Markets are steady today ahead of a long list of economic data and Fed speakers scheduled for later this week. While this morning’s new home sales data underwhelmed expectations, investors are looking ahead to durable goods, consumer confidence, PCE Inflation and ISM-Manufacturing in the coming days. Wrapping up the week is the threat of another government shutdown, as election-year politics converge with significant disagreements regarding fiscal matters. Funding for about a fifth of the government expires this Friday and only seven days after that milestone, or March 8, the remaining four-fifths expires. Against that backdrop, the Treasury will be auctioning roughly $229 billion in bills and $169 billion in notes today and tomorrow.

7 Handle Mortgages Weigh on Real Estate

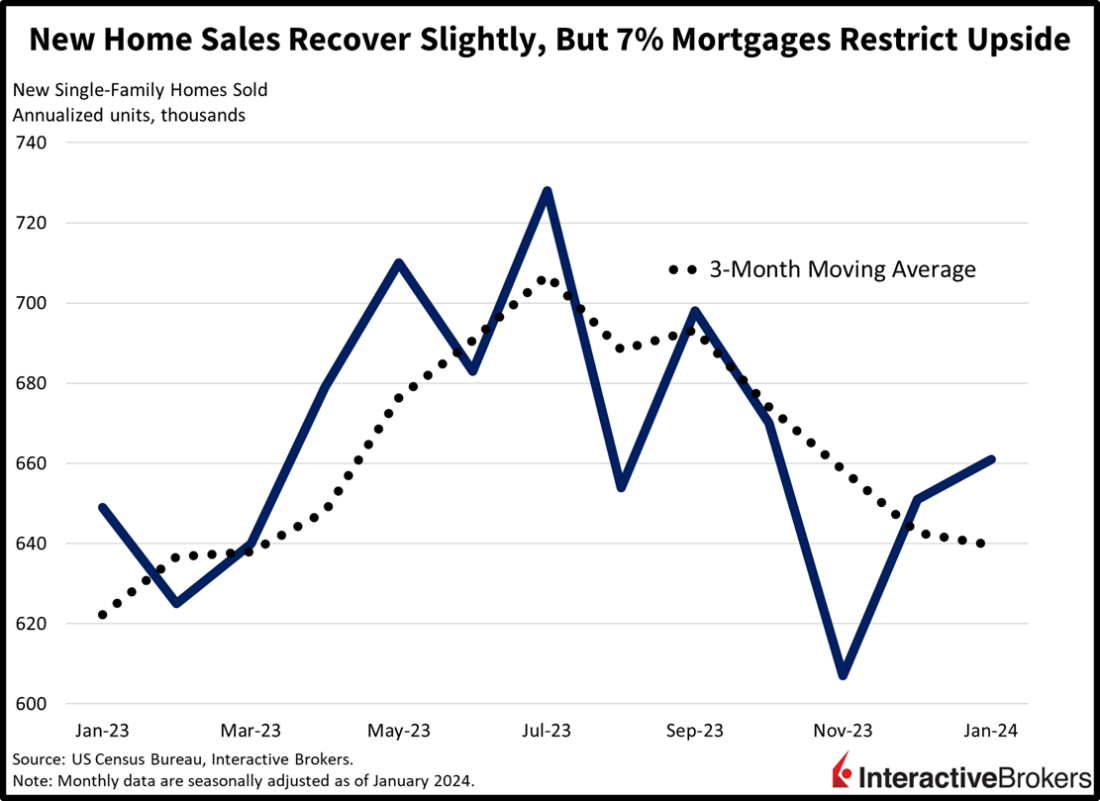

New home sales grew last month as Northeastern and West Coast buyers propelled results, but mortgage rates exceeding 7% limited the increase. The sales pace rose 1.5% month-over-month (m/m) to 661,000 seasonally adjusted annualized units (SAAU). The figure missed expectations calling for 680,000 SAAU despite climbing from 651,000 in December. Transactions in the Northeast, West and South grew 72%, 38.7% and 7.7% m/m, respectively. The South lagged, slipping 15.6%. Pricing remained lackluster though, with the median price of $420,700 slipping 2.6% year-over-year (y/y) from $432,100. Inventories also rose, with the median number of months for sale since completion rising to 2.8 m/m, the loftiest level since May.

