Risk-off sentiments are driving markets today after the first interest hike by the Bank of Japan (BoJ) in almost two decades. Hotter-than-anticipated data continue to dominate economic trends stateside, with homebuilder sentiment and construction activity shattering expectations yesterday and today. Against this backdrop, market players are gearing up for tomorrow’s monetary policy decision by the Fed and the central bank’s release of its Summary of Economic Projections (SEP). Top of mind is whether the recent string of stronger-than-expected inflation and activity data will reduce the amount of rate cuts projected by policymakers this year. The probability of the first-rate reduction occurring in June has dropped to near coin-flip odds as investors realize that the recent loosening in financial conditions come at an inflationary cost.

Homebuilders Are Optimistic About Potential Rate Cut

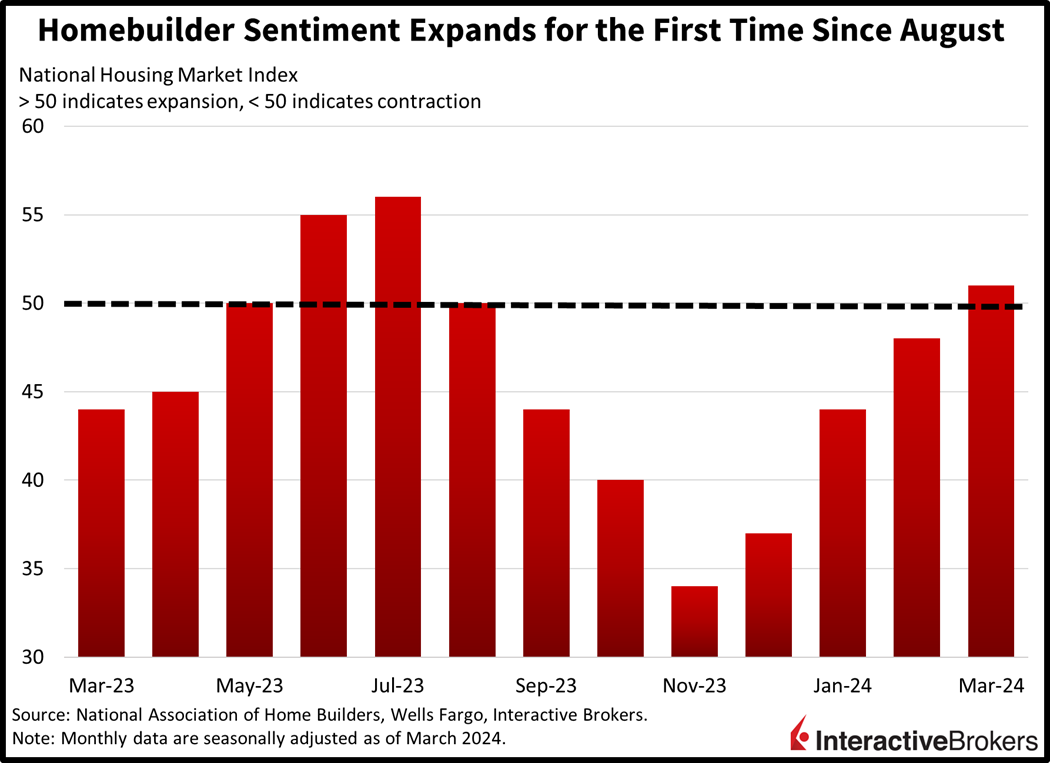

Homebuilder sentiment recovered this month with developers envisioning buyers leaping into the market as the Fed begins to provide accommodative monetary policy. Builders must remember, however, that the Fed doesn’t control the long-end as directly as the short-end, leading to a possible dynamic where Fed cuts are met by higher long-term rates, a bear-steepening formation across the yield curve. Prospective buyers are indeed adapting to the costliest housing market in history though as buoyant capital markets cushion the impact of all-time high prices paired with mortgage rates north of 7%. Homebuilder sentiment jumped into positive territory for the first time since last summer, reaching a level of 51, shattering projections calling for an unchanged figure of 48. Broad-based improvement occurred across sub-indexes, with results for current single-family sales, single-family sales six months out and traffic of prospective buyers all improving from levels of 52, 60 and 31 to 56, 62 and 34. Trends were mixed across regions, however, with the South and Midwest improving from 50 and 38 to 52 and 49 while the Northeast and West saw small decreases, dropping from 62 and 47 to 61 and 45.

