Shares of website company GoDaddy (GDDY -14.28%) crashed on Friday after the company released its financial results for the fourth quarter of 2024. As of 12:50 p.m. ET, GoDaddy stock was down about 13%.

GoDaddy comes up just short of expectations

For Q4, GoDaddy expected to grow revenue by only about 7% year over year, but it wound up growing by 8% to $1.2 billion. And for 2025, the company expects to grow by another 7%, which isn’t bad considering its current growth rate and size. Moreover, its 2024 revenue beat analysts’ expectations.

However, GoDaddy had full-year earnings per share (EPS) of $6.45. While that was down significantly year over year, 2023 had a huge tax benefit that boosted profits. So the year-over-year decline wasn’t the problem. The problem was that investors had expected EPS just a tad higher.

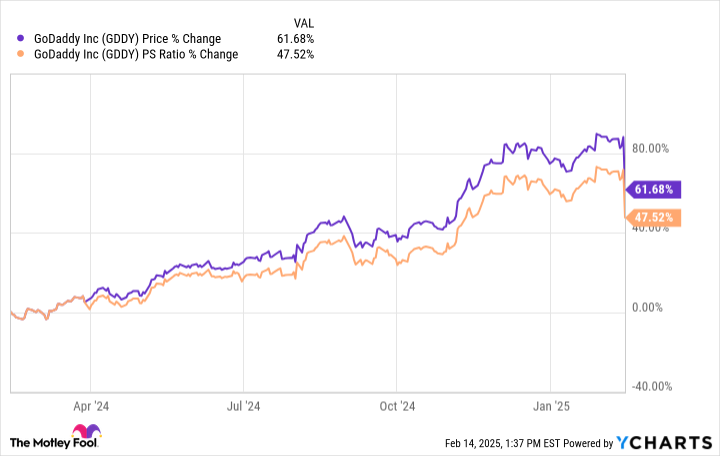

As the chart below shows, GoDaddy stock is up 62% over the past year, but its price-to-sales (P/S) valuation is up by 48%. In other words, most of its gains are due to a higher valuation, reflecting heightened investor expectations. Since some of those expectations went unmet today, GoDaddy stock crashed.

No reason for GoDaddy’s shareholders to panic

In my opinion, GoDaddy stock just got a little ahead of itself, but it seems to be more reasonably valued now. For 2025, management expects free cash flow of about $1.5 billion, meaning it trades at about 17 times those expectations right now. That’s not a bad valuation at all if the business can continue to find growth over the long term.

GoDaddy’s management thinks it can muster 6% to 8% top-line annual growth over the next couple of years and make additional improvements to profitability. And those seem like reasonable expectations to me given the company’s brand recognition and leadership in the website-building space. In short, today’s pullback feels like nothing more than a healthy speed bump for shareholders.

Jon Quast has no position in any of the stocks mentioned. The Motley Fool recommends GoDaddy. The Motley Fool has a disclosure policy.