Stocks are sprinting north again in back-to-back fashion as this morning’s lighter-than-expected CPI print bolsters animal spirits following yesterday’s optimism sparked by tariff reprieves between Beijing and Washington. The softer figures are adding to confidence that the Trump policy mix won’t produce much inflation, even as levies are a risk for cost pressures down the line. But at almost four months in, prices have been tempered under the new administration, for now. The developments have investors viewing the landscape with a glass half-full perspective as they aggressively add exposure to risk assets. Traders are scooping up equities, cyclical commodities and forecast contracts, especially those related to the major US indices. Conversely, folks are dumping shares in the defensive health care and consumer staples sectors, as well as Treasuries, greenback wagers and equity volatility protection instruments. Pricier duration is also leading to selling in the rate sensitive, real estate equity segment, meanwhile, but 8 out of 11 components are in the green.

April Price Gains Were Modest

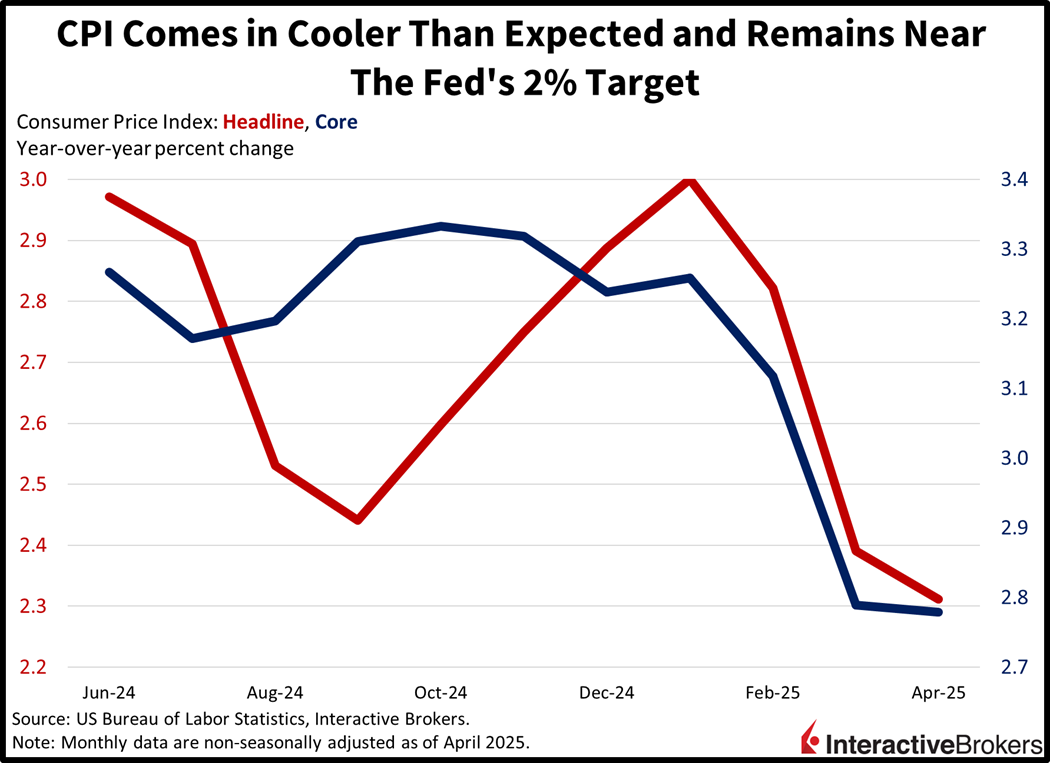

Consumer prices rose at a tempered pace last month as deflation from automobiles, apparel, food and gasoline helped to counter accelerating shelter and natural gas costs. April’s Consumer Price Index (CPI) climbed just 0.2% month over month (m/m) across both the headline and core segments, a tenth lighter than estimates. On an annualized basis, they increased 2.3% and 2.8% year over year (y/y), softer than the 2.4% projection on the former but in-line on the latter. In comparison, March’s results were -0.1% and 0.1% m/m and 2.4% and 2.8% y/y.

