Scorching wholesale inflation data amidst this morning’s lower-than-expected unemployment claims are sending market players back to the drawing board as they reevaluate the path of potential Fed rate cuts. The year has certainly seen monetary policy expectations shift considerably, as investors are now thinking that rate relief may arrive in July rather than June, with expectations now nearing coin flip odds for the earlier month. Stocks were once again trying to shrug off another hot inflation report this week ahead of a monthly options expiration tomorrow, but reversed into the red in early trading shortly after opening green. Bonds dipped immediately after the 8:30 am reports were released, with yields soaring closer to their yearly highs.

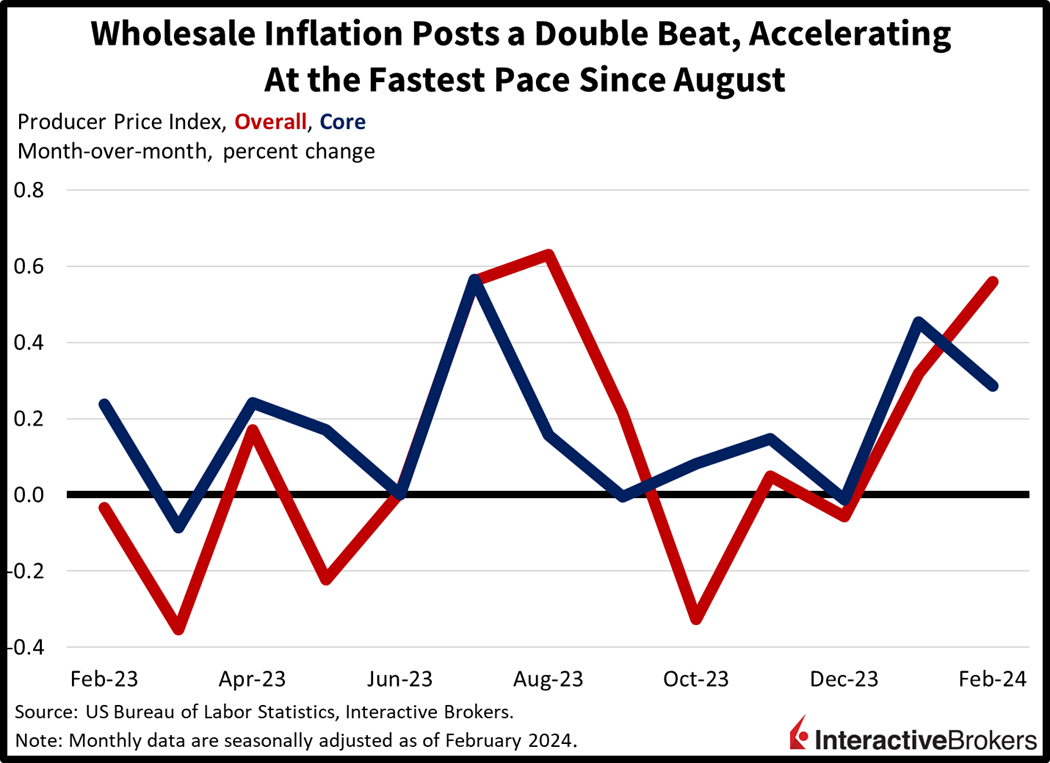

PPI Shatters Expectations

Wholesale inflation posted a double beat in February while accelerating for the second-consecutive month, as services, goods and commodities all experienced material price gains. February’s Producer Price Index (PPI) rose 0.6% month over month (m/m) and 1.6% year over year (y/y), shattering expectations of just 0.3% and 1.1% and gaining from January’s rates of 0.3% and 1%. Core figures, which exclude food and energy, also beat projections, rising 0.3% m/m and 2% y/y versus estimates of 0.2% and 1.9% and the previous period’s 0.5% and 2%.

Goods and Commodities Lead Price Gains

Wholesale price gains were broad, with goods and commodities leading while services gained at more tempered levels. Energy, with a 4.4% increase, climbed the most followed by foods, with a gain of 1%, and the transportation and warehousing category, which jumped 0.9%. The other services category increased 0.5% while trade services experienced price relief of -0.3% during the period.

