The Fed leaves rates unchanged … Powell suggests March will be too soon for rate cuts … the markets don’t take it well … is it time to move away from the Mag 7 stocks? … where to look now

This afternoon, after its January policy meeting, the Federal Reserve left interest rates unchanged.

This was expected. The real issue today was what clues the Fed would provide about the timing of rate cuts here in 2024.

I hope you didn’t pick “March” in your office pool.

Here’s Federal Reserve Chairman Jerome Powell from his live press conference, speaking about the conditions need to cut interest rates:

I don’t think it’s likely that the committee will reach a level of confidence by the time of the March meeting to identify March is the time to do that.

The “level of confidence” Powell references relates to inflation falling to the Fed’s 2% goal in a sustainable way. This is a refrain Powell echoed repeatedly this afternoon.

Now, you might be scratching your head – inflation has plummeted! What more does the Fed need to see?

That’s a good question. And Powell’s answer today was a bit vague.

On one hand, he said he was very pleased with progress on inflation. And the issue isn’t so much that the inflation numbers aren’t coming in to Powell’s liking. Instead, Powell said that he and the Fed members simply want more of these good data reports. The Fed Chair was explicit that six months of good data isn’t enough.

A reporter pointed out that Powell had just indicated that cuts in March weren’t likely. And if good inflation data continues through March, that would mean that “eight months good data” wouldn’t be enough either. The reporter then tried to pin Powell down on exactly how many months of good data would be enough to initiate rate cuts.

Powell tap-danced, returning to his talking points about “more evidence,” “more confidence that we’re on a sustainable path to 2%,” and “data dependent.”

Yesterday, we highlighted how legendary investor Louis Navellier is pointing toward April for when the Fed will make its first rate cut. That seems a reasonable guess in the wake of today’s news.

Here are some other takeaways from Powell’s press conference:

- Fed members believe they’ve hit the peak interest rate level of this tightening campaign.

- If the labor market begins to slide substantially, that would accelerate the timing of rate cuts.

- “Just tapping” 2% inflation wouldn’t be good enough. Powell wants data showing that inflation is consistently coming in at 2%.

- Powell is not declaring a soft landing, and we have a way to go before he’d feel comfortable taking such a victory lap.

- When the Fed does cut rates for the first time, it won’t necessarily be the beginning of a consistent rate-cut cycle. It could be just a one-off rate cut. The data will inform the Fed’s decision.

Put it all together and the market didn’t like what it heard

All three major stock indexes traded lower in the wake of Powell’s press conference, led by the Nasdaq which fell more than 2%.

This has been a risk we’ve repeatedly pointed toward here in the Digest.

Wall Street has second-guessed the Fed at every step of this interest rate policy cycle, anticipating far more, and quicker, rate cuts than the Fed was signaling.

We’ve been warning that this divergence would likely be a source of market volatility. After all, Wall Street has been pricing in a “picture perfect” 2024, and today’s wakeup call from Powell throws cold water on those happily-ever-after expectations.

It’ll be interesting to see whether today’s selloff turns into a larger correction, which could present a great buying opportunity.

If it does, the question becomes “which stocks should you consider buying?”

Where are you looking for opportunities in today’s market?

To borrow from legendary investor Louis Navellier, this increasingly feels like a market where “it’s every stock for itself.”

And that means both opportunities and threats.

Beginning with threats, one part of your portfolio to eye with caution are your mega-cap market tech darlings. Basically, the Magnificent Seven.

For an overview on why, let’s jump to Bloomberg:

The dominance of the 10 biggest stocks in US equity markets is increasingly drawing similarities with the dot-com bubble, raising the risk of a selloff, according to JPMorgan Chase & Co. quantitative strategists.

The share of the top ten stocks on the MSCI USA Index, including all of the so-called Magnificent Seven tech stocks, has risen to 29.3% by the end of December, the strategists led by Khuram Chaudhry wrote in a Tuesday note.

That’s just moderately below the historical peak share of 33.2%, which occurred in June 2000. Furthermore, only four sectors are represented in the top 10, compared to the historical median of six, the strategists said.

The chart below shows us the ratio of the market cap of the top 10 largest stocks in the S&P compared to the market cap of the MSCI USA Index.

The solid black line is the average reading. The dotted black line shows us the average plus/minus one standard deviation.

As you’ll see below, our current level is towering above the plus-one-standard deviation line.

Translation – mega-cap stocks have a highly concentrated amount of the market’s overall invested capital. And as the JPMorgan analyst note highlighted, today’s level isn’t too far from that of the Dot Com bubble.

From the JPMorgan note to clients:

The key takeaway is that extremely concentrated markets present a clear and present risk to equity markets in 2024.

Just as a very limited number of stocks were responsible for the majority of gains in the MSCI USA, drawdowns in the top 10 could pull equity markets down with them.

