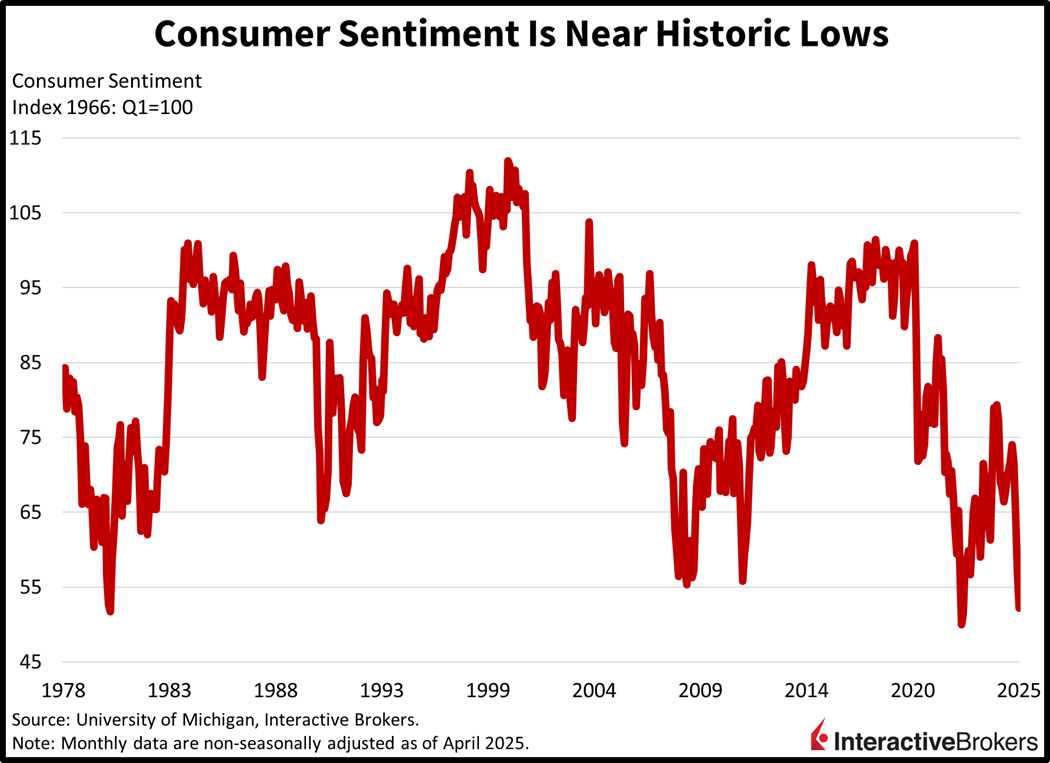

Stalling progress on trade negotiations and lackluster corporate earnings have halted this week’s stock market rally. Another reason for the pause was the unpleasant reminder that this April was one of the worst consumer sentiment months in history, according to the University of Michigan. Indeed, this morning’s publication was revised positively from the 50.8 reported two Fridays ago, but 52.2 remained amongst the lowest on record. Households communicated elevated angst regarding future inflation and employment opportunities. Investors are responding to the absence of good news by selling equities and trimming commodity holdings in favor of Treasuries, greenback futures and forecast contracts.

Stocks Take a Breather

Stocks are lower in aggregate but mixed amongst the indices with the Nasdaq 100 up 0.2%, the Russell 2000 and Dow Jones Industrial losing 0.6% and 0.5% and the S&P 500 is unchanged. Sectoral breadth is negative with only consumer discretionary, communication services and technology gaining; they’re up 1%, 0.4% and 0.4%. All other eight segments are down as materials, consumer staples and financials lose 1%, 0.7% and 0.6%. Treasuries are catching modest bids with the 2- and 10-year maturities changing hands at 3.78% and 4.27%,1 and 5 basis points (bps) lighter on the session. Similarly, the greenback is advancing and appreciating relative to all of its major counterparts, including the euro, pound sterling, franc, yen, yuan, loonie and Aussie tender. The US Dollar Index is up 35 bps. Commodities are being trimmed across the board with gold, silver, copper, lumber and crude oil sinking 2.3%, 1.9%, 1.5%, 0.4% and 0.1%.

