There is really no way to sugarcoat this morning’s economic reports, and traders appear to realize that as well. The combination of reduced hiring, a shrinking economy, and higher inflation was initially too much for a recently resurgent stock market. But that hasn’t stopped traders from pursuing their favorite new pastime – chasing a bouncing market.

The first piece of sour data came from ADP. We first noted a few years ago that the ADP Employment reports released on the Wednesday preceding the monthly jobs data from the Bureau of Labor Statistics are typically a poor predictor of the more encompassing data that follows. As a result, the ADP report is usually not a major market catalyst. Today it was, however. Stock futures sank after today’s 62,000 increase came in below even the low end of economists’ predictions. It is impossible to ignore a report that shatters consensus.

But the bigger blow came 15 minutes later with the Q1 GDP report. Expectations were already for a negative print, thanks to a sharp rise in imports that attempted to front-run the April tariff announcement, but the -0.3% print was below the consensus. Worse, the GDP Price Index and quarterly Core PCE Price Index rose by +3.7% and +3.5% respectively, when +3.1 was expected for each. We’re a long way from ‘70s-style stagflation, but the pairing of lower output and rising prices is nasty prerequisite.

Thus, it was unsurprising when the S&P 500 (SPX) and other indices opened sharply lower. The numbers were unequivocally disappointing, so it was not surprising when flattish futures turned into a -1.5% pre-market loss after the reports, then worsened to a -2% loss after the open. The drop ended about a half-hour after the open, just before the next set of numbers, which included Personal Income and Spending, and the Monthly Core PCE Price Index, were set to arrive. There was an understandable bounce off the lows when those proved to be generally in-line or slightly better than expected.

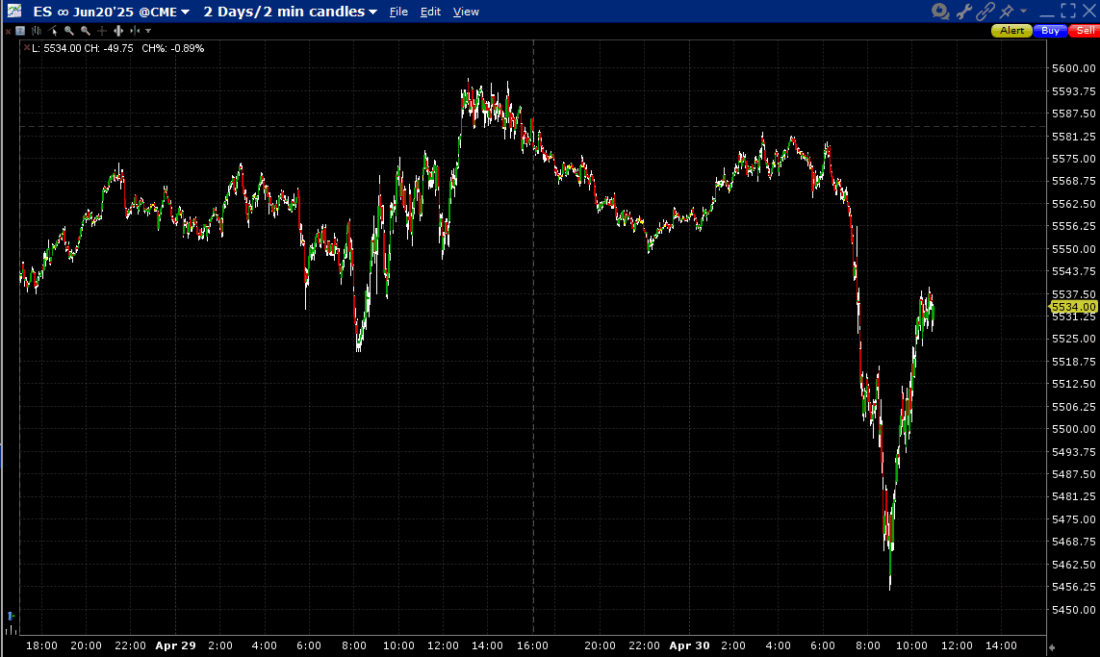

Over the ensuing hour, the modest relief bounce morphed into US-based traders’ favorite current pastime – chasing a rally. When we look at a two-day chart of ES futures, we can see that some of the initial decline appeared to be the result of stops being triggered at yesterday’s low, which also appears to be around the level at which the bounce has found some resistance:

