The market ignores the slowdown on inflation progress … are longer-term inflation expectations rising again? … why the Fed will probably disappoint on rate cuts … what it means for the market

Yesterday, the market shrugged off the hotter-than-expected Consumer Price Index (CPI) report.

The big “up” day in stocks that followed was a bit of a headscratcher.

Here in 2024, the market has zoomed higher in expectation of rate cuts later this year. Historically, rate cuts are fantastic for stocks (unless they’re required to jump start a flatlining economy, which is not our case today).

But when rate cuts begin, and how many we get, are up to the Federal Reserve. And driving the Fed’s policy is, as you know, inflation.

Here’s what Powell said on this topic last week:

The Committee does not expect that it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.

This is where things get murky.

In congressional testimony last week, Fed Chairman Jerome Powell said he wants “just a bit more evidence” that inflation is moving toward its 2% target before cutting interest rates. But he did add “we’re not far from it.”

Score one for the rate-cut camp.

But then came yesterday’s CPI data that topped expectations. This wasn’t a one-off. It was the third straight month of a hotter-than-expected print.

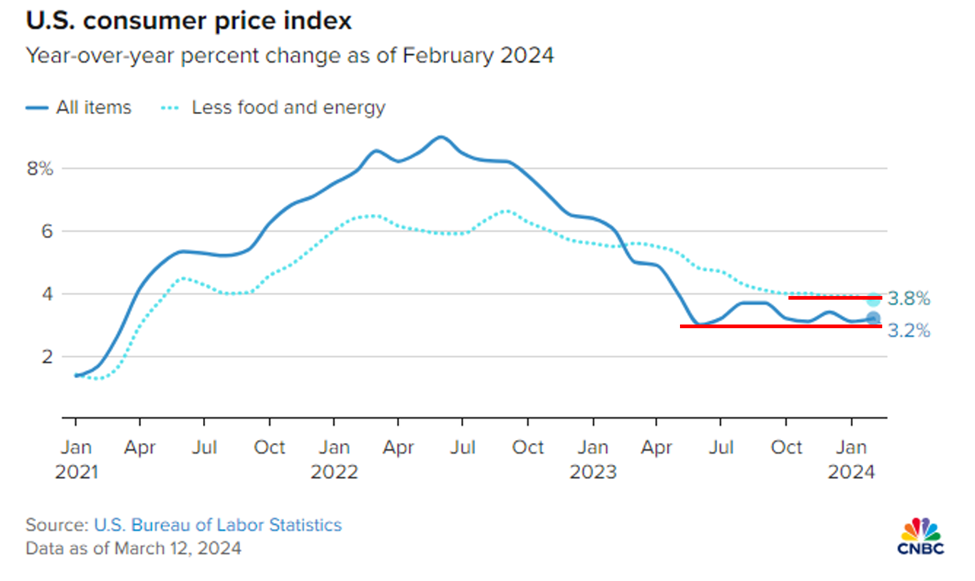

Plus, when we zoom out and look at a chart of headline and core CPI, we see that inflation appears to be moving not so much “down” but more so “sideways.”

Below, I’ve added red lines showing this sideways action for headline CPI since last spring and core CPI since last fall.

What do you think?

And that brings us to what’s happening with real-time inflation here in March.

Is inflation beginning to rear its head again?

For more on this, let’s go to our hypergrowth expert, Luke Lango.

From Monday’s Daily Notes in Innovation Investor:

Real-time data suggests that inflation is picking up again in March.

Bloomberg’s Commodity Price Index has risen 2% month-to-date. Asking rents are increasing, according to Redfin. Inflation expectations have ceased to decline.

Combining these factors, the current estimate for March CPI inflation is 3.3%, up from February’s rate of 3.2%.

In essence, the trend of disinflation we’ve seen is shifting to gradual reinflation in March.

This shift is concerning. The general trend over the past 18 months has been that falling inflation leads to rising stocks, while rising inflation results in falling stocks.

After [the] CPI report, investors will focus on the March CPI report. If disinflation gives way to reinflation, this could negatively affect stocks in the short term.

Now, there are two related-yet-different issues here we need to address…

Reflation versus a simple stalling out of deflation.

The risk of significant reflation is relatively low unless the Fed goes “full dove” too soon, but consumer expectations about longer-term inflation could become a problem

For shorter-term reinflation, let’s return to Luke:

We believe any reinflation seen in March will be temporary. Disinflation is likely to resume, possibly as soon as April.

Furthermore, we anticipate that strong earnings and improving economic activity will counter any short-term challenges caused by a March reinflation scare.

We are optimistic about a broadening economic recovery in 2024, which we expect to drive a widespread stock market rally into the summer.

We tend to agree with Luke. But let’s keep in mind that the bigger issue is what consumers believe.

After all, if consumers become convinced that inflation will worsen, they’ll buy goods and services today at prices they believe will be lower than prices tomorrow. Of course, it’s this very buying pressure that increases demand, fueling price increases. It’s a self-reinforcing feedback loop.

On Monday, we learned that consumers’ beliefs about inflation are moving in the wrong direction.

From CNBC:

Consumers increasingly doubt the Federal Reserve can achieve its inflation goals anytime soon, according to a survey Monday from the New York Federal Reserve.

While the outlook over the next year was unchanged at 3%, that wasn’t the case for the longer term. At the three-year range, expectations rose 0.3 percentage point to 2.7%, while the five-year outlook jumped even more, up 0.4 percentage point to 2.9%.

All three are well ahead of the Fed’s 2% goal for 12-month inflation, indicating the central bank may need to keep policy tighter for longer.

This dovetails into the second issue…

Even if we avoid a resurgence of inflation, the stock market can stumble if our progress on deflation stalls out.

In our opinion, this is the greater risk today.

