Palantir (PLTR -1.49%) delivered another blowout earnings report on Monday.

The company posted its seventh consecutive quarter of revenue growth in the first quarter of 2025 as revenue grew 39% to $883.9 million, which easily beat the consensus at $862.1 million.

Generally accepted accounting principles (GAAP) operating income more than doubled to $176 million, giving the company an operating margin of 20%. On an adjusted basis, earnings per share increased from $0.08 to $0.13, which matched estimates.

Palantir also raised its guidance for the year, calling for 36% growth for the full year to $3.89 billion to $3.902 billion, ahead of the consensus at $3.75 billion.

Despite the strong results, the stock sold off on the news, falling about 12% on Tuesday, and there was an obvious reason for the move: valuation.

Palantir continues to trade at an astronomical valuation. Even after the sell-off and strong quarter, its price-to-sales ratio is 82.4.

Image source: Getty Images.

A valuation conundrum

Palantir shares have soared about 1,000% over the last three years as it’s launched its popular Artificial Intelligence Platform (AIP), delivered accelerating growth over several quarters, turned profitable, gained admission into the S&P 500, and built a strong U.S. commercial business.

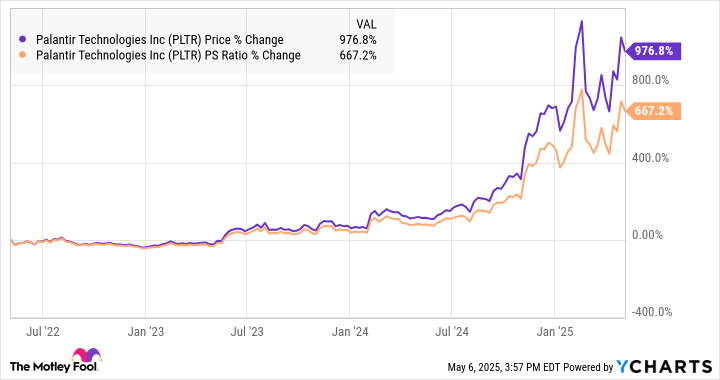

However, as you can see from the chart below, most of that growth in the stock price has come from a rerating of the valuation, rather than growth in underlying revenue.

As you can see about two-thirds of the gain in the stock have come from multiple expansion, at least based on revenue, rather than underlying growth in the business.

That rerating is deserved as Palantir’s growth and profitability have dramatically improved in the last three years. However, stocks can’t grow forever like that, and at its current valuation, the price-to-sales ratio is a headwind as it assumes that Palantir’s growth rate remains at this level or accelerates for several years.

A peerless stock

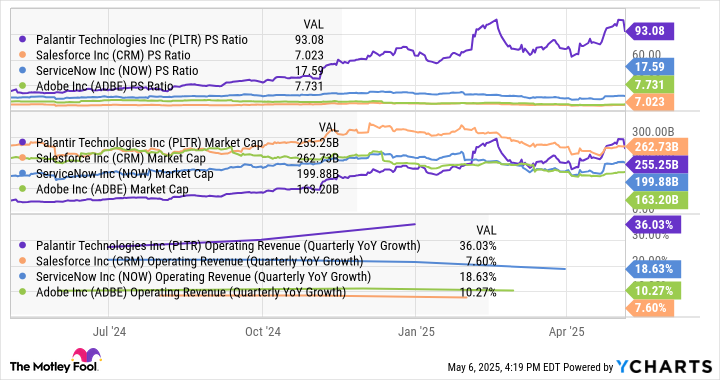

Along with the skyrocketing growth in the stock, Palantir is now one of the country’s most valuable pure-play software companies with a market cap of over $250 billion. The chart below shows how it compares with peers like Salesforce, ServiceNow, and Intuit.

PLTR PS Ratio data by YCharts

As you can see, Palantir is more than 5 times more expensive than its closest peer in that group, though its revenue growth is only about twice as fast.

As a business Palantir is still relatively small with trailing revenue just over $3 billion. Every other stock in that group brings in more than $10 billion in revenue, and Salesforce earned $38 billion in revenue in the last four quarters.

While Palantir is a unique company, comparing it to other software companies is useful. Based on its market cap and valuation, investors seem to be assuming that Palantir will grow to at least $10 billion, which would mean growing revenue at 40% for three more years beyond the current one, through 2028.

If the stock price held steady during that time, its price-to-sales ratio would fall to 25, a valuation that would be considered pricey but reasonable. Keep in mind that assumes no growth in the stock in the next 3.5 years.

Can Palantir reach $1 trillion by 2030?

At this point, the biggest question for Palantir, especially for those wondering if the stock can keep growing, is what its total addressable market (TAM) is. Palantir, which makes a wide range of products for both the defense sector and commercial businesses, doesn’t provide a figure, and estimates vary widely.

If the addressable market grows rapidly, driven by adoption of AI, Palantir’s chances of reaching $1 trillion in five years are much greater.

Assuming the company’s price-to-sales ratio settles at 25 by 2030, Palantir’s revenue would have to reach $40 billion by 2030. From roughly $4 billion in revenue at the end of 2025, the company would have to grow revenue by around 60% over the next five years to reach that goal. If Palantir achieved a 30% GAAP profit margin by then, it would have $12 billion in net income, giving it a price-to-earnings ratio of 83. Those seem like reasonable valuation metrics for a company growing at that rate.

Despite Palantir’s impressive progress in capturing new customers with new products, including NATO’s adoption of its Maven Smart System, reaching those figures by 2030 would be a tall task, especially given the uncertainty in the economy.

Palantir could get there eventually, especially if AI adoption accelerates, but investors should tamp down their expectations for the stock’s growth.

While Palantir’s execution has been phenomenal, the valuation simply leaves little upside potential to the stock at this point, and investors got a reminder of that after the first-quarter report.