- With 90% of S&P 500® companies reporting for the Q1 reporting season, EPS growth currently stands at 13.4%

- Three companies reporting this week have delayed their earnings dates: Fox Corp DaVita Inc. and NRG Energy

- This marks the final week of Q1 peak earnings season with 2,300 companies expected to report

The Q1 2025 earnings season heads into its final peak week with mostly positive results from S&P 500 companies thus far. With 90% of companies from the index now reporting, 78% have beaten Wall Street’s expectations, slightly better than what we’ve seen historically. Furthermore, the average percentage by which companies are beating stands at 8.5%, better than the 10 year average of 6.9%, but slightly below the 5 year average of 8.8%. These better-than-expected results have pushed S&P 500 blended EPS growth to 13.4%, nearly double the expectation at the beginning of the season, and making it the second consecutive quarter of double-digit growth.1

Last week saw impressive results from some highly anticipated names. Two of the standouts were Palantir and Disney. Palantir beat on the top and bottom-line and increased full-year revenue guidance to $3.89B – $3.90B from a prior outlook of $3.74B – $3.76B due to robust adoption of its AI software.2 Disney also beat on the top and bottom-line when they reported Q1 results on Tuesday, thanks to better-than-expected subscriber growth for its Disney+ streaming platform.3

On the flipside, results from Wynn4, Clorox5 and Restaurant Brands International6 came in weaker than anticipated on profits and revenues, which could possibly serve as commentary on how consumers are willing to spend their money in the current environment. Headwinds mentioned on earnings calls ranged from the impact of tariffs to the cautious consumer, providing a good set up for the kick-off of the retail earnings parade this week.