Is Wall Street getting it wrong again?

It wasn’t long ago that Wall Street was convinced we would have seven rate cuts here in 2024. It also wasn’t long ago that Wall Street was convinced we’d have the first rate cut in March.

It’s safe to say that Wall Street is going to go “0 for 2” on those calls.

As Powell has (mostly) stuck to his guns in recent months, that “seven rate cuts” expectation has finally drifted lower. As I write, the CME Group’s FedWatch Tool shows that most traders now believe the Fed will enact either three or four quarter-point rate cuts this year.

But is that expectation still too high?

Well, not if we look at the Fed’s December 2023 Dot Plot that showed three cuts.

For any newer Digest readers, the Dot Plot is a graphical representation that shows us each committee member’s anonymous projection of where they believe rates will be at upcoming dates in the future.

But remember, the Fed’s Dot Plot is dynamic. As Fed members analyze new data, their opinions about policy change to reflect those data.

The latest Dot Plot arrives next Wednesday when the Fed wraps up its March meeting. Is it likely that “three rate cuts” will remain the majority opinion?

Cue this headline from Bloomberg:

Fed’s Kashkari Sees Two Rate Cuts in 2024, Potentially Just One

As to why just one or two rate cuts would be the Fed’s preferred plan for 2024, we can look to Atlanta Fed President Raphael Bostic and his recently-coined term…

Bostic wants to avoid the inflationary impact of “pent-up exuberance.”

Here’s Bostic:

As my staff and I have talked to business decision-makers in recent weeks, the theme we’ve heard rings of expectant optimism.

Despite business activity broadly moderating, firms are not distressed. Instead, many executives tell us they are on pause, ready to deploy assets and ramp up hiring when the time is right.

I asked one gathering of business leaders if they were ready to pounce at the first hint of an interest rate cut.

The response was an overwhelming ‘yes.’

For a market environment in which progress on inflation is slowing, businesses that are “ready to pounce” is not great news. It smacks of resurgent inflation the Fed is desperate to avoid.

Bostic is now suggesting the Fed enacts one rate cut sometime in the 3rd quarter and then pauses.

From Bloomberg last week:

Federal Reserve Bank of Atlanta President Raphael Bostic said he expects the Fed’s first interest-rate cut, which he has penciled in for the third quarter, will be followed by a pause the following meeting to assess how the policy shift is affecting the economy…

“I would probably not anticipate they would be back to back” cuts, Bostic said. “Given the uncertainty, I think there is some appeal to acting and then seeing how participants in the markets, businesses leaders and families respond to that.”

This doesn’t bode well for “three or four” rate cuts in 2024.

Plus, remember the “ego” part of all of this

Federal Reserve Chairman Jerome Powell already has a plaque in the “bad call hall of fame” for his use of “transitory inflation” two years ago. You can be sure that egg on his face will haunt him for a long time.

Given this, he’s likely sensitive to avoiding becoming this generation’s Arthur Burns.

For anyone less familiar, Burns was the Federal Reserve’s Chair during most of the 1970s. His rate-cut policies are largely seen as enabling and inflaming that decade’s brutal inflation.

From FederalReserveHistory.org:

Burns assumed leadership of the Federal Reserve during the middle of what would later become known as the Great Inflation (1965–82). In short, easy monetary policy during this period helped spur a surge in inflation and inflation expectations.

Burns would hike rates, see the ensuing fall in inflation, assume victory and cut rates in response, only then to see inflation roar back to life, requiring another round of rate hikes.

Fast forward to today, and here’s billionaire Ken Griffin from Citadel Capital speaking to avoiding this mistake:

If I’m [the Fed], I don’t want to cut too quickly.

The worst thing they could end up doing is cutting, pausing and then changing direction back towards higher rates quickly. That would, in my opinion, be the most devastating course of action that they could pursue.

So, I think they are going to be a bit slower than what people were expecting two months ago in cutting rates.

Let’s be clear about what this does and does not mean

If the Fed doesn’t move as fast as Wall Street hopes, yet our economy holds up, then we could see a short-term price correction but it’s unlikely to derail this bull market, especially considering improving earnings.

Yes, certain interest-rate sensitive sectors of the market could stumble as disappointed bullish traders reallocate their capital. But a delay in rate cuts most likely means little more than a commensurate delay in the continuation of this bull market.

The greater risk would be if “higher for longer” causes the economy finally to roll over. But this is where things get tough to predict.

On one hand, today’s economy is rather strong. On the other hand, there’s the ongoing question about the resilience of the U.S. consumer.

JPMorgan’s CEO Jamie Dimon captured this tension this week when speaking at the Australian Financial Review Business Summit. Despite the economy “kind of booming,” as he put it, Dimon still believes a recession is more than possible.

From Bloomberg:

Jamie Dimon said he wouldn’t take the prospect of a recession in the US “off the table,” but that the Federal Reserve should wait before it cuts interest rates.

“The world is pricing in a soft landing, at probably 70-80%,” the JPMorgan Chase & Co. chief executive officer said via video link at the Australian Financial Review Business Summit in Sydney on Tuesday.

“I think the chance of a soft landing in the next year or two is half that. The worst case would be stagflation.”

In the face of this uncertain future, our plan remains the same for now…

Stay in the market and continue trading it higher.

I’m not saying ignore whatever fundamental indicator you’re watching that might be screaming “be careful!”, but for the time being, this is a market that’s creating wealth.

So, mind your position sizes and stop losses… don’t stick your neck out too far… remember that return of capital is more important than return on capital… but stick with what’s working. And today, that means stick with this bull market.

For more of Luke’s market analysis, and to see exactly how he’s positioning his Innovation Investor portfolio, click here.

We’ll keep you updated.

Have a good evening,

Jeff Remsburg