Stocks are crying wolf as investors await Fed Chair Powell’s update on monetary policy this afternoon and digest an abundant buffet of corporate earnings and economic data. Comments from executives and economic statistics are providing mixed messages, however, with some firms worried about consumer health while others appear quite satisfied with shoppers’ momentum. As for job figures, ADP is reflecting persistent labor market strength while ISM and JOLTS are telling a slightly different tale.

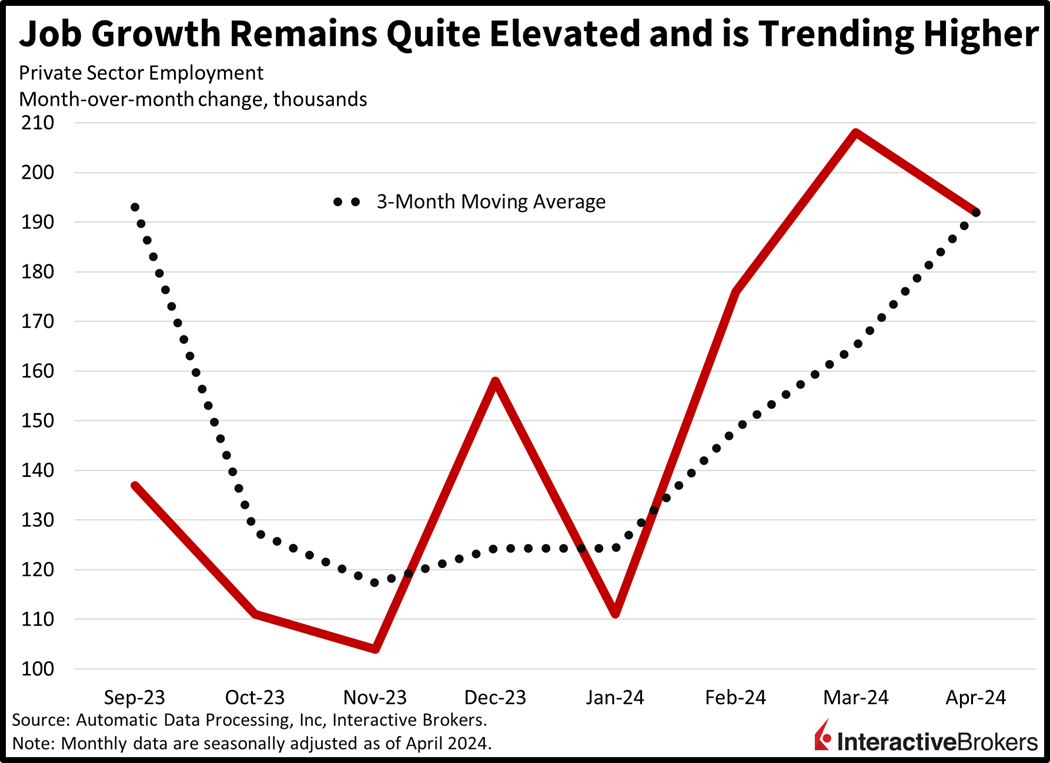

ADP Reports Another Month of Strong Hiring

The private sector maintained a strong hiring pace last month, according to payroll processing firm ADP. Employers added 192,000 jobs, beating estimates of 175,000 but slightly less than March’s gain of 208,000. Strength was widespread with ten out of eleven sectors increasing headcounts. Leading the charge were the leisure and hospitality category, with 56,000 additions, and the construction category, with 35,000 hirers. Other gainers and numbers of additions included the following:

Education/health services, 26,000

Trade/transportation/utilities, 22,000

Professional/business services, 16,000

Manufacturing, natural resources/mining and other services all gained less than 10,000

The information category was the sole decliner with a loss of 4,000.

Companies Big and Small Add Workers

Job growth also extended across business sizes, with large (500+employees), mid (50-499) and small (1-49) firms expanding rosters by 98,000, 62,000 and 38,000. Wage figures remained a problem for the inflation outlook, however, with the median year-over-year (y/y) compensation change for job stayers and job changers coming in at 5.1% and 10%. The former maintained an unchanged growth rate from March while the latter accelerated sharply from 7.6% y/y.