ES June Futures, 2-Days, 2-Minute Candles

Source: Interactive Brokers

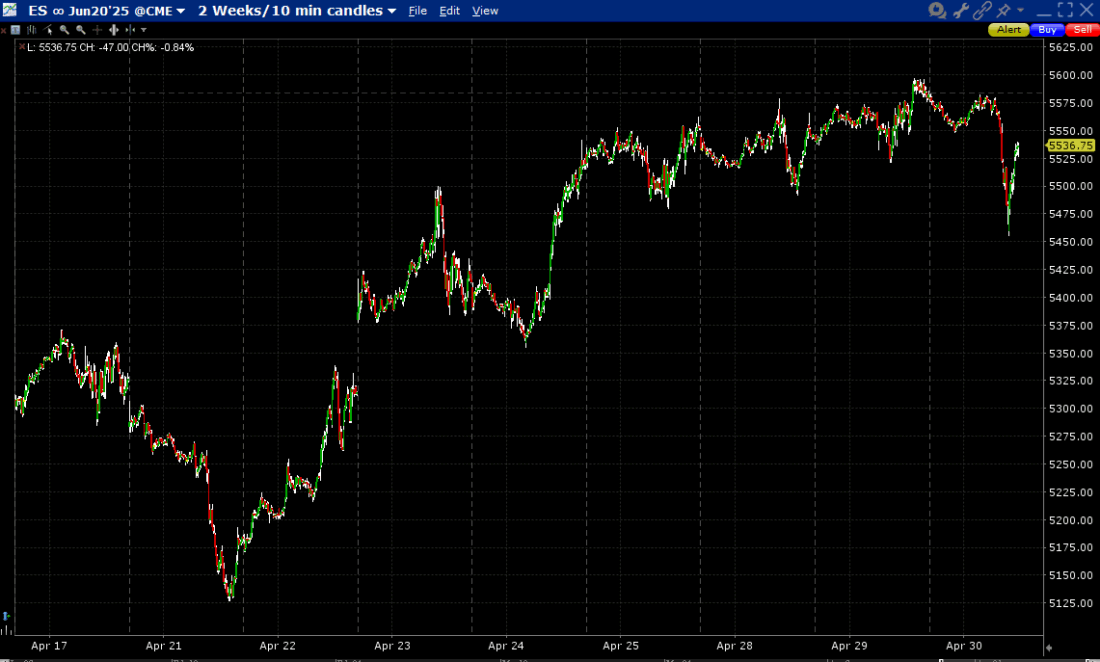

A slightly longer view shows that this morning’s drop reversed at roughly the level that triggered a breakout last week:

ES June Futures, 2-Weeks, 10-Minute Candles

Source: Interactive Brokers

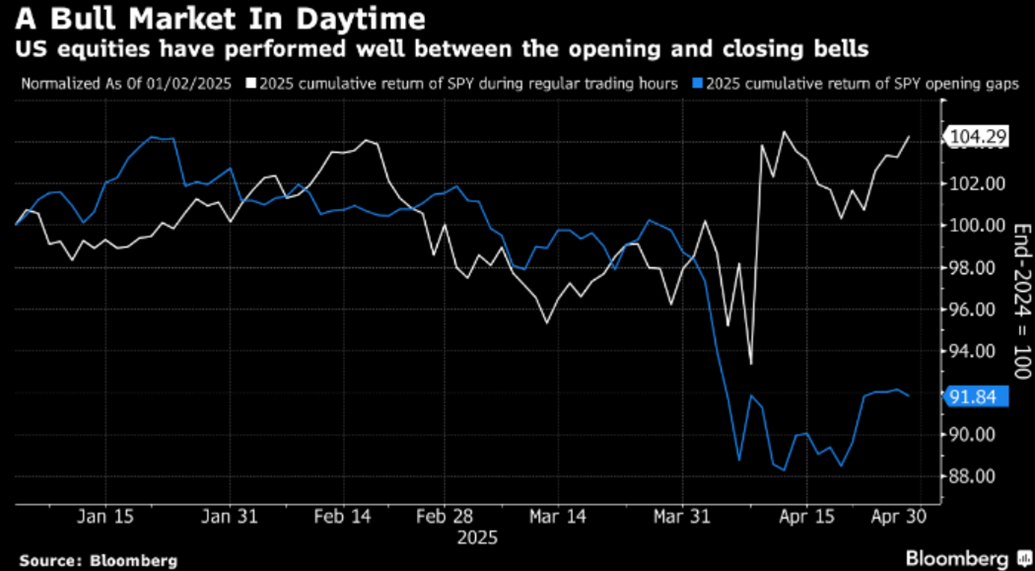

I had been trying to prove that the rally has been driven by aggressive traders during US hours, but quite frankly, I was unable to do so. This morning, however, a Bloomberg article by Cameron Crise offered a graph of the data that I should have compiled. It shows the incredible gap that has developed in recent weeks between the overnight performance of SPX and the moves that have occurred during the regular session:

It is quite apparent that enthusiastic traders have been pushing equities higher all month. It’s as though we wait until the foreign spoilsports go home and then begin the party once they leave. This fits with our assertion that non-US investors have been net sellers of US assets. They seem to be less aggressive sellers than they were a few days ago, but then again, traders during US hours have become more aggressive buyers.

Thus, considering that today’s month-end offers the possibility, if not the likelihood, of a late-day markup, it would not surprise me in the least if we saw an unchanged – or even a positive – close. The intra-day momentum has been powerful enough to outweigh most market concerns for several days, so today could be no exception. At least in the short-term, positive momentum is outweighing soggy fundamentals. That doesn’t seem as though it can persist indefinitely, but this is the inverse of what we noted about consumer sentiment yesterday. Just as unhappy consumers can induce economic weakness if their mood sours sufficiently, enthusiastic traders can spur a rally if they remain exuberant long enough – at least for a while.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.