Alphabet’s pursuit of artificial intelligence (AI) may be overshadowed by the competition, but notable investor Bill Ackman says not to sleep on the company.

One of the best ways to see where “smart money” is moving is to look through the regulatory filings of money managers. Bill Ackman, a hedge fund manager and CEO of Pershing Square Capital Management, is a closely followed investor on Wall Street.

Ackman is known to keep a limited number of stocks in his portfolio — only taking positions in high-conviction opportunities. In 2023, it was revealed that Ackman had initiated an investment in Alphabet (GOOG -0.30%) (GOOGL -0.29%).

This seemed a curious move as the artificial intelligence (AI) revolution was only beginning to take shape. Why Alphabet instead of Microsoft, Amazon, Nvidia, or a number of other players?

In Pershing Square’s 2023 annual report released on March 22, Ackman provided some clues regarding his attraction to Alphabet’s investment prospects, writing that the company has “an unmatched business model.” That’s a bold statement, considering the level of competition within the AI realm.

Let’s dig into what Ackman sees in Alphabet and assess whether now is a good time to scoop up shares.

More than an advertising business

Alphabet is largely known to be an advertising business. Given the company owns the world’s two most visited websites — Google and YouTube — it makes sense that advertisers would be keen to leverage these platforms.

Indeed, with more than three-quarters of annual sales stemming from advertising, Alphabet is heavily reliant on its large internet surface area. However, competition from TikTok, Meta‘s Instagram and Facebook, and even smaller platforms such as Snap and Pinterest have proven a challenge Alphabet’s dominance in attracting advertisers in recent years.

For this reason, the company’s forays into cloud computing and cybersecurity have served as necessary moves as Alphabet seeks to diversify its business. The more subtle aspect, however, is how Alphabet may be able to apply AI across its evolving ecosystem.

Image source: Getty Images.

AI is just beginning

The last year or so has been jam-packed with headlines about AI. Unfortunately for Alphabet, the company has been on the receiving end of some negative PR following blunders in the company’s launch of chatbots Bard and Gemini.

Ackman addressed this in his letter, calling these botched campaigns a “flawed rollout.” However, he makes a good counterpoint in that other generative AI models have also “displayed similarly biased and inaccurate responses.”

The bigger theme Ackman is talking about is that AI is in its early innings. Given the volume of data Alphabet collects across its various platforms, the company has an unparalleled source to continue training and honing its AI models and applications. In turn, this should lead to enhanced products and services across other areas of the business — notably in the cloud and productivity suites.

A compelling valuation story

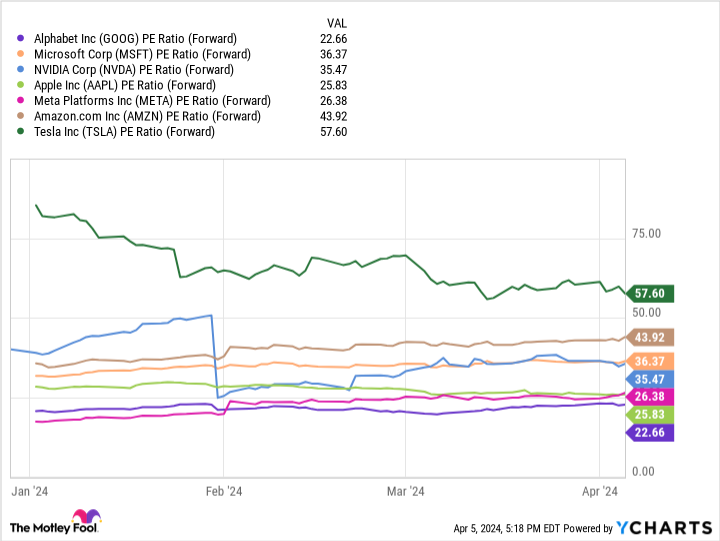

As of the time of my writing this article, Alphabet has the lowest forward price-to-earnings (P/E) multiple among the “Magnificent Seven” stocks. That makes it look like a bargain.

GOOG PE Ratio (Forward) data by YCharts. PE Ratio = price-to-earnings ratio.

A few months ago, Ackman went as far as to say that Alphabet’s AI business is “free.” The disparity in valuation multiples from the chart above is hard to overlook, considering Apple hasn’t grown revenue in a year, and Tesla appears to be decelerating with a tough economy. I’m aligned with Ackman and think investors have a generational opportunity to buy into a leading AI opportunity at a stark discount relative to peers.

Alphabet ended 2023 with $110 billion of cash and equivalents on the balance sheet. This provides a deep level of financial flexibility that few other businesses possess.

With such robust financials and a leading position across multiple areas of the internet and cloud, I think Ackman is right in his assessment of Alphabet’s multifaceted business model. I see the next phase of Alphabet’s growth anchored by AI — and its impact across the company’s various applications shouldn’t be overlooked. However, this process is going to take time, and investors should remain patient.

Given its discount when benchmarked against other megacap AI enterprises, I think Alphabet stock looks dirt cheap. Now could be a terrific opportunity to use dollar-cost averaging to initiate or add to an existing position to hold long-term.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Pinterest, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.