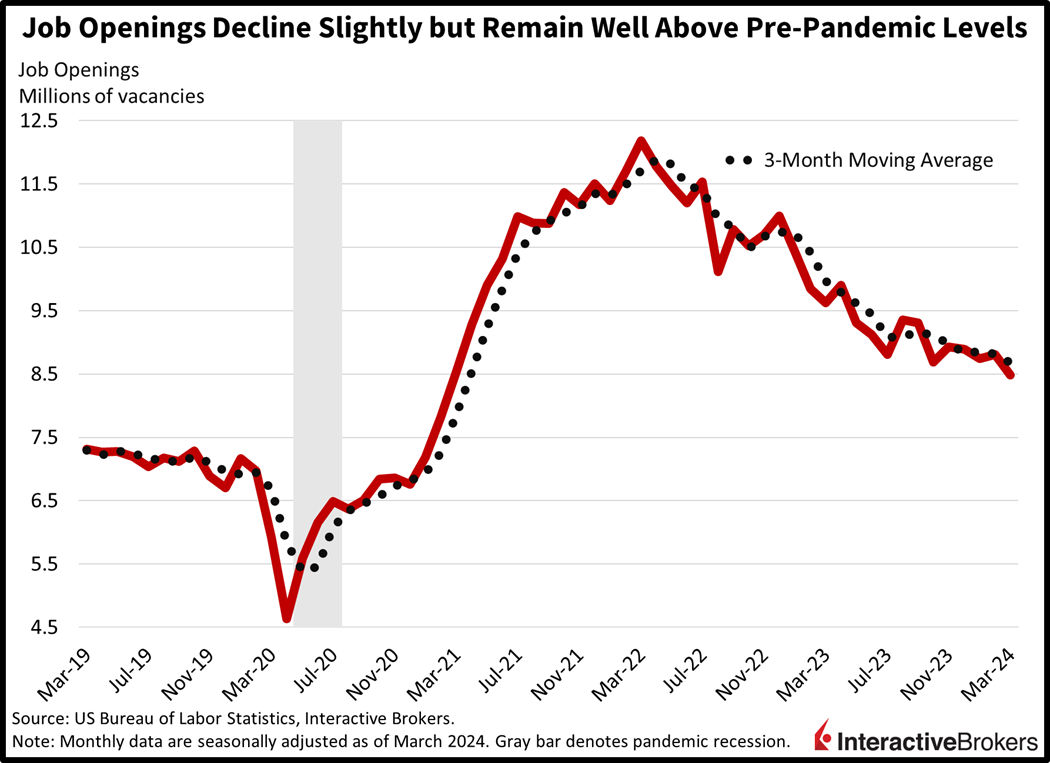

Job Openings Decline

Labor vacancies slipped slightly in March, according to the Job Openings and Labor Turnover Survey (JOLTS) from the Bureau of Labor Statistics. Job openings came in at 8.488 million, much lighter than the 8.69 million projected and the 8.813 million from February. In a sign of reduced confidence from workers being able to replace their current employers, job quits fell sharply to 3.329 million from 3.527 million in the prior month.