Investors Brace for a Full Week of Econ Data

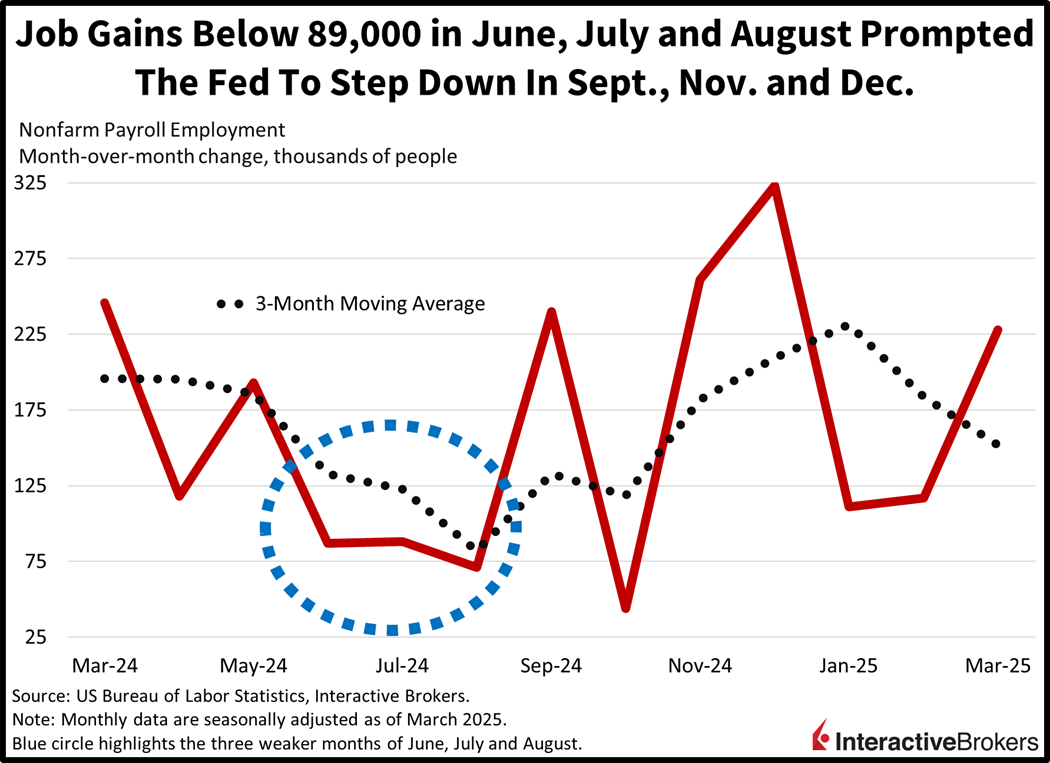

A justification for today’s lack of conviction in markets is next week’s jampacked US economic calendar. On the labor front we have job openings, ADP roster gains, the employment cost index, unemployment claims, challenger cuts and nonfarm payrolls being released from Tuesday through Friday. Other significant updates will come in the form of an initial look at first quarter GDP, March household spending, PCE price pressures and goods trade balance, April’s ISM-manufacturing and the Treasury refunding announcement. And lower on the totem pole we have consumer confidence, construction expenditures, pending home sales, home prices and a few Federal Reserve regional surveys. Taken together, the data will point to whether the US economy is slowing faster than feared, or if conditions are decelerating in orderly fashion. The former case may feature a negative GDP print and sub-80,000 payrolls. This development, shall it occur, has the potential to compel the Fed to deliver a 25-bp cut on May 7. This decision could be supported further, with a March PCE inflation figure of 2.2%, right in the realm of the central bank’s 2% target. Finally, the 2.1% PCE reading in September widened the path down the monetary policy stairs late last year, which was preceded by another growth scare characterized by three consecutive months of payroll gains below 89,000.

International Roundup

GFK Report Confirms Weak UK Consumer Sentiment

The UK GfK Consumer Confidence Index sank from -19 in March to -23 this month, a worse result than the consensus expectation of -22. In a trend that mirrors recently released data from the British Retail Consortium (BRC), Gfk reported broad declines in shoppers’ moods. Personal finances during the last year came in at -10, a one-point drop from March, and expectations for financial wellbeing over the next 12 months dropped four points to -3. The largest weakness was the view of the general economy during the next 12 months, which collapsed eight points to -37. On Thursday, the BRC reported in a separate survey that households’ views of the economy over the next three months fell from -35 in March to -48 this month, its lowest level on record.

But Sales Climbed in March

On a positive note, March was a strong month for household spending with retail volume climbing 0.4% month over month, exceeding the analyst expectation for a 0.4% decline but easing from February’s 0.7% increase. Cashier activity climbed 2.6% relative to the same month in 2024, exceeding the median forecast expecting an unchanged 1.8%.

Japan Inflation Picks Up

Price pressures in Japan’s capital city accelerated this month with the Tokyo Consumer Price Index (CPI) climbing 3.5% compared to 2.9% in March. Core prices also picked up, ascending by 3.4% y/y compared to 2.4% in March and the median estimate of 3.2%.

Singapore Property Price Increases Slow

Singapore property price gains during the first quarter of this year moderated from the last three months of 2024, increasing only 0.8% quarter over quarter. In the three months ended December 31, the gauge climbed 2.3%.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Hong Kong Limited, and Interactive Brokers Singapore Pte. Ltd.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.