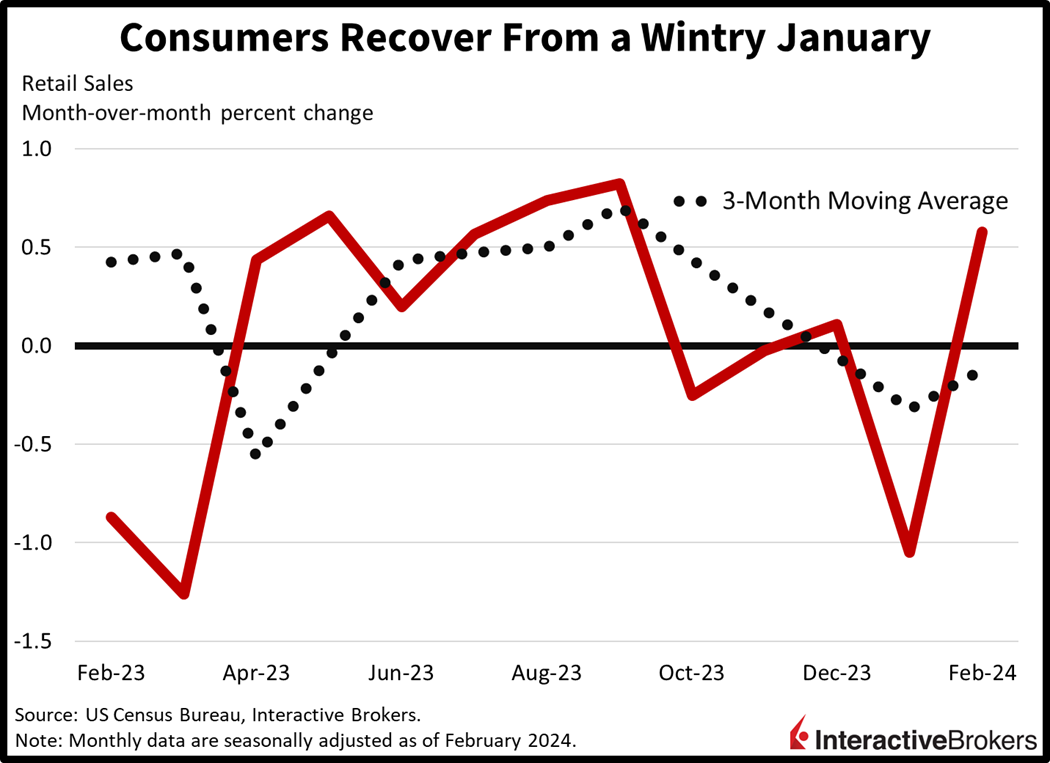

Shoppers Bounce Back

Retail sales made a comeback last month as weather conditions improved, incentivizing consumers to go out and shop. Retail transactions grew 0.6% m/m, missing expectations of 0.8% but recovering some of January’s 1.1% decline. Excluding gasoline and automobiles, transactions gained 0.3% versus estimates of 0.5%, also paring some of the previous month’s 0.8% decrease. The control group, which comprises an important part of the consumption aspect of gross domestic product, was unchanged m/m, missing the anticipated 0.4% but better than January’s 0.3% decline.

Transaction Volumes Improve Broadly

Across sectors, gains were widespread, with 11 out of 13 segments gaining on the month. Additionally, eight sectors gained more than 1% m/m. Categories with gains in excess of 2% consisted of the following:

- Health and personal care stores, up 3.2%

- Apparel shops, up 3%

- Sporting goods retailers, up 2.4%

- Building materials suppliers, up 2.2%

Sectors with increases exceeding 1% included the automobile dealerships group and the general merchandise category, with both experiencing 1.6% increases. Prices for electronics establishments and gasoline stations increased at slower rates of 1.5% and 1.4%, respectively. Miscellaneous stores, restaurants and bars, and food markets experienced milder increases of 0.6%, 0.4% and 0.1%. Furniture showrooms and ecommerce destinations offset some of the progress, with transactions declining 1.1% and 0.1% during the period. These figures are not adjusted for inflation, which came in at 0.4% during the month.

