Many of you are aware of Warren Buffett’s legendary investment in Apple (AAPL -0.22%). He and his lieutenants started buying shares in 2016 and 2017 for Berkshire Hathaway, making it the largest position in the conglomerate’s stock portfolio. Today, the stake is worth an estimated $175 billion. Shares are up over 500% since the beginning of 2017, making the Apple investment one of Buffett’s best purchases ever.

But just because Apple has done well in the past does not mean it will do well in the future. There are looming risks with this “Magnificent Seven” favorite that I believe are underappreciated by investors right now. Here’s why Apple stock remains risky for investors to own in 2024.

Stagnating revenue, lackluster Vision Pro launch

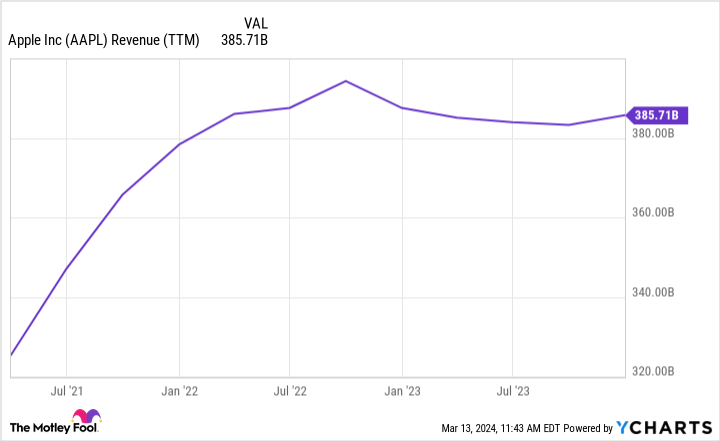

The first concern with Apple is broad-based: Revenue is stagnating. Despite high inflation around the world in the last few years, Apple’s revenue on a trailing-12-month basis is actually down from the middle of 2022. Adjusted for inflation, this means that Apple’s sales have taken quite a hit in the last few years.

The only hardware segment that grew sales in fiscal Q1 2024 was the iPhone, hitting $70 billion in revenue for the holiday quarter compared to $66 billion a year prior. This business should remain solid for Apple if it can continue to raise prices, but unit sales for smartphones have stagnated for years. The days of hyper-growth for the iPhone are likely over.

AAPL Revenue (TTM) data by YCharts

So how can Apple increase its revenue? Setting aside its burgeoning services segment, Apple needs to find another hardware device that can drive sales. It certainly won’t be the iPad, Watch, or Mac segments, which serve as either niche or adjacent products to the iPhone. But what about the Vision Pro mixed reality headset? It launched earlier this year and sports a $3,500 price tag. If Apple can start selling a lot of Vision Pros, this could drive growth over the next decade.

The problem is that the Vision Pro looks like a flop. A lot of buyers are returning their devices, with many saying they have stopped using it regularly. Time will tell, but so far it looks like the Vision Pro is far from the next iPhone. To drive sales growth for a company like Apple, the Vision Pro will have to become a global hit. That has not happened with its first iteration and is likely many years away from happening, if it ever does.

Geopolitical headwinds with major financial implications

Stagnant revenue isn’t the only concern for Apple. There are major looming risks from government regulations that could eliminate some of its historical cash cows.

First, the Chinese government is increasing its oversight and regulations against Apple products. It is widening the iPhone ban across governmental agencies as the East Asian giant expands its conflict with Apple’s home country, the United States. Last quarter, 17.4% of Apple’s sales came from China. If this goes away, it would be a major hit to Apple’s income statement.

Some investors might argue that Apple’s services segment will drive growth. It has in the past and is now a much larger part of the business. Last fiscal year, services brought in $85 billion in high-margin revenue from things like Apple Music, the App Store, and AppleTV+. The issue is that governments are attacking Apple’s App Store and distribution payments from Google.

We are seeing increasing regulatory attention focused on the App Store. The E.U. just fined Apple around $2 billion solely for being anticompetitive in the music streaming business. Multiple governments are debating whether to pass regulation against the App Store and its 30% take rate on digital transactions, which generates a ton of high-margin revenue for Apple each year.

Perhaps more important is Apple’s distribution payment that it receives from Google Search each year. It is estimated that the search giant pays Apple upwards of $20 billion just to be the default search engine on Apple devices. This is basically pure profit and would make up a large chunk of the Mac maker’s $118 billion in annual operating earnings. The courts in the United States are debating whether this payment from Google is anticompetitive. If they decide it is, $20 billion in annual earnings could be immediately wiped away from Apple’s income statement.

The valuation is not appealing, either

If we look at Apple’s stock price, it shows that the company’s valuation is not very attractive for a low-growth operation. Its trailing price-to-earnings ratio (P/E) is 27, which is right around the market average but still sits at a premium to faster-growing companies like Alphabet, the parent of Google Search.

And these trailing earnings do not take into account any future headwinds from China, a Vision Pro flop, or the potential steep reduction in high-margin services revenue. Add everything together, and Apple may be the riskiest Magnificent Seven stock to own in 2024.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Brett Schafer has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Apple, and Berkshire Hathaway. The Motley Fool has a disclosure policy.