Builders Dust off Blueprints

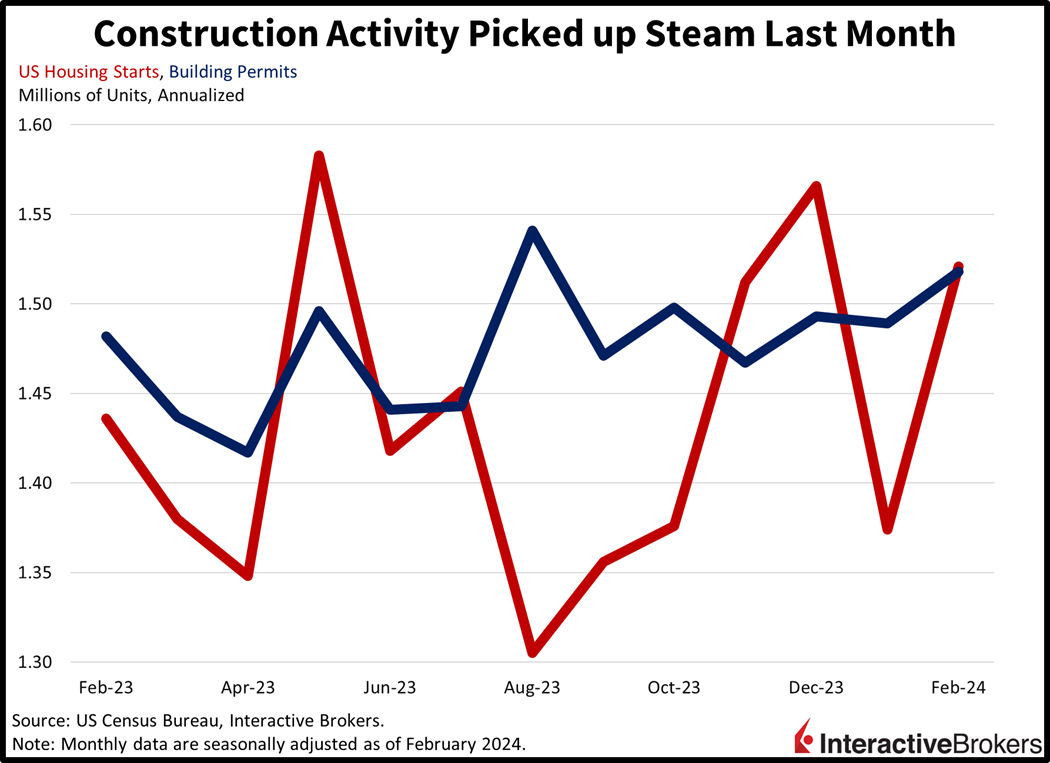

Construction activity and future development plans recovered further last month as builders rushed to add supply ahead of Fed rate cuts. The pace of Housing Starts and Building Permits rose to 1.521 million and 1.518 million seasonally adjusted annualized units (SAAU), flying past anticipations of 1.425 million and 1.495 million. Starts and Permits figures gained 10.7% and 1.7% month-over-month (m/m) from January’s 1.374 million and 1.489 million SAAU. Progress was made across the single-and multi-family segments, with starts and permits rising 11.6% and 1% m/m for single-family while increasing 8.6% and 2.4% for multi-family. Regional discrepancies were present, however, with starts boosted by the Midwest and South regions, which sported increases of 50.7% and 15.7%, respectively, while the Northeast and West regions slipped 10.3% and 7.9%. Permits, meanwhile, were led by the Northeast and Midwest regions which gained 36.2% and 3.8% m/m while the West and South experienced declines of 6.8% and 1.3% m/m.

