Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

The Jalapeños of Investing

Whenever the topic of commodity investing comes up in client meetings, I often use the analogy that “building a portfolio is a lot like making dinner.”

- The main course is typically your domestic stocks, although some people eat less than others,

- International stocks are typically your side-dishes,

- Bonds and Fixed Income are like the water that makes the food go down easier, and then

- Commodities are like jalapenos that add a bit of spice…

…and it seems that any time some jalapenos get added to the dish, everyone freaks out!

Investors range in terms of comfort level when it comes to different types of investments and asset classes. Some refuse to buy international stocks because their late father fought in World War II (true story, by the way). Others want nothing to do with commodities because they lost money in oil limited partnerships back in the 80s.

The truth is, commodities can be a great diversifier, and even “core holding” when everything else is falling. Case in point, look back to 2022 – when the S&P500 was down almost -20%, the Nasdaq was down more than -30%, bonds were down anywhere between -16 – 40% (depending on the fixed income sector you were observing), but the commodity asset class (especially energy) was virtually the only one making any money!

We can’t look at ALL of them, so let’s go from best-to-worst today, with some hand-picked commodity positions I grabbed out of my chartbook…

1/ Cocoa Futures

Here’s a fun one to start with… Cocoa Futures. Cocoa went absolutely nowhere for more than two years, and then all of a sudden, it broke out in spring of 2023 (just a year ago at this juncture). Notice how it gapped down shortly after the breakout, retested what was formerly an overhead ceiling of resistance (the red, dashed line), held that re-test, and then continued & followed through to the upside.

One of the oldest quotes in technical analysis, who I believe was coined by the great Louise Yamada (if I’m not mistaken – if I am, I apologize to the O.G. quote wizard who originally said) “The wider the base, the higher in space.” Well, cocoa built up a 2-year base, and I don’t think anyone is going to email me (below) and argue with the undeniable fact that this investment is, indeed, going higher into space.

The only thing that sucks is, there’s no way to invest in Cocoa anymore, unless you’re a futures trader. iPath and WisdomTree both de-listed their Cocoa ETFs in June of 2023 and January of 2024, respectively, which is unfortunate, but interesting timing, don’t you think? Too bad…

2/ Gold

Gold! Hah! Gold investors have been waiting for this for a LONNNNNG time. Finally, after almost four years of attempting to break out of a base, gold has finally done it.

The question now is, “Can it hold above that line-in-the-sand” represented by the former ceiling of resistance going back to summer of 2020?

In a perfect world, if you’re a gold bull, you’d want to see the start of this current pullback bottom-out at those previous highs, chop sideways, and then resume the upward trend. However, if it falls below that line for more than a week without reclaiming it, I think we’ll have to call it a “bull trap” and as a result, gold would be categorized as being “back in the range” once again.

3/ Gold vs. Silver

“Hold on, Adam… but why did you mention gold and not silver?”

Good question! Remember the Investopedia Chart Advisor issue from last week, when I explained how to use a Relative Strength chart?

Well, before deciding to use gold or silver in today’s issue, I ran a quick RS chart to make sure we were talking about the stronger of the two (because we could discuss ALL the charts, but this would obviously get a little messy, eventually).

As you can see above (and we’ll call this “classroom review!”), the trend is up, the chart is above the 150-day moving average, which tells me that gold is the stronger investment between the two, and looking back in time, it has been since pretty much the 4th quarter of 2023. Before that, things were pretty choppy, trendless, and there really was no clear leader… but there is now.