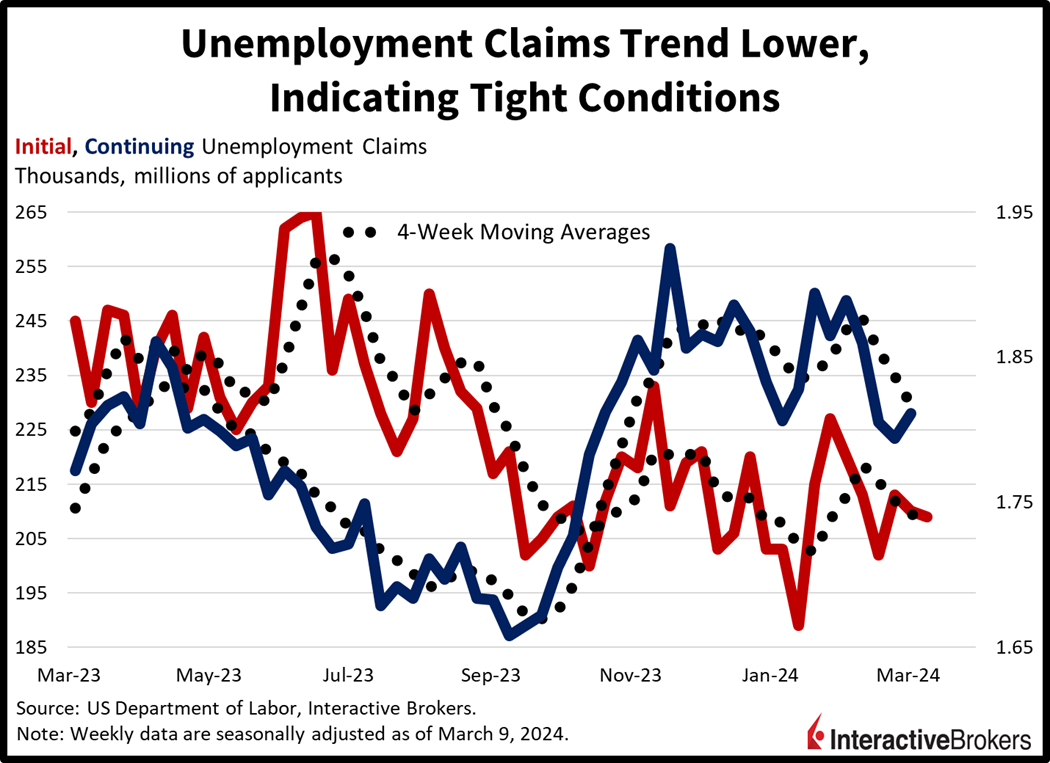

Labor Market Pressure Persists

Labor market conditions remained tight this month, with unemployment claims trending lower and pointing to sustainable headcounts across the economy. Initial unemployment claims fell to 209,000 for the week ended March 9, below estimates of 218,000 and the previous week’s 210,000. Continuing claims rose to 1.811 million for the week ended March 2, below projections of 1.9 million but slightly higher than the previous period’s 1.794 million. Continuing unemployment claims benefited greatly from downside revisions, bringing the figure significantly below the pivotal 1.9 million threshold. The four-week moving average for both figures shifted from 209,500 and 1.837 million to 208,500 and 1.799 million.

