This morning 4,700 Telefonaktiebolaget LM Ericson (Symbol: ERIC) February 16 ’24 6 calls trade for $0.20. The calls are a 45 delta, so the trade is the equivalent of 211,500 shares of stock. This was an opening trade with the open interest this morning in the ERIC February 6 calls under 2,000 contracts. At the time of the trade ERIC was trading at $5.83.

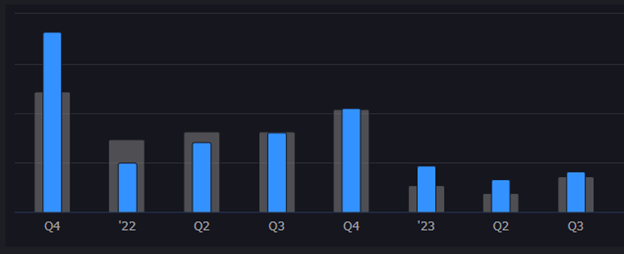

This was most likely an earnings trade as ERIC is expected to release results on January 23rd before the market opens. ERIC’s earnings have either surprised to the upside or been inline with estimates six of the past eight cycles.

ERIC is currently trading at $5.84. ERIC has a 52-week high of $6.36 and a 52-week low of $4.33.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the “Characteristics and Risks of Standardized Options” also known as the options disclosure document (ODD) or visit ibkr.com/occ