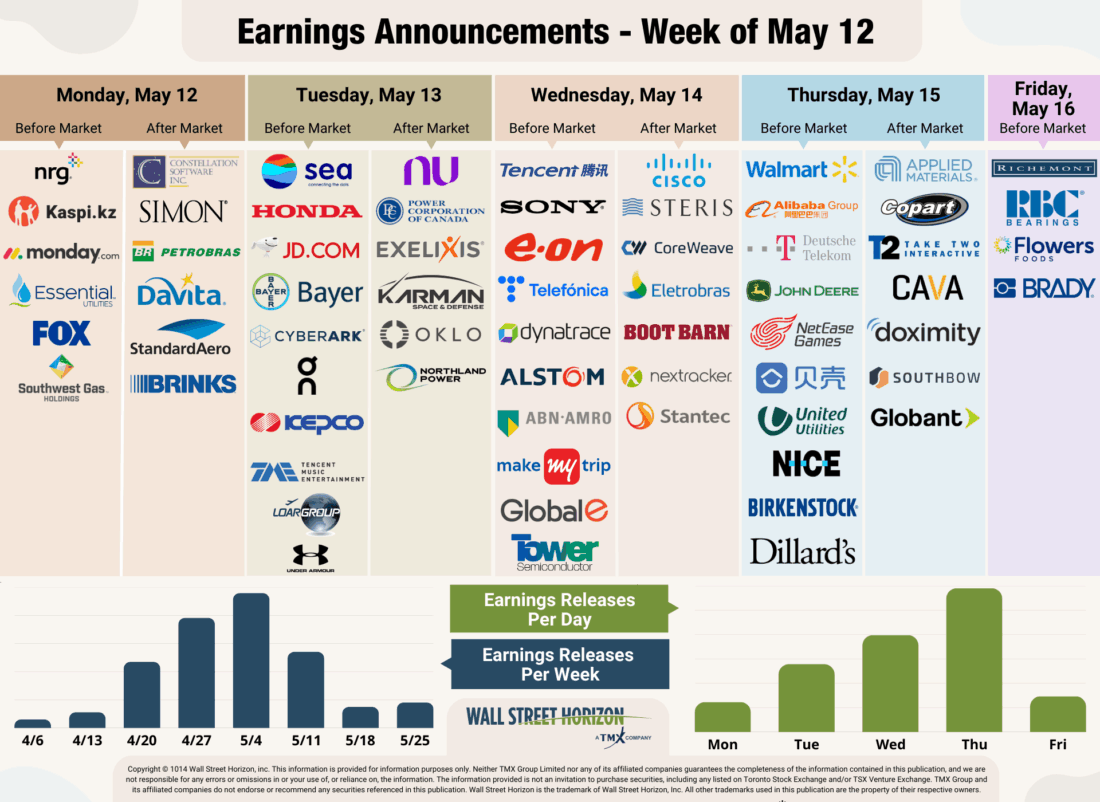

On Deck This Week

In this final peak week of the first quarter earnings season, all eyes will be on the retailers. The world’s biggest retailer, Walmart, is set to release results on Thursday. Walmart has been firing on all cylinders as of late by stealing market share from competitors like Target and luring higher-income shoppers. In a recent note, Wells Fargo pegged Walmart as a winner in nearly any macroeconomic backdrop.7

Other consumer-facing names to watch this week include department store Dillards, fast casual chain Cava Group, footwear maker Birkenstock and Chinese ecommerce giants JD.com and Alibaba.

Source: Wall Street Horizon

Outlier Earnings Dates This Week

Academic research shows that when a company confirms a quarterly earnings date that is later than when they have historically reported, it’s typically a sign that the company will share negative news on their upcoming call, while moving a release date earlier suggests the opposite.8

This week, we get results from a handful of large companies on major indexes that have pushed their Q1 2025 earnings dates outside of their historical norms. Three companies within the S&P 500 confirmed outlier earnings dates for this week, all of which are later than usual and therefore have negative DateBreaks Factors*. Those names are Fox Corp (FOXA), DaVita Inc. (DVA) and NRG Energy (NRG).

* Wall Street Horizon DateBreaks Factor: statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company’s 5-year trend for the same quarter. Negative means the earnings date is confirmed to be later than historical average while Positive is earlier.

Q1 Earnings Wave

The third and final week of peak earnings season takes place this week, with 2,300 names expected to report. Thus far, 87% of companies have confirmed their earnings date (out of our universe of 11,000+ global names), and 63% have reported results.

Source: Wall Street Horizon

—

Originally Posted on May 12, 2025 – A Better-than-Expected Q1 Earnings Season Wraps up with the Retailers

- Earnings Insight, FactSet, John Butters, May 9, 2025, https://advantage.factset.com

- Palantir Reports Q1 2025 Results, May 5, 2025, https://investors.palantir.com

- The Walt Disney Company Reports Second Quarter and Six Months Earnings for Fiscal 2025, May 7, 2025 https://thewaltdisneycompany.com

- Wynn Resorts, Limited Reports First Quarter 2025 Results, May 6, 2025 https://investors.wynnresorts.com

- Clorox Reports Q3 Fiscal Year 2025 Results, Updates Outlook, May 5, 2025 https://investors.thecloroxcompany.com

- Restaurant Brands International Inc. Reports First Quarter 2025 Results, May 8, 2025 https://www.rbi.com

- “This retailer wins no matter the economic backdrop, says Wells Fargo,” CNBC, Brian Evans, May 6, 2025, https://www.cnbc.com

- Time Will Tell: Information in the Timing of Scheduled Earnings News, Journal of Financial and Quantitative Analysis, Eric C. So, Travis L. Johnson, Dec, 2018, https://papers.ssrn.com

Copyright © 2025 Wall Street Horizon, Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Wall Street Horizon’s prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities, including any listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. This publication shall not constitute an offer to sell or the solicitation of an offer to buy, nor may there be any sale of any securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, and TSX Venture Exchange are the trademarks of TSX Inc. and are used under license. Wall Street Horizon is the trademark of Wall Street Horizon, Inc. All other trademarks used in this publication are the property of their respective owners.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Wall Street Horizon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Wall Street Horizon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.