Shares of Oklo (OKLO 7.70%) soared last month as the Sam Altman-backed nuclear energy company benefited from two news events.

First, the announcement of the Stargate Project (for which Altman joined President Trump and Oracle Founder Larry Ellison at the White House) signaled at least $100 billion of investments in AI data centers, which is likely to fuel demand for energy. That piqued the interest of investors in the nuclear energy stock as nuclear is seen as a valuable source of energy to power data centers in the future.

Like the rest of the AI sector, Oklo faced a setback from the DeepSeek launch, which poses a threat to the AI infrastructure ecosystem that companies like Oklo fit into. Later that week, the stock jumped as it signed a memorandum of understanding for a fuel fabrication facility and after it got a buy rating from an analyst.

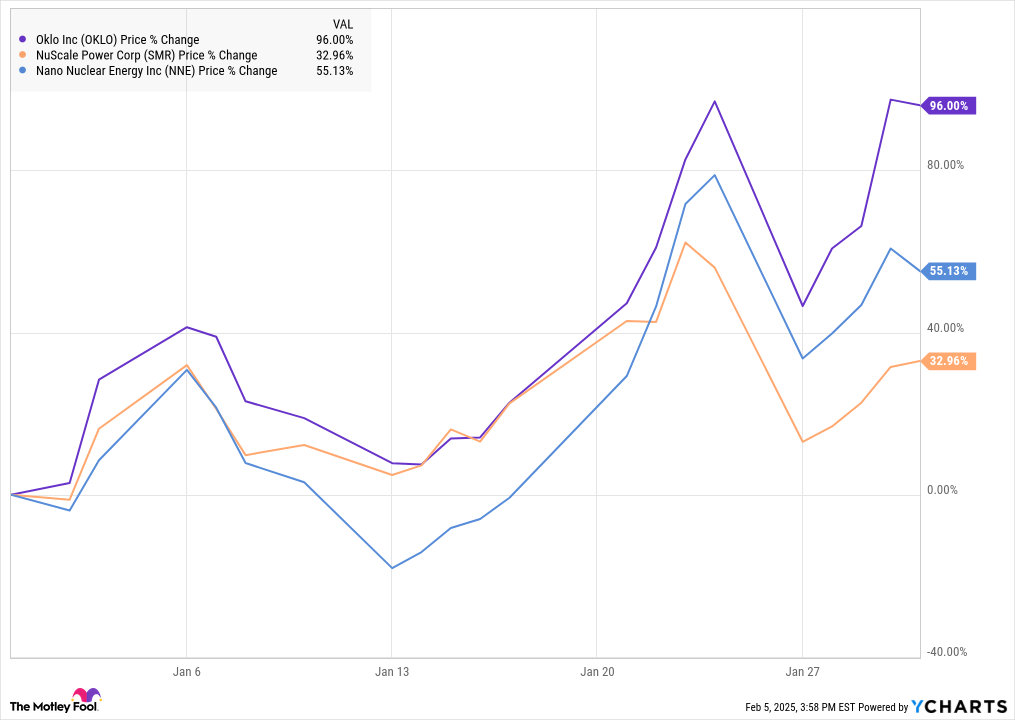

Altogether, the stock finished the month up 96%, according to data from S&P Global Market Intelligence. As you can see from the chart below, the stock’s gains came in the second half of the month.

Oklo’s momentum continues

Oklo was one of a handful of stocks focused on small modular reactors (SMRs) that soared last year, including NuScale Power and Nano Nuclear Energy, and the performance in January shows investors continue to be bullish on that sector.

Oklo stock started to rally on Jan. 17, gaining 7.5% after it signed a memorandum of understanding wth RPower to accelerate power availability for data centers.

The stock then soared following the inauguration and jumped on the Stargate announcement, which would seem to favor Oklo as Altman is the chairman of the company. OpenAI, the AI start-up for which Altman is the CEO, has pledged to invest $19 billion in the Stargate joint venture, though there aren’t direct implications for Oklo for now as the SMR technology is still in development.

Finally, following a pullback on the DeepSeek news, Oklo jumped again after getting a buy rating from Craig-Hallum, which believed the stock could hit $80 a share or more as it’s likely to play a key role in the transition to nuclear.

Image source: Getty Images.

What’s next for Oklo

For now, investors should expect Oklo stock to move in line with broader expectations around AI. For example, the stock gained on Wednesday in response to the news that Alphabet is ramping up capital expenditures to $75 billion this year, up from $52.5 billion in 2024, showing it intends to spend significantly more money on AI.

The company is also aiming to deploy its first Aurora powerhouse in 2027, so investors should keep their eye on developments around that as well, but this looks like a leveraged play on AI hopes in the meantime.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet and Oracle. The Motley Fool recommends NuScale Power. The Motley Fool has a disclosure policy.