate environment puts more pressure on Lumen’s turnaround effort to succeed quicker.

Meanwhile, Tellurian is a bit of a disaster. The company was only in the early stages of construction of its Driftwood LNG export plant back in 2022 when interest rates began to take off. The rising rate environment and highly volatile natural gas prices have prevented Tellurian from finding financing for the massive $14.5 billion project on palatable terms. Moreover, Tellurian has also seen some long-term offtake customers cancel their contracts.

Given that the company will potentially run out of money at some point if it can’t find financing in the medium term, today’s rising interest rates make the company’s difficult situation even more so.

Be careful of heavily indebted companies

As these three companies show, it’s best to be extra cautious or avoid altogether the stock of any public company that needs to raise outside capital in order to survive or hit management’s growth targets. This is because outside factors such as today’s CPI report can throw a wrench even into carefully thought-out plans by management.

While all three of these companies’ stocks look extremely cheap, their debt and financing needs can make that ephemeral “value” a mirage — especially if rates continue to go the wrong way.

Billy Duberstein has no position in any of the stocks mentioned. His clients may own shares of the companies mentioned. The Motley Fool has positions in and recommends NextEra Energy. The Motley Fool has a disclosure policy.