Electricity and Heating Led Cost Pressures

Pressures were led by loftier charges for natural gas related energy services (electricity and heating), medical care services, food at dining establishments, shelter and transportation services with those segments seeing their costs climb 1.5%, 0.5%, 0.4%, 0.3% and 0.1%. But used vehicles, food at markets, apparel and gasoline saw burdens drop 0.5%, 0.4%, 0.2% and 0.1%. The overall food category, which includes grocery stores and restaurants alike, dropped 0.1%, as deflation in the former segment countered inflation in the latter. New cars were unchanged.

Small Biz Sentiment Drops Again

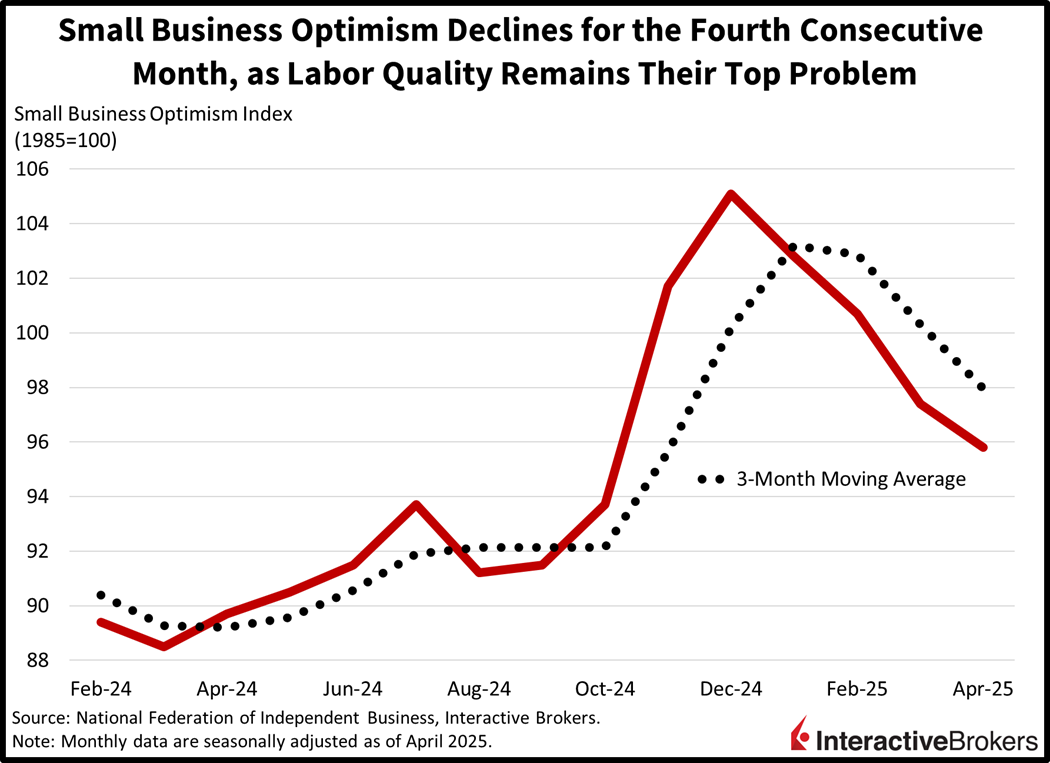

The National Federation of Independent Business’s Optimism Index fell for the fourth consecutive month in April as a lack of economic confidence and lackluster revenue projections weighed on results. The headline result of 95.8 beat expectations calling for 94.5, however, but was lighter than March’s 97.4. Reduced job openings, weaker capital expenditure and inventory prospects and pessimism regarding credit conditions also hampered sentiment. But profits and hiring plans contributed positively. The ranking for the single-most-important problem for enterprises, meanwhile, was quality of labor, followed by taxes and then inflation.

