New York Community Bank (NYCB 17.95%) endured an alarmingly poor quarterly earnings report, a credit rating downgrade, a significant dividend reduction, and serious accounting issues in February. These factors caused the stock to tumble 26% in during the month, according to data provided by S&P Global Market Intelligence.

Macroeconomic issues are hurting this regional bank

New York Community Bank published disappointing fourth-quarter earnings on Jan. 31. The bank reported a larger-than-expected net loss, and it announced that it would be slashing its quarterly dividend from $0.17 to $0.05 per share. That sort of news tends to hurt any stock’s price, but investors are worried that conditions will deteriorate further for the regional bank.

NYCB is struggling with a few major headwinds. The Federal Reserve’s interest rate hikes have driven increased expenses for banks paying interest to depositors. Meanwhile, weak demand for loans is preventing many banks from offsetting their increased interest costs with new loans bearing higher rates. That’s a sector-wide issue that NYCB can’t escape.

Image source: Getty Images

NYCB has its own set of challenges, too

NYCB comes with company-specific problems due to its heavy exposure to commercial real estate loans since it acquired the distressed Signature Bank last year. Economic weakness, remote work, and mass relocation have severely impacted demand for office and commercial spaces, especially in some cities. This is causing many large property owners to default on loans, which results in losses for NYCB and some of its peers.

The Signature acquisition also pushed the bank beyond the $100 billion asset threshold, which comes with higher regulatory standards and capital requirements. These force the institution to utilize short-term funding to maintain sufficient liquidity, increasing expenses. NYCB shares dropped nearly 40% following the quarterly earnings report.

The pain didn’t stop there. The bank’s credit rating was lowered to “junk” by ratings agencies in the wake of the financial report, sending the stock even lower.

The problems are persisting

March hasn’t been much better for NYCB. The company amended its fourth-quarter results on March 1, explaining that it had discovered material weakness in its internal accounting controls. Not only were results even worse than previously reported, but those errors threaten its reporting credibility. That’s horrible news for a financial institution.

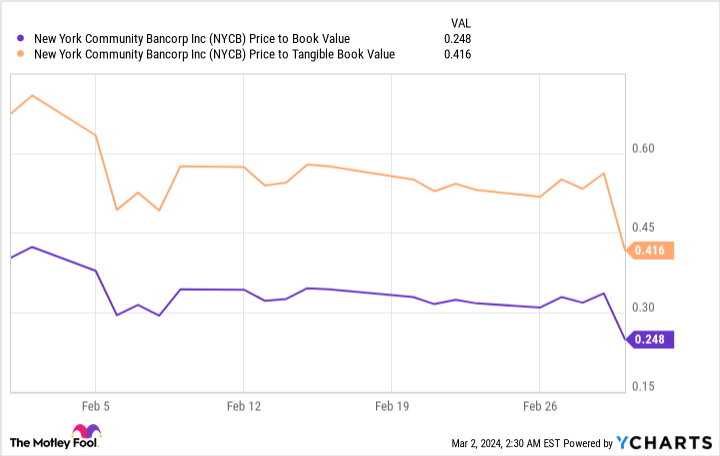

The stock’s forward dividend yield is just over 5%, now that its annualized dividend is $0.20. Its price-to-tangible book value is just over 0.4, which is a steep discount to the value of the items on its balance sheet. That suggests that investors are expecting ongoing losses or asset write-offs.

NYCB Price to Book Value data by YCharts

There could be trouble ahead if the commercial real estate market hits tough times. If NYCB can avoid disaster, the stock is priced attractively for long-term investors.

Ryan Downie has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.