This isn’t Amazon’s core business, but it’s growing faster than the others.

Amazon (AMZN -1.54%) is best known as the king of e-commerce, accounting for more than a third of all U.S. e-commerce sales, a staggering lead. As for Amazon’s own business, e-commerce accounts for about 67% of total sales. Online store sales increased 9% year over year in the 2023 fourth quarter, and third-party sales rose 20%.

Amazon Web Services (AWS) is Amazon’s second-largest segment, accounting for 14% of the total, and AWS sales increased 13% year over year in the fourth quarter. But advertising has emerged as Amazon’s third-largest segment, and it’s also its fastest growing. Let’s consider its potential and what it could mean for investors.

Keeping Amazon in the growth category

At $14 billion, advertising accounts for around 8% of sales. But ad sales increased 27% year over year in the fourth quarter, and it’s been the fastest-growing segment for several quarters. Amazon only began to report it as a separate segment at the end of 2021.

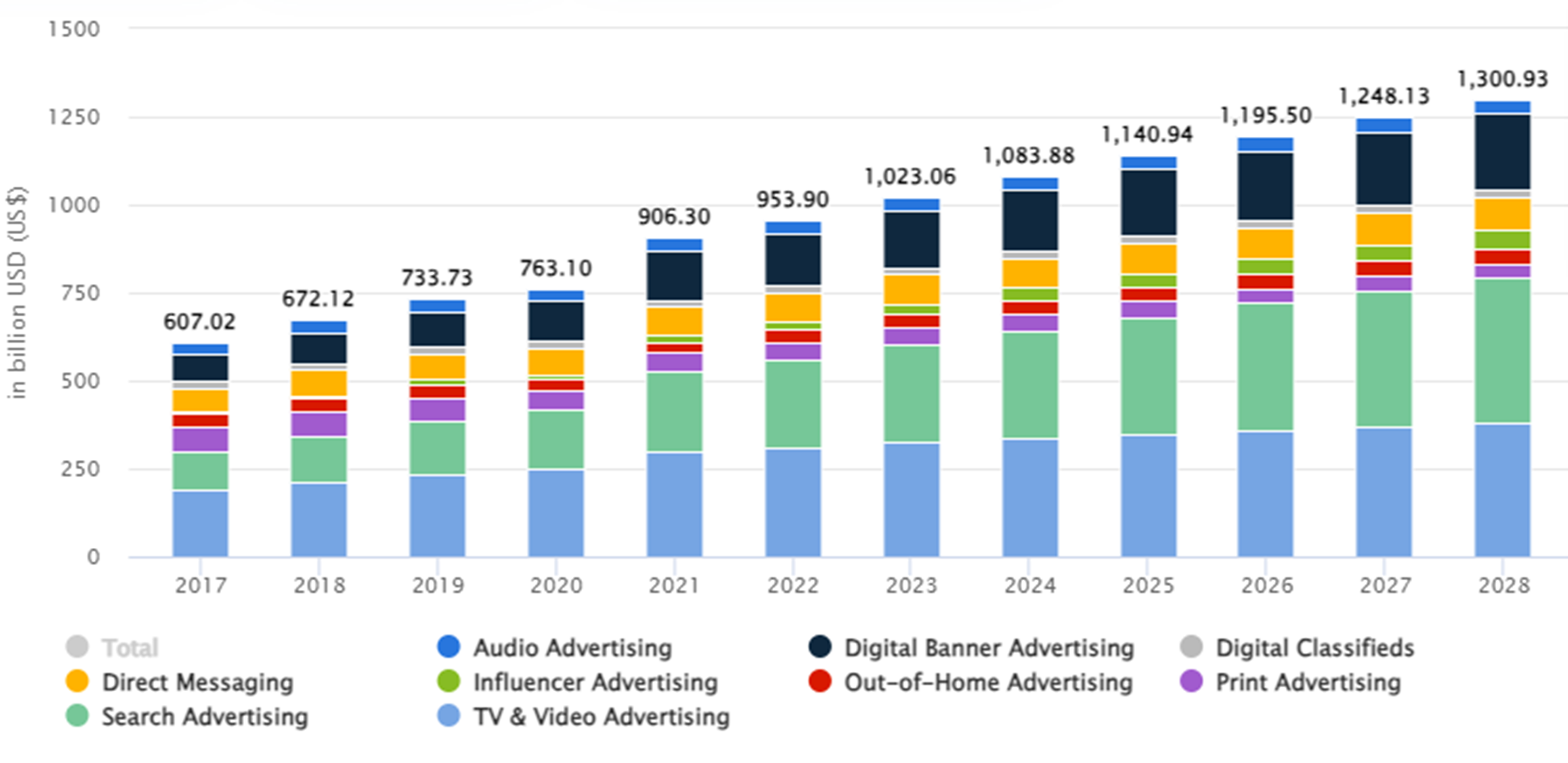

With the advent of artificial intelligence as a major force in business, advertising is undergoing a remarkable transformation, paving the way for substantial growth. And experts expect this growth to continue over the next few years, as the chart below suggests.

Image source: Statista.

Amazon has several advantages in advertising. It has powerful AI capabilities that help advertisers find the right audience with pinpoint accuracy, and since hundreds of millions of shoppers are already on Amazon’s website looking for products advertisers offer, it’s the perfect spot for exposure. The largest ad categories per the chart, TV and video advertising and search advertising, are in Amazon’s wheelhouse.

The company recently launched sponsored TV ads in the U.S. to open up the opportunity to smaller businesses that don’t have large budgets and expand its own opportunities. Management said sales increases for some of its football streaming has been “dramatic,” and it’s still just getting started with developing full ad capabilities. Even better, advertising is a high-margin business that’s helping pad the bottom line.

Expect advertising to drive high growth at Amazon for the foreseeable future.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.