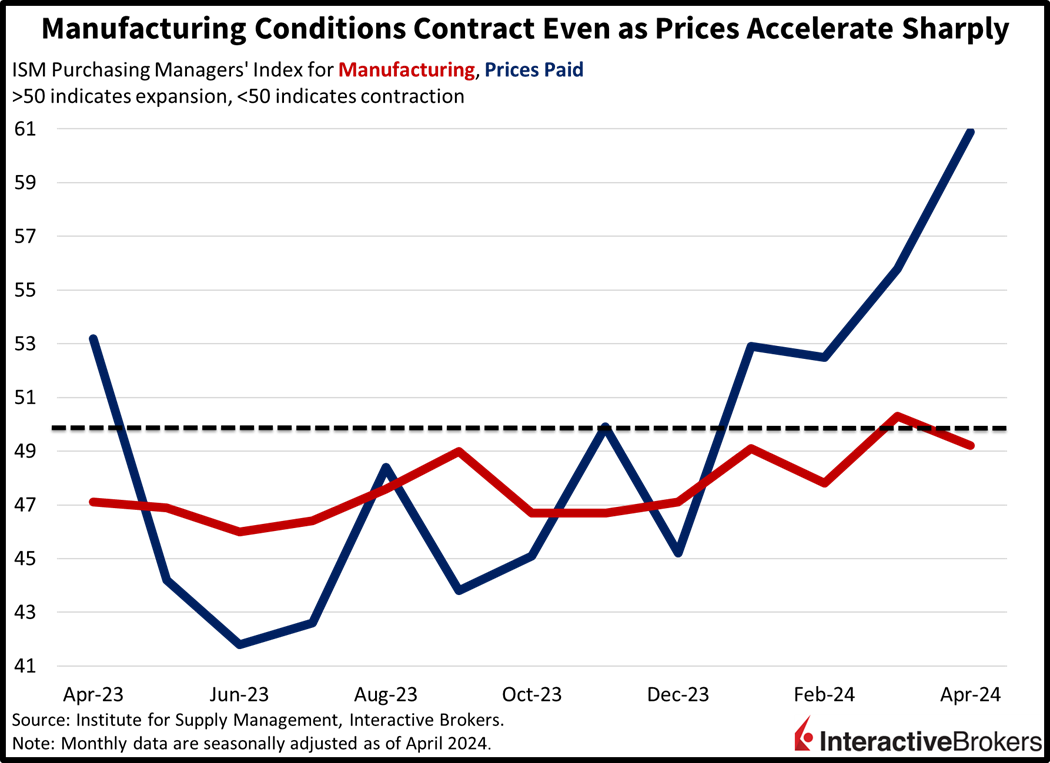

Manufacturing Goes Back in Reverse

Manufacturing conditions reentered contraction territory last month, according to the Institute of Supply Management (ISM). Prices, however, accelerated strongly despite a reduction in orders and staffing. The ISM’s Purchasing Managers’ Index (PMI) for manufacturing slipped to 49.2 for April, missing the expansion/contraction threshold of 50. Last month’s figure declined from 50.3 in March and missed expectations for 50. Weighing on the headline were contractions in demand, employment, and backlogs, which came in at 49.1, 48.6 and 45.4. Production offset some of the weakness, however, with a score of 51.3. Prices, meanwhile, jumped to 60.9, accelerating fiercely from the previous month’s 55.8.

Consumers Rely on Credit while AI Boosts Tech Results

Consumers are continuing to rely on credit cards for shopping and traveling while restaurants are reporting mixed results with sales. In the tech sector, cloud computing, artificial intelligence (AI) and advertising are helping to support earnings, although in at least one instance, supply chain issues have surfaced. The following highlights elaborate on these prevalent themes from recent earnings calls:

- Mastercard said the total value of transactions processed on its platform increased 9% y/y, missing the analyst expectation. However, Mastercard experienced an 18% increase in cross-border transactions, which is a metric for foreign travel. The metric was also supported by the company increasing its footprint in foreign markets. For the quarter, earnings exceeded the analyst consensus forecast despite revenue only meeting expectations. In a possible sign of weakening consumer spending, the company lowered its revenue guidance for the full year.

- Starbucks is already facing the headwind of weakening consumer spending. The company’s same-store sales dropped 4% y/y during its fiscal second quarter, its first such decline since 2020. In China, a contracting economy resulted in same-store sales tanking 11%. Half-off deals and new drinks, such as lavender lattes, failed to convince budget-conscious consumers to boost their caffeine intake at the company’s stores. The company said the decline in sales occurred in every region. Its earnings, revenues, average ticket size and same-store sales trailed analysts’ expectations. The company also reduced its revenue guidance and Starbuck’s share price tanked 14% in morning trading.

- Yum Brands, which is the parent company of KFC, Taco Bell and Pizza Hut, said same-store sales declined 3%, missing the analyst consensus expectation for a small increase. For the quarter, both earnings and revenue missed consensus expectations. While sales declined in the US for KFC and Pizza Hut, Taco Bell produced an increase. KFC and Pizza Hut stores in the Middle East also experienced notable sales declines.