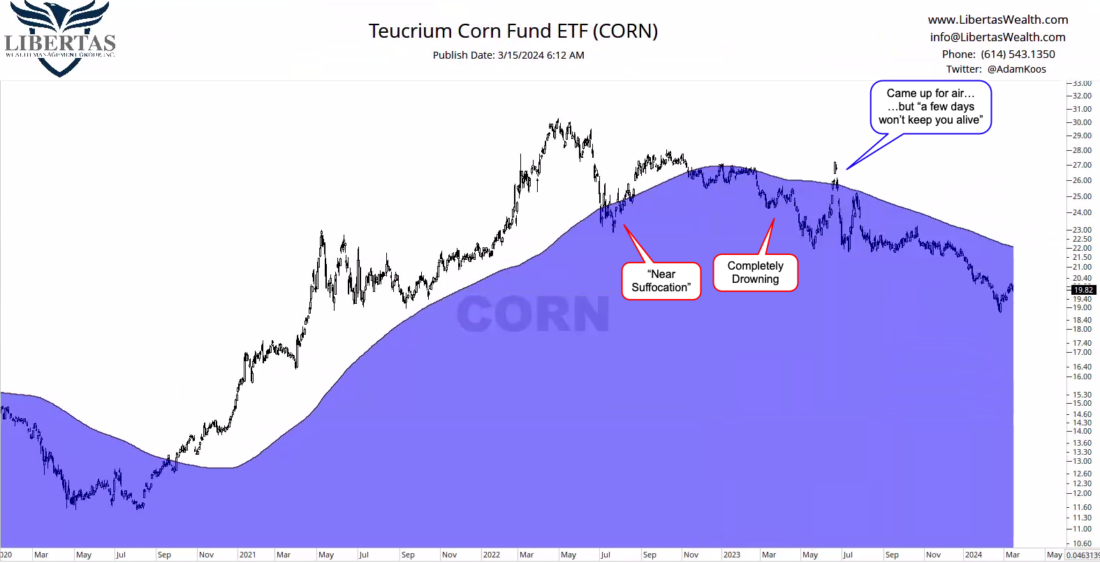

4/ Corn

We’ve looked at a stellar commodity performer in cocoa, a recent breakout in gold, so now we’re looking at the not-so-great commodities out there (i.e., commodities you probably don’t want to invest in).

I decided to throw a 200-day moving average (200MA) on the chart above, just to make the trend more obvious. As you can see, corn was in a clear, powerful uptrend from 4Q20 through summer of 2022, but then things got a little dicey.

You can see how it was pulled “under water” to a point that I’m eloquently calling “near suffocation,” meaning, it was under the 200MA for probably too long, but it did manage to climb back above its rising moving average in early fall of 2022.

However, by the end of 2023, it fell back below water and with the exception of literally – maybe 4-5 days in summer of 2023, it’s essentially been drowning ever since. Definitely a no-touch, here.

