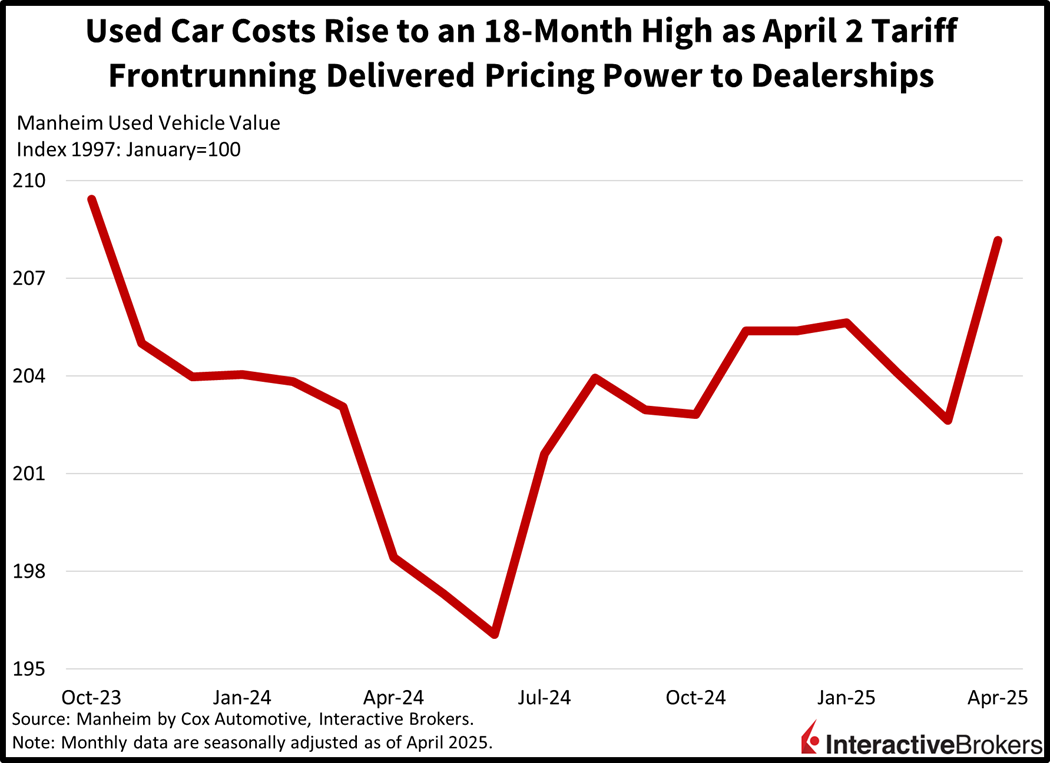

Trading action has been indecisive this morning as participants await this afternoon’s FOMC that will feature an interest rate decision followed by the Powell Presser 30 minutes later. Stocks opened firmly in the green on the heels of Washington and Beijing announcing initial talks this weekend in Geneva. The opening meeting is bolstering optimism that both sides are incrementally making progress toward de-escalation. But equities have lost much of the early momentum at this juncture, as a stateside economic report pointed to used car prices leaping to an 18-month high in April. Furthermore, investors are concerned that the Fed may point to tariff uncertainty and strong hiring as justifications to keep its benchmark steady. The development is likely to draw criticism from President Trump though, who has been warning that the central bank is too late in loosening policy. Markets are mixed at the moment, with neutral equity performance as value trades positively and growth negatively. Another bifurcation is occurring in the Treasury complex, with short-end yields heavier but duration lighter. Meanwhile, traders are upping their exposures to the greenback and forecast contracts while trimming commodity holdings.

Race to Beat Tariffs Revs Up Auto Prices

The rush to purchase automobiles ahead of April 2 tariffs pushed up wholesale costs quite significantly, as the Cox Automotive Used Vehicle Value Index jumped to its highest level since October of 2023. The 208.2 headline reading for April was reached with 2.7% month-over-month (m/m) and 4.9% year-over-year (y/y) advances, much greater than the -0.7% and -0.2% subtractions from March. Prices did decline during the last week of April, however, against the backdrop of frontloaded purchases.