- Wingstop bucked the trend of weakening consumer spending. Domestic same-store sales jumped nearly 22% y/y and the company’s earnings and revenue exceeded analyst consensus expectations. In addition to strong same-store sales, the addition of 65 restaurants worldwide supported revenue. Going forward, the company expects same-store sales to increase in the low double-digit range this year.

- Amazon.com, meanwhile, reported a strong quarter with results driven by growth in cloud computing, advertising and AI services. Sales for its cloud services jumped 17% while advertising revenue, which got a boost from the addition of commercials to Prime Video, increased 24%. Both metrics as well as earnings and revenue exceeded analyst consensus expectations. Amazon.com provided current-quarter earnings and revenue guidance that fell below analysts’ expectations. Amazon.com shares climbed roughly 3% this morning, largely due to the strong results of the company’s cloud computing and advertising services.

- Super Micro Computer posted revenue that missed the analyst consensus forecast, but the company provided stronger-than-expected guidance due to growing demand for AI applications. Its revenue jumped 200% y/y, narrowly missing the consensus expectation but helping the company’s earnings surpass forecasts. CEO Charles Liang said results for the provider of computer servers would have been stronger but supply chain issues created a shortage of key components. He expects AI to continue to support demand for the company’s products, and he increased the company’s annual guidance. After nearly tripling in value this year, shares of Super Micro declined more than 10% following the earnings call, a response to the revenue miss and the company noting that its inventory has increased.

- Advanced Micro Devices, or AMD, said its new AI chips resulted in sales in its Data Center segment growing 80% y/y. Its recent-quarter earnings and sales narrowly beat analyst consensus expectations and its guidance was roughly in line with Wall Street’s outlook. AMD said sales in the current quarter are likely to climb 6% y/y. The shares had rallied 14% year to date but dropped 7% yesterday following the earnings call.

Investors Dump Risk Assets

Risk assets are getting creamed as we await Chair Powell’s run from the dugout to the mound. Investors are clamoring for protection as downside hedges are getting pricier alongside safe havens, with gold and Treasuries catching bids. For major stock indexes, though, only the Dow Jones Industrial Average is higher. The Nasdaq Composite, S&P 500 and Russell 2000 benchmarks are lower by 0.6%, 0.3% and 0.3%. Sectoral participation is not as bad, however, with 6 out of 11 segments higher this session. Leading the charge upward are communication services, utilities and materials sectors, which are gaining 1%, 0.8% and 0.5%. Energy, consumer discretionary and technology are collectively pushing equity benchmarks lower, however, with the sectors losing 1.5%, 0.9% and 0.8%. Energy is suffering from a sharp decline in oil prices as WTI crude is down 2.7%, or $2.17, to $79.26 per barrel. Increased optimism about a potential Middle East ceasefire and a significant increase in stateside inventories are to blame. Gold and copper are higher by 0.9% and 0.1%, meanwhile. In fixed-income and currency land, the 2- and 10-year Treasury maturities are trading at 5.01% and 4.66%, 3 basis points (bps) lower on the session for both instruments. The dollar is paring some of yesterday’s upside as traders re-evaluate recent hawkish moves in yields while awaiting further guidance from Powell today. The US currency is down versus most of its major counterparts including the euro, yen, yuan and Aussie and Canadian dollars. The greenback is gaining slightly relative to the pound sterling and franc though.

Will Powell Save the Day?

Chair Powell is truly unpredictable when he starts taking questions from the crowd following his review of economic conditions. Sometimes his comments attempt to strike a balance between the committee’s statement regarding the direction of monetary policy and his presentation. But risk assets selling off prior to the chair approaching the mound is emblematic of what the markets want, which is more upside. Will Powell be sensitive to the hawkish repricing across equities and fixed-income and use that opportunity to take it easy? Or will he talk economic pain, Volcker and the Fed sticking to its 2% inflation goal, hell or high water? As far as what I’m expecting: a hawkish statement, a sympathetic Powell.

Visit Traders’ Academy to Learn More About ISM-Manufacturing and Other Economic Indicators

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.