ZINGER KEY POINTS

- Wide gulf between S&P 500 and Russell 2000 index opens up after mega-cap rally.

- Small caps could see rally in second half if Federal Reserve cuts interest rates.

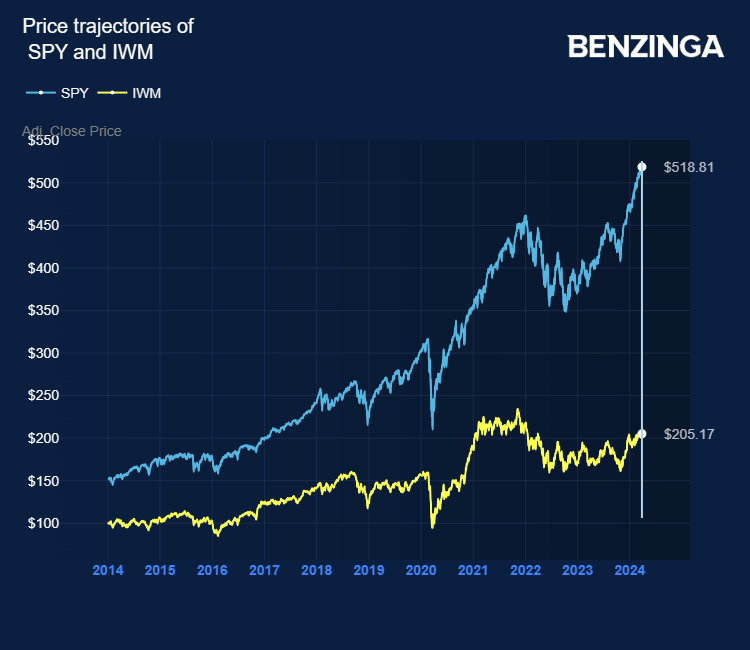

Investors chasing the phenomenal returns delivered by the U.S. technology mega caps have wrought havoc on small cap stock prices, opening up a massive gulf in percentage terms between the S&P 500 and the Russell 2000 indexes.

Data compiled by the Financial Times suggests that the Russell 2000 Index of small cap stocks is on its worst run relative to the S&P 500 seen in 20 years as investors struggle to see beyond the themes of big tech, with companies such as Nvidia Corporation, Broadcom Inc and AMD enjoying triple digit gains over the past three years.

Over the same three-year period, the S&P 500 index has returned 31%, while the Russell 2000 has lost 6.8%.

The exchange traded funds that track these two indexes have put in similar performances, with the SPDR S&P 500 ETF up 31% and the iShares Russell 2000 ETF down 7%.

Widening Gulf

The gulf between the two indexes has widened in percentage terms over the past three years as interest rates have increased.

Shares in smaller companies typically underperform during periods of higher interest rates as they rely more heavily on lines of credit to grow, and higher interest payments to service these debts eat into their bottom line.

“The valuation gap between small caps and large caps has been extreme,” said Denise Chisholm, director of quantitative market strategy at Fidelity.

Based on metrics such as price-to-book value, Chisholm calculates that, relative to large caps, small caps have recently been trading in the bottom decile of their historical valuation range since 1990.

At such extreme levels of undervaluation, compared with some of the lofty prices now seen among the mega caps, what is the likelihood of a rebound in the small cap sector?

Backbone Of The Economy

Investors often hear the term “small businesses are the backbone of the economy.” According to a report by the Small Business Administration in 2019, small companies generate around two-thirds of net new jobs and around 43% of annual GDP.

For small cap stocks to significantly rally, a couple of things are needed in the coming weeks and months: continued U.S. economic growth and Federal Reserve interest rate cuts. With these in place, investors could enter the market at attractive valuations.

“Small caps have historically benefited more than large caps from the first rate cut of a cycle,” said Chisholm. “And their advantage has been even greater when earnings also improved.”

With fourth quarter earnings season all but over, Lipper data showed net earnings for the Russell 2000 companies were down 17.6% year-over-year. By contrast, S&P 500 earnings were up 4%.

But the small cap index’s numbers were undermined by 30% of its companies that were unprofitable, while the S&P 500 was flattered by the huge mega-cap profits.

However, the momentum of gains seen for the likes of Nvidia during the first 10 weeks of 2024 appears to be slowing. Could the second half of 2024 see a resurgent small cap sector?

Chisholm at Fidelity believes so.

She said that small cap stocks had been priced in anticipation of a recession and have plenty of room for recovery now that a soft landing for the U.S. economy appears to be the most likely scenario.

“In my opinion, your risk-reward trade-off is very skewed in favor of small caps,” she said.

—

March 27, 2024 – Russell 2000 Vs. S&P 500: Turning Tide For Small Caps? ‘Risk-Reward Trade-Off Is Very Skewed’

Disclosure: Benzinga

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Benzinga and is being posted with its permission. The views expressed in this material are solely those of the author and/or Benzinga and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.