On that note, Alphabet missed expectations for Q4 ad revenue last night and ended the day down 7%.

To be clear, Alphabet topped earnings and overall revenue expectations, but it missed on the ad revenue forecast. It’s not a great sign when a market leader enjoys a double beat but is still punished by Wall Street.

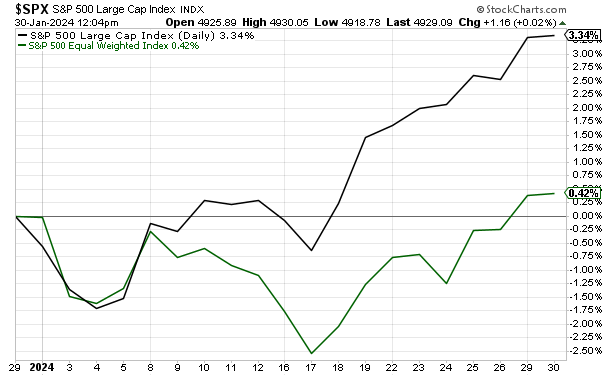

Another way to look at the concentration in mega-cap stocks is by comparing the S&P to the S&P Equal Weight Index

The S&P 500 is a “weight averaged” index. In other words, the bigger the company, the more “representation” it has in the index. So, the bigger the stock, the more that the performance of that stock influences the overall S&P return.

Given this, when we look at the S&P’s price, we’re not viewing an accurate depiction of how its average stock is performing. We’re getting a skewed conclusion, heavily impacted by the performance of the largest companies in the index, which include the Magnificent Seven.

For a more accurate reading on the performance of the average S&P stock, we’d analyze the “Equal Weight” S&P 500 index. As the name suggests, this allots an equal weighting to every stock in the S&P so that no single company has outsized influence on the overall reading.

Below, we look at the S&P 500 (in black) and the S&P 500 Equal Weight (in green) so far in 2024 through yesterday. We’ll add commentary momentarily.

This is massive outperformance by the S&P – which means the Magnificent Seven and those top 10 mega-cap holdings.

If it doesn’t seem that way to you, keep in mind that this ~3% marginal outperformance represents less than one month of market action. Running a crude extrapolation over an entire year would give us an S&P return of 40% compared with an S&P Equal Weight return of just 5%.

That’s an enormously lopsided market.

Switching now to “opportunities,” if this seems like a reason to begin looking for outperformance from smaller stocks, you’re thinking just like Luke Lango

As our hypergrowth expert and the editor of Early Stage Investor, Luke isn’t bearish on leading mega-cap stocks, but he’s wildly bullish on smaller stocks today – especially small-cap AI stocks.

Here he is explaining why:

The large-cap S&P 500 is currently at all-time highs. Meanwhile, the small-cap Russell 2000 is still in a bear market. This has never happened before.

In the three instances closest to the current situation – where the S&P 500 rose to all-time highs while the Russell 2000 remained >10% off all-time highs – stocks always rallied over the following year, and small caps always outperformed.

In two of those instances, small caps rallied more than 35% over the next year.

We think history will repeat here.

Luke goes on to make a big prediction…

He thinks small caps will rally somewhere between 30% and 40% over the next year, led by small-cap AI stocks. And he sees a handful of the leading small-cap AI stocks doubling over the next 12 months.

If you’re looking for exposure to small-caps, check out the iShares Russell 2000 ETF, IWM. Of course, that won’t pinpoint leading AI plays.

Alternatively, there are a handful of AI ETFs available to you (for example, the Global X Artificial Intelligence & Technology ETF, AIQ), but I haven’t seen one that limits its holdings to small-cap stocks.

For the specific small-cap AI recommendations that Luke has just added to his Early Stage Investor portfolio, click here.

Finally, for one more corner of the market poised for outperformance, don’t miss last week’s “AI Wars” research video from Eric Fry

Here’s Eric explaining what these “AI Wars” are:

What I’m calling the “AI Wars of 2024” marks a new era of technological competition among leading nations.

And this war focuses on developing advanced AI capabilities to achieve technological superiority. I believe those who harness AI’s power will lead the world for the foreseeable future.

To win this war for AI supremacy, the U.S. government is about to funnel $53 billion toward leading AI companies as part of the CHIPS And Science Act Of 2022. In fact, tomorrow is a key deadline for companies hoping to be the beneficiaries of these government dollars.

That means the government could be awarding funds any day after tomorrow – potentially moving the stock prices of the lucky recipients. Rumor has it that Intel and Taiwan Semiconductor are on the short list.

Eric put together a research video that delves into all the details, but today is the last day we’re making it available. Click here to watch it before we take it down this evening.

Have a good evening,

Jeff Remsburg