Japan Returns To Positive Interest Rates

Strong wage concessions given to workers by Tokyo’s largest labor union pushed the Bank of Japan to raise interest rates 20 basis points (bps), bringing the rate range of 0% to 0.1% into positive territory for the first time since 2007. The central bank had previously focused on deflation, sluggish economic momentum and an aging population during the past decade and change. The labor union’s wage increase of 5.3%, the largest raise since 1991, is running at a pace much faster than the central bank’s 2% inflation target, which concerns the nation’s officials of a wage-price spiral. Still, however, BoJ Governor Kazuo Ueda committed to an accommodative stance, as the central bank will purchase bonds to the tune of $6 trillion yen per month and intervene if yields rise too sharply, all while ditching their yield-curve control and ETF purchasing programs.

Australia Holds Rates

Further south in Sydney, Australia, the nation’s central bank kept rates unchanged but Governor Michelle Bullock stated that policy was balanced. Both the yen and Aussie dollars are weakening considerably following their central bank meetings. Traders appeared to front-run the BoJ’s first rate hike in 17 years, but it appears the moves were priced in and what followed was a buy the rumor sell the news development, with the yen falling a sharp 1% versus the US dollar. As for the Aussie dollar, the Reserve Bank of Australia’s (RBA) shift from a hawkish stance to a more balanced one is weighing on their currency.

Investors Flee to Safety

Investors are selling stocks and scooping up bonds during a big week of central banking developments that may serve as headwinds to the equity market’s ferocious run. Most major equity indices are lower being led by the rate sensitive Nasdaq Composite and Russell 2000 indices, which are down 0.6% and 0.3%. The S&P 500 is lower by a much milder 0.1% while the Dow Jones Industrial Average is higher by 0.4%. Sectoral breadth is positive with 7 out of 11 segments higher, led by energy, utilities and consumer discretionary, which are higher by 0.9%, 0.4% and 0.3%. Communication services, real estate and technology are lagging; they’re down 0.6%, 0.4% and 0.4%. Bond yields are softer as fixed-income players await Fed Chair Powell for more clarity on the path of rate cuts. The 2- and 10-year Treasury notes are trading at 4.7% and 4.31%, 4 and 2 basis points (bps) less than the previous close. The dollar is jumping as traders react to a sell the news story for the Japanese yen while spectators interpret the RBA’s dovish commentary. The Dollar Index is up 32 bps to 103.92 as the greenback appreciates relative to all of its major developed market peers including the euro, pound sterling, franc, yen, yuan and Aussie and Canadian dollars. Crude oil is firmer as supply-demand dynamics push the commodity’s price higher. Ukrainian attacks on Russian oil infrastructure are capping output while exports from Riyadh and Bagdad are subdued. Stronger demand conditions stateside and in Beijing are also driving bullish sentiments with WTI crude oil up a sharp 0.5% or $0.42, to $82.57 per barrel. The commodity reached $82.86 in earlier trading, its loftiest cost since November.

Fed To Accept 3% Inflation

As we approach tomorrow’s Fed meeting, certain aspects of the event will be integral for investor sentiment. Significant insights will be extracted from the central bank’s quantitative tightening plans, the median projections for rate cuts and Fed Chair Powell’s tone. While Powell seemed content with the recent trajectory of inflation the last time we heard from him in Congress, many investors are wondering if this month’s hot reports on February payrolls, consumer prices and wholesale inflation will move the needle? The recent surge in commodity prices also points to increased caution regarding monetary policy easing. Nevertheless, gone are the days when Powell would reference Volcker, economic pain and the importance of 2% inflation. Does Powell and the Fed want to create a recession to get inflation back to 2% or are they fine with price pressures running at 3%? While I was firmly in the former camp regarding the seriousness of the 2% inflation target, this Fed and potentially the next one appear unwilling to push to the end. I expect Powell to call the recent strings of inflation transitory, while he pushes back against imminent rate cuts and awaits additional data. As for quantitative easing and the SEP, or dot plot, I’m expecting the central bank to soon slow its balance sheet runoff down from $95 billion to $50 billion while penciling in two cuts this year instead of the three expected during the last update.

Visit Traders’ Academy to Learn More About Housing Starts and Other Economic Indicators

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.