Equities Stage Broad Rally

Risk-on sentiment is dominating markets and investors are pouncing on equities, cyclical commodities and forecast contracts hand over fist. The Nasdaq 100, S&P 500 and Russell 2000 benchmarks are up 1.7%, 0.8% and 0.6%, but the Dow Jones Industrial is being held back by a sharp 16% fall in large constituent UnitedHealth Group; it’s down 0.4%. Sectoral breadth is positive as all 11 major segments are higher minus healthcare, real estate and consumer staples, which are losing 2.4%, 1.5% and 1.4%. Technology, energy and communication services are leading the bulls, meanwhile, posting increases of 2.3%, 1.7% and 1.1%. Treasurys are getting trimmed though, with the 2- and 10-year maturities changing hands at 4.02% and 4.49%, 1 and 2 basis points (bps) heavier on the session. The greenback is also in the red. Its index is lower by 62 bps as the US currency depreciates relative to all of its major counterparts, including the euro, pound sterling, franc, krona, yen, yuan, loonie and Aussie tender. Commodities are buoyant as illustrated by lumber, crude oil, copper, silver and gold futures gaining 4.7%, 3%, 2%, 1.1% and 0.6%. WTI crude is trading at $63.77 per barrel on stronger global economic growth expectations.

Easing Inflation and Trade Progress Boost Optimism

This morning’s CPI miss is strengthening confidence across Wall Street that inflation is under control in the short term. The well-received figures arrived beneath expectations despite an increase in overall energy costs, which is music to the ears of stock market investors. And while the road ahead is uncertain, progress on the trade front has significantly widened the path to reaccelerating economic growth and buoyant profitability. The run can continue, folks, especially with a few more trade deals, friendly data prints and a GOP sponsored taxation bill. As far as the stateside calendar, we have plenty more on deck as the week progresses. While tomorrow is quiet, we have the CPI’s cousin, retail sales, unemployment claims, industrial production, homebuilder sentiment, Philly and NY Fed regional surveys and a Chair Powell speech on Thursday. And on Friday, we have building permits, housing starts, Michigan consumer sentiment and import/export prices.

International Roundup

Bank of Japan Eyes Rate Hikes

The Bank of Japan (BoJ) anticipates further interest rate increases but also believes growing trade uncertainties make economic forecasting difficult, according to a recently released statement of opinions from the organization’s meeting that ended May 1. Among comments included in the statement, one central banker said low real rates and the outlook for price changes support the likelihood that policymakers will raise the key interest level. Another member said that tariff policies are highly fluid, and the bank could revise its outlook quickly if levies on cross-border commerce change. During its meeting, the BoJ lowered its growth forecast from 1.1% to 0.5% for the fiscal year ending March 2026 and maintained its key interest rate at 0.5%. It also lowered its core CPI forecast from 2.4% to 2.2%.

Aussie Consumer Sentiment Climbs

The May Australia Westpac Consumer Sentiment gauge rose 2.2% m/m, partially recovering from the 6% drop in April that was sparked by growing trade uncertainties. Overall, survey participants’ assessments of their personal finances improved and their views of the economy in the year ahead increased. The number of individuals who believe this is a good time to buy a major household item climbed as well.

While Business Conditions and Confidence Are Mixed

The National Australia Bank (NAB) Business Confidence Index showed that negative sentiment softened marginally with a -1 result in April compared to -2 in the preceding month. Readings below zero imply worsening conditions. Within the Business Survey, weaker profitability resulting from a faster rate of increase for input costs and weaker trading conditions pulled down results. The transportation and utilities group and the mining sector were noteworthy for their weakness. Regarding sentiment, results were the lowest in retail and wholesale.

And Building Permits Falter

The total number of building approvals in March dropped 8.8% m/m to 15,220, according to the Australian Bureau of Statistics. The decline matched the analyst consensus expectation but weakened significantly from the revised 0.2% contraction in February. It was the largest drop since December 2023 when approvals fell 9.5%. Conversely, on y/y basis, approvals were up 13.4%. Private house approvals also fell, dropping 4.5% m/m to 8,804, consistent with the consensus estimate but reversing from the 1% gain in February. Relative to the third month of 2024, approvals were down 3.3%.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.