Investors looking for real growth don’t have to make it complicated. In fact, they should make a point of keeping it simple.

Are you a fan of simplicity? Maybe you’d just like to spend less time keeping tabs on individual stocks. Or, perhaps you’ve figured out that when it comes to investing for retirement, less is more.

Whatever your motivation is, exchange-traded funds (or ETFs) are a great, easy way to participate in the stock market’s long-term potential. The key is just finding the right ones to buy.

State Street‘s family of funds are a great place to start — and maybe even finish — your search for new ETF holdings. Here’s a rundown of three of your best State Street fund options that could help you retire a millionaire.

Technology Select Sector SPDR Fund

You should always maintain a well-diversified portfolio. That being said, it would be naïve to ignore the fact that technology stocks have generally delivered more growth than tickers from other sectors. Overweighting your overall exposure to these names wouldn’t be a terrible idea.

Enter the Technology Select Sector SPDR Fund (XLK -1.62%).

As the name suggests, this exchange-traded fund holds nothing but technology stocks that are part of the S&P 500 index. Its biggest positions right now are Microsoft, Apple, Broadcom, and Nvidia, which not coincidentally are also the stock market’s biggest technology names… in that same order. These tickers became the fund’s biggest holdings, in fact, specifically because their underlying companies developed game-changing solutions, and subsequently earned their enormous size. Just as these well-known tech companies did themselves, when other technology outfits come up with new and better products and services, they’ll displace these well-known tickers as the tech sector’s top names.

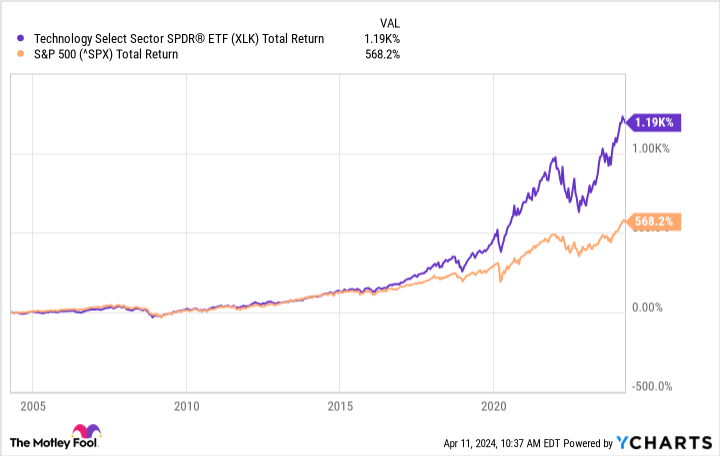

More important to investors, technology stocks have a long-term market-beating track record. Over the course of the past 20 years the Technology Select Sector SPDR Fund has outperformed the S&P 500 by a margin of more than 2 to 1.

XLK Total Return Level data by YCharts

There is a caveat. That is (as you might suspect), technology stocks also tend to be more volatile than the broad market… bullishly and bearishly. These wild swings can make owning this ETF a bit unnerving at times.

If you can mentally brace for this volatility though, it’s worth it in the long run.

SPDR S&P Kensho New Economies Composite ETF

Although technology companies in general are behind the world’s most incredible sociocultural changes, the sector doesn’t enjoy an outright monopoly on major evolutions. Other kinds of organizations can shake things up as well. The SPDR S&P Kensho New Economies Composite ETF (KOMP -2.69%) holds many of these disruptive players for as long as they’re being disruptive.

This exchange-traded fund is meant to mirror the performance of Standard & Poor’s Kensho New Economies Composite Index, which is designed “to represent companies that are focused on propelling the Fourth Industrial Revolution and fostering new industries that will be transformative.”

Many of its holdings are admittedly tech-centric right now. But they don’t have to be, and not all of them are. The ETF’s (and index’s) biggest positions at this time are cryptocurrency outfit Coinbase Global, government contractor Leidos Holdings, and scientific equipment maker Bruker. None of these are significantly overrepresented though, and could easily be displaced by the index’s next-biggest positions, Facebook parent Meta Platforms and Teledyne Technologies.

The bigger takeaway here, however, is the index in question holds a lot — over 400 — of important, game-changing players, many of which would otherwise remain off of investors’ radars.

Investors may be concerned by the fact that the SPDR S&P Kensho New Economies Composite ETF has actually been a subpar performer since mid-2021, when its pandemic-prompted bullishness peaked. Don’t read too much into it though. The market’s overall gains for past three years have been led by a handful of high-profile technology names like the aforementioned Microsoft and Nvidia… often at the expense of many of the lesser-known names that make up the S&P Kensho New Economies Composite Index. So, don’t sweat it. The fund’s and the index’s constituents’ anticipated earnings growth rate for the next three to five years is just under 17%, which is more than enough to reignite bullishness sooner or later. Just be patient.

SPDR S&P 500 ETF Trust

Last but not least, retirement-minded investors may want to consider buying (or buying more of) the SPDR S&P 500 ETF Trust (SPY -1.38%) to better populate their portfolio.

Yes, it’s boring. The S&P 500-based index fund is specifically designed not to beat the broad market, but merely match its performance.

But that’s the point.

See, while it’s certainly not impossible, outperforming the overall market for any meaningful length of time is difficult to do. It’s so difficult, in fact, that even most professional stock pickers can’t do it. Standard & Poor’s reports that only a little over 40% of the large-cap mutual funds available to U.S. investors beat the S&P 500 last year. Things get even worse the longer the time frame gets, too. Over the course of the past five years, nearly 79% of these funds lagged the market. For the past 10 years, more than 87% of U.S. large-cap mutual funds underperformed compared to the S&P 500.

And just for the record, the funds that do beat the market in one of these time frames are rarely the same funds that outperform the S&P 500 in a different time frame.

It doesn’t get any better when looking at hedge funds‘ results either. While last year was decent for the business, there’s a reason investors pulled (net) $100 billion from hedge funds in 2023 — according to Goldman Sachs — despite a slight market-beating performance. The crux of that reason is likely five years’ worth of underperformance. Aurum reports the average hedge fund’s annualized rate of return for the time frame is 6.5%, versus the S&P 500’s average annualized rate of return of 9.4% for the same five-year stretch.

Beating the market is hard enough already. It’s even harder with a relatively active stock picking approach. A more passive approach like the ones exchange-traded funds encourage is often more fruitful.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Coinbase Global, Goldman Sachs Group, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends Broadcom and Teledyne Technologies and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.