Devon Energy (DVN 0.75%) made a subtle change to its capital return strategy this year. The oil giant had paid out a gusher of dividends over the past couple of years by prioritizing paying variable dividends to return excess cash to shareholders. However, it plans to emphasize repurchasing its shares in 2024.

Fueling the focus on share repurchases is Devon’s deep-seated belief that the company’s shares, and oil stocks in general, are dirt cheap these days. Here’s a look at the factors driving that view.

A bottom-of-the-barrel valuation

Devon Energy CEO Rick Muncrief discussed the company’s capital return plans on the fourth-quarter conference call. He noted that Devon expects to become much more efficient this year. Falling oilfield service costs and focus on developing its world-class position in the Delaware Basin will enable the company to cut capital expenses by 10%. That positions the company to grow its free cash flow by 20% to $3.2 billion, assuming oil averages around $80 per barrel (slightly above the recent price).

Devon plans to return 70% of that money to shareholders and use the rest to strengthen its already fortress-like balance sheet. The foundation of that return will be its base quarterly dividend, which it’s increasing by 10% for 2024. It plans to be flexible with the remaining excess cash.

Muncrief stated:

With our flexible cash return framework, we will judiciously allocate our free cash flow toward the best opportunity, whether that be buybacks or dividends. Given that the equity market is heavily discounting valuations in the energy sector, it’s an easy decision to prioritize a buyback over the variable dividend to capture the incredible value that Devon offers at these historically low valuations.

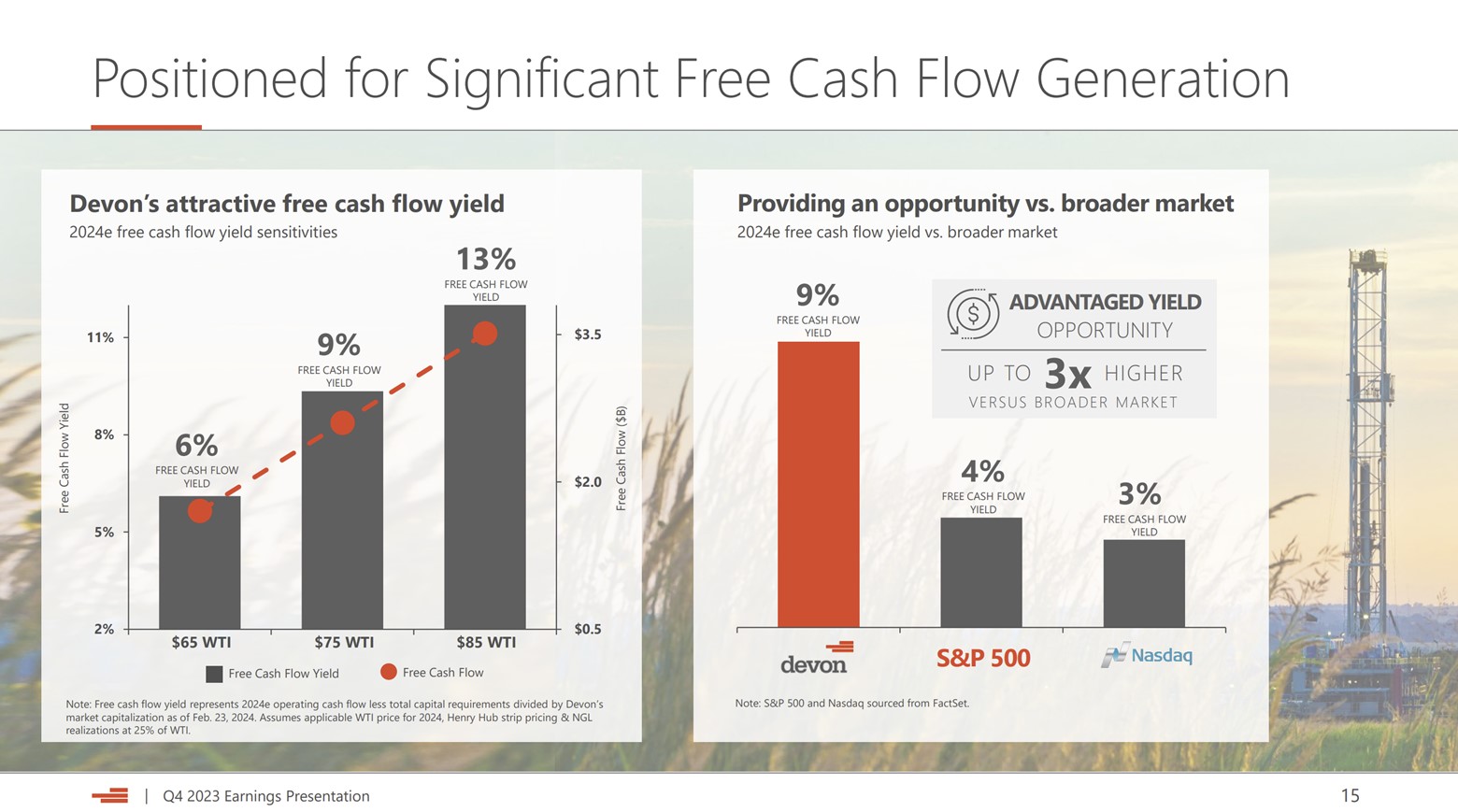

He highlighted that at $75 oil (slightly above the recent price), “Our business is set to deliver a free cash flow yield that is up to three times that offered by the broader markets”:

Image source: Devon Energy.

As that slide shows, Devon trades at a 9% free-cash-flow yield, putting its valuation at a steep discount to the broader market indexes. Because of that, the company plans to prioritize using its excess free cash flow to repurchase its cheap shares. It will use the variable dividend to distribute any remaining excess cash to investors each quarter.