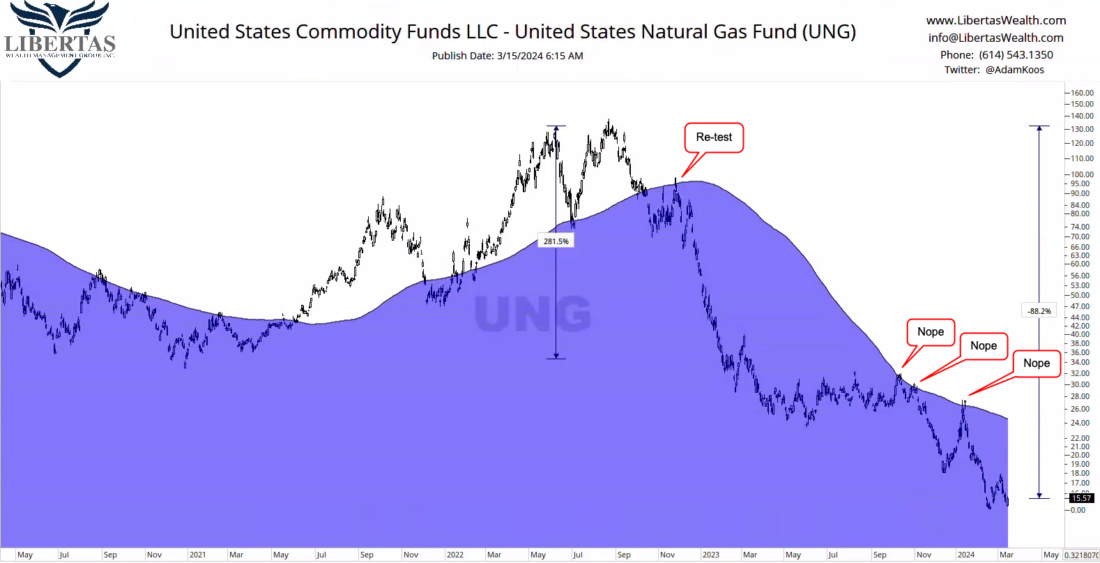

5/ Natural Gas

Last, but certainly not least, let’s look at Natural Gas. What’s interesting about NatGas is that it was all the hype in 2022 (kinda’ like Cocoa is today). From bottom-to-top, there was a point over which, if you timed it perfectly (which is impossible without a time machine), you would’ve made more than a 280% ROR between early-2021 and mid-2022. I’m sure most people would’ve been happy with half that return over the same timeframe, but it would’ve certainly been a very volatile ride (as NatGas tends to be, on the reg).

Since late-2022, however, you can see how it gapped down, below its 200MA, tried to re-test it from under water, but failed miserably… only to fall more than -88% to-date, even after three different attempts to come up for air over the past six months. Again, definitely a no-touch here, and as my good friend Dave Keller often says, “Don’t confuse the bottom of the chart with support.” It can definitely go much, much lower. 😉

6/ Commodities

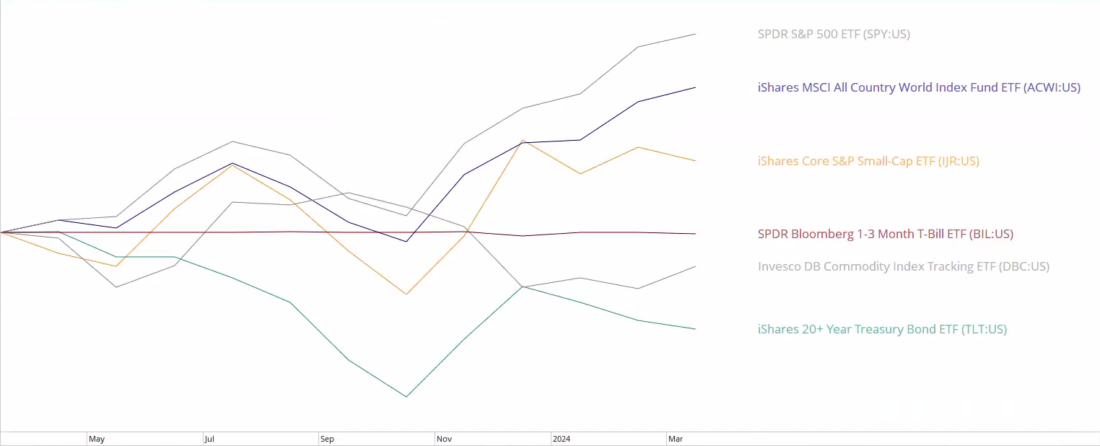

Lastly, after looking at the “good stuff” and avoiding the “bad stuff” above, you might be wondering, “Should I be invested in commodities right now?” The answer is, “It depends on your approach.”

For me, I tend to look at the markets from a top-down approach, ranking the asset classes first, then drilling down into sectors, sub-sectors, industry groups, cap & style, regions and countries overseas… and I implement RS calculations across the board to essentially keep our money invested “in the playoff teams” while avoiding the rest of those “teams” that don’t – or aren’t looking like they’re going to make the playoffs this year.

As metaphorical win/loss records change over time, investments that are lagging and don’t look like they’re going to make the “playoffs” this year get ejected from the portfolio and replaced with the new, stronger, higher-RS positions instead.

…and when I look at commodities as an asset class, I observe one of the few ranking systems I use “at the top” of the top-down approach and see that commodities rank 2nd-to-last, just above 20-year Treasury bonds.

So, are there a couple great commodities that look worthwhile for investment? Sure! …but there are almost always a few great stocks when the stock market is crashing – or a few great bonds when the bond market sucks. Instead, I prefer to invest with the trend, and when other asset classes are exhibiting higher RS, I want to swim with the current, not against it, and then drill down from there, diving deeper into each of the best asset classes to find the best sectors, sub-sectors, and so on…

At the end of the day, you need to find a strategy that works for you, and if this isn’t “your thing,” hire a true fiduciary financial planning and investment management firm to help.

—

Originally posted on March 18th 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.