Traders Await FOMC For Direction

Major domestic equity benchmarks are trading in opposite directions as investors prepare the popcorn for commentary from the US central bank. The Dow Jones Industrial and Russell 2000 indices are up 0.4% and 0.3% but the Nasdaq 100 and S&P 500 gauges are retreating by 0.3% and 0.1%. Sectoral breadth is strongly positive though, as materials, technology and energy are the only segments taking losses; they’re reversing by 0.3%, 0.2% and 0.2%. But the other 8 majors are advancing, with financials, consumer discretionary and real estate gaining 0.7%, 0.6% and 0.5%. In fixed-income, the 2- and 10-year Treasury maturities are changing hands at 3.80% and 4.28%, 2 basis points (bps) heavier on the former but 2 bps lighter on the latter. The Dollar Index is up 10 bps as the greenback appreciates relative to all of its major counterparts, including the euro, pound sterling, franc, krona, yen, yuan, loonie and Aussie tender. Commodities are losing steam with copper, silver, gold and crude oil falling 2.4%, 1.7%, 1.5% and 0.4%. Lumber is bucking the trend, however, and is being helped by softer long-end yields. It’s up 0.2%.

Powell & Company to Ease in June

The Fed is in a tricky spot because a step down prior to a potential reacceleration in goods prices would counter the central bank’s objective. But so far this year, inflationary forces have cooperated, as services cooled while commodities backtracked, widening the door to an absorption of loftier product charges without a necessary spike in the Consumer Price Index. With headline inflation tracking at around 2.3% in April, according to our IBKR prediction market, my opinion is that the FOMC is too tight at a midpoint of 4.375%, marking over 200 bps of positive real rate restriction. In conclusion folks, June is a live meeting and considering the momentum of cost pressures, I believe we will see an out-of-consensus quarter-point cut next month.

International Roundup

Eurozone Retail Falters

Easing inflation and a strong job market in the eurozone failed to overcome shoppers’ trade war angst with March retail sales volumes dropping 0.1% m/m, in-line with the consensus estimate but down from the 0.2% gain in the preceding month. Despite the m/m decline, the indicator is still up 1.5% y/y, but the metric was below both the 1.6% forecast and February’s 1.9% increase. Relative to February, the food, drinks and tobacco category and the non-foods except fuel group both dropped 0.1%, but volumes at automotive fuel sales at specialized stores jumped 0.4%.

German Factory Orders Exceed Estimates

The growth of factory orders in Germany during March outpaced expectations after a long period of weakness. Orders climbed 3.6% m/m, according to the Federal Statistical Office (Destatis) well above expectations of 1.4%. The increase within Europe’s largest economy spanned the spectrum of sectors with electrical, transport equipment, machinery, automotive and pharmaceuticals all advancing. Among those categories, pharmaceutical volumes jumped 17.3% while electrical equipment orders climbed 14.5%.

HK Contraction Continues

The S&P Global Hong Kong SAR Purchasing Manager’s Index (PMI), which is a composite gauge, remained at 48.3 in April for the second-consecutive month, the lowest level since July 2024. Any score below 50 implies contraction. New orders and exports shrank at the fastest rates since July of last year and April 2022, respectively. On a positive note, while demand from China was still weak, it strengthened marginally. Meanwhile, firms attributed a decline in output to expectations of slowing economic conditions and US tariffs. Sentiment for the coming 12-month period also weakened, hitting the lowest level in four-and-a-half years.

Australian Economy Still Weak

Indices from the Australia Industry Group, or Ai Group, that track industry, manufacturing and construction found that the overall contraction slowed in April, but all three benchmarks were weighed down by uncertainties regarding global trade, skilled labor shortages and the country’s elections, which just last week resulted in the Labor Party maintaining its majority. Currency volatility also hurt headline results, especially for machinery and metal subindustries.

The Ai Group Australian Industry Index, which measures all industries, climbed in April but remained well below the zero neutral level with a score of -15. Meanwhile, the Australian PMI for manufacturing increased 3.2 points but remained deep in negative territory with a score of -26.5. The Australian Construction Index was -7.9 despite climbing 11.4 points.

Within the broad industrial gauge, employment continued to deteriorate as a shortage of skilled labor weighed on results.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.