Devon has retired 6% of its outstanding shares since launching its repurchase program in late 2021. At its current price, it could retire 9% of its shares by completing its $3 billion repurchase authorization.

Tossed into the bargain bin

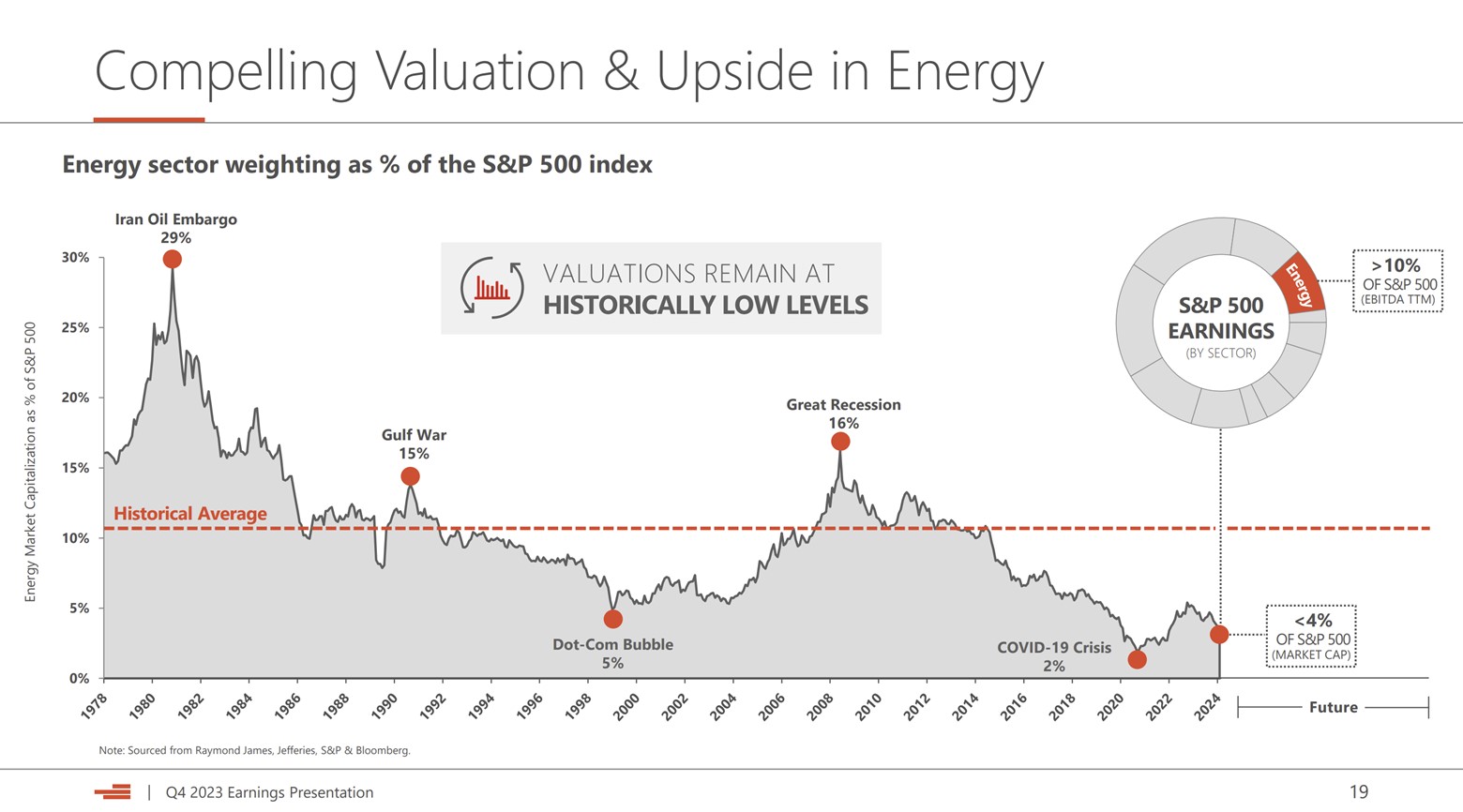

Devon Energy isn’t the only energy stock the market has tossed into the bargain bin. The entire sector trades at historically low levels:

Image source: Devon Energy.

As that slide shows, energy represents less than 4% of the S&P 500 despite contributing 10% of its earnings. Muncrief commented: “This is noteworthy given the energy’s S&P weighting historically tracks its earnings contribution over time. I believe this gap exists due to extreme valuations in tech, combined with a pervasive misunderstanding of hydrocarbon demand over time.”

He then noted that with “global energy demand forecasted to increase 50% by 2050, the world is going to need growth from all sources of energy, including oil and natural gas.” That drives his belief that “peak oil demand is nowhere in sight and our industry will be an important contributor of energy growth for the foreseeable future.”

Growing demand for oil and gas will enable Devon to increase its production, free cash flow, and cash returns to shareholders. Because of that, high-quality companies like “Devon provide significant equity upside over time as you collect outsized cash returns,” stated the CEO. That’s “why we are putting our money to work actively repurchasing shares.”

A great buy in a historically attractive sector

Devon Energy believes it’s a no-brainer to shift its cash return strategy from focusing on paying variable dividends to repurchasing its shares. The stock trades at a steep discount to the broader market indexes due in part to investors bidding up tech stocks. Over the long term, things should normalize, which should boost the value of energy stocks like Devon. By repurchasing its dirt cheap shares now, Devon could deliver enhanced value creation for shareholders over the long term.

Matt DiLallo has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.