Buffett Fails to Find Value Opportunities

Warren Buffett reported a second consecutive quarter of record profits for Berkshire Hathaway, but he also provided a modest outlook for the company’s performance, noting a lack of investment opportunities among companies that are large enough to have a significant impact on the conglomerate. For the fourth quarter, revenue of $169.9 billion, which includes unrealized and realized investment gains and losses, climbed y/y from $92.6 billion. Without including investment gains or losses, revenue climbed to $133.1 billion, up 70.33% y/y. Revenue gains were driven by the company’s integration of Alleghany, an insurance and investment company, and Pilot Travel Centers, which provides truck stop and recreational vehicle plazas. Berkshire Hathaway’s operating profit of $8.48 billion, or $5,884 per class A share, climbed 28% y/y and exceeded the average analyst forecast of $5,471. Strong results from insurance company GEICO helped offset weak performance of the conglomerate’s BNSF railroad and Berkshire Hathaway Energy. The conglomerate is now valued at more than $900 billion, or roughly comparable to 6% of the total S&P 500 market capitalization. Without recent investment opportunities for the champion value investor, the company’s cash has swelled to a record $167.6 billion. Shares climbed 1.5% in premarket trading.

Buffett Awaits Better Prices

Warren Buffett, one of the kings of value investing, dislikes buying companies at high prices. He’s known for analyzing metrics like price to earnings (PE), price to book (PB) and price to cash-flow (PCF). Given that most developed nations have equity indices near all-time highs, his caution serves as a warning. Buffett prefers to wait, mastering a patient approach of buying when the price is right. One of his famous quotes is to “be fearful when others are greedy but be greedy when others are fearful.” Given the irrational exuberance in these markets depicted by many fundamental and technical indicators like fear and greed, volatility levels, price to earnings, relative strength indices, technical oscillators, market cap to GDP, etc., it’s no surprise that Buffett is patiently awaiting to pounce when the time is right.

Traders Wait for Treasury Auction Results

Asset prices are near the flatline as traders digest real estate data and wait for today’s auction results from the US Treasury. All major US stock indices are higher, with the Russell 2000 and Nasdaq Composite sporting gains of 0.7% and 0.3%. The S&P 500 and Dow Jones Industrial indices are both up 0.1%, meanwhile. Sectoral breadth is tilted negative, with 7 out of 11 sectors lower. Energy, consumer discretionary and technology are higher with gains of 0.8%, 0.7% and 0.4%. Utilities, communication services and materials are lagging, meanwhile, with declines of 1.5%, 0.8% and 0.5%. In fixed-income land, rates are up slightly across the curve, with yields on the 2- and 10-year Treasury maturities climbing 2 basis points (bps) to 4.71% and 4.28%. The dollar is down marginally, as the greenback sheds value relative to the euro, pound sterling, franc and yuan while it gains against the yen and Aussie and Canadian dollars. In energy markets, a weaker supply outlook amidst continued Middle East tensions is pushing up crude oil, with WTI higher by 0.6%, or $0.46, to $77.00 per barrel.

Monetary Policy Converges with Fiscal Policy

Fed speakers this week are likely to support delaying rate cuts beyond June while some may even hint at the need for another hike, a result of renewed inflationary forces. Indeed, this month marks the fourth consecutive period of accelerating price pressures, with February headline and core inflation likely to have gained 0.5% and 0.4%, respectively. In Washington, meanwhile, Congressional negotiators are scheduled to meet tomorrow with the Biden Administration as the Friday deadline for striking a budget agreement for one-fifth of the government, including departments such as Agriculture, Energy, Veterans Affairs and Transportation quickly approaches. Over the weekend, the tense nature of the negotiations was demonstrated when Senate Majority Leader Chuck Schumer maintained that House Republicans need to sort out their differences while House Speaker Mike Johnson complained that Democrats have proposed new demands that could block a potential agreement. As with past budget debates, issues will likely include reducing the overall annual deficit and funding for the Internal Revenue Service. Other issues may involve proposals to increase the child-care tax credit and funding for Ukraine’s defense against Russia and Israel’s battle against Hamas. Additionally, the Republican’s narrow majority in Congress could complicate the process as the more conservative arm of the party is likely to push for budget cuts that will exceed what Senate Democrats will accept.

Visit Traders’ Academy to Learn More About New Home Sales and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.