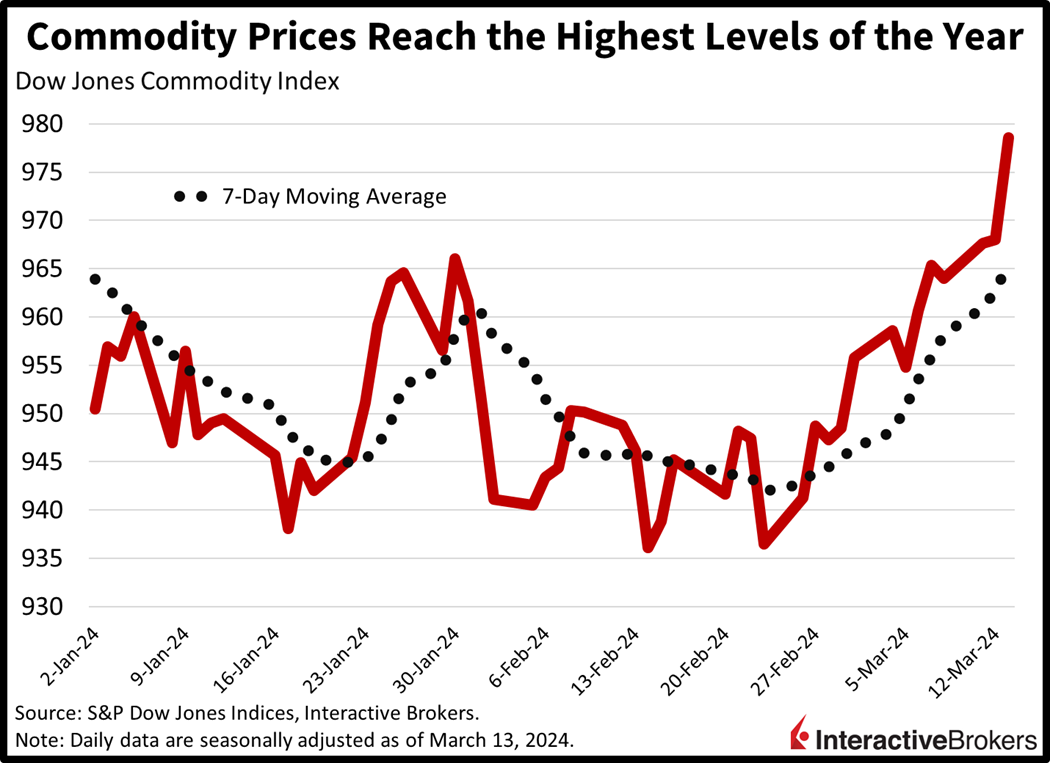

Commodities Helped in ’23, But Hurt in ‘24

Commodities are continuing to provide inflationary pressure with West Texas Intermediate Crude climbing above $81 a barrel today after lumber and copper prices hit 12-month highs yesterday. Oil prices climbed sharply on supply concerns following Ukraine’s two-day drone attack on Russia that included oil facility targets. Ukraine has attacked approximately 25% of Russia’s refinery capacity so far this year and the most recent attack hit a facility that can process 340,000 barrels a day. Meanwhile, demand for lumber and copper is likely to increase as manufacturers and real estate developers pounce on looser financial conditions and firmer animal spirits.

Sporting Goods Sizzle but Bargains Flourish in Other Categories

Consumers are splurging on sporting goods while increasingly seeking bargains on groceries and other necessities. Meanwhile, homebuilders are continuing to rely on discounting to support sales. These trends were illustrated by the following earnings call highlights:

- Dick’s Sporting Goods reported a strong fiscal quarter that ended February 29 with earnings and sales that exceeded analysts’ expectations. It was an all-time high quarter for sales. Comparable sales climbed 2.8% y/y, exceeding the analyst expectation of 0.8%. Dick’s expects to reduce its use of discounts and increase profit margins on its products. Its upper range of earnings per share guidance exceeded the analyst consensus expectation and its stock price increased more than 5.5% in morning trading.

- Dollar General also posted a strong quarter, attributing its success to inflation causing customers to seek less expensive groceries and other discounted items. This trend resulted in higher traffic to the company’s stores. Its recent-quarter earnings and revenue beat the analyst consensus expectations; however, its profit guidance missed the analyst outlook. The company said profits will be challenged by higher costs for labor, raw materials and its supply chain.

- Fossil Group reported a larger y/y net loss for the calendar fourth quarter and said Chief Operating Officer Jeffrey N. Boyer has replaced Chief Executive Officer Kosta Kartsotis. The company has launched a strategic review to improve results and during the quarter, it exited the smartwatch category, closed underperforming stores and reduced its overall inventory by 33%. On a positive note, lower inventory costs and reduced freight expenses helped the company improve its gross markets, but sales were hurt by weak overall consumer spending, especially in China, which is an important market for the company.

- Lennar Corp., which is a homebuilder, grew its quarterly revenue 12.7% for the quarter ended February 29 and the number of delivered homes climbed 23%, but its top-line result missed the analyst consensus expectation. Its earnings, however, surpassed the analyst expectation, despite its average home sale price falling significantly below estimates. The company discounted homes during the quarter with the combination of tight supply driving up prices and 7% mortgage rates pushing many potential buyers out of the market.

Bulls Lose to Inflation

Markets are bearish today as equity bulls fail to conquer another hotter-than-expected inflation report this week. Equity and bond bulls are staring at their calendars and drawing a big red circle around the 20th of this month, which is the next Fed meeting. Indeed, folks are concerned that Chair Powell may have to pull a dangerous U-turn during his ride on the monetary policy highway. His dovish messaging since December has definitely driven an intense loosening in financial conditions that has propelled inflation higher.

All major US equity indices are lower, led by the small-cap, rate-sensitive Russell 2000 benchmark, which is lower by 1.4%. The S&P 500, Dow Jones Industrial and Nasdaq Composite baskets are down a much milder 0.2%, 0.1% and 0.1%, as traders pick up beaten down technology shares to spare the gauges. Sectoral breadth is deeply negative though, with 9 out of the 11 major sectors lower, being dragged down the most by real estate, utilities and health care, which are down 1.7%, 0.9% and 0.7%. Energy and technology are the only gaining sectors, with segments jumping 0.6% and 0.2%, respectively. Yields are flying higher as the 2- and 10-year Treasury maturities trade near year-to-date highs. The instruments are changing hands with rates of 4.68% and 4.28%, 4 and 9 basis points (bps) loftier on the session. Renewed Fed easing anticipations and loftier inflation expectations are pushing up the dollar as well, with the greenback’s index up 41 bps to 103.22.

Will Powell Pitch a Slider or Whip a U-Turn?

August 2022 comes to mind when examining the current trend of inflation amidst animal spirits in markets. At the time, the S&P 500 rose from 3636 to 4324, a 19% rally off of comments from Fed Chair Powell emphasizing that the current posture of the central bank was neutral, even though the Fed funds rate was at a midpoint of just 2.38%. The reignition of commodity prices, a few hotter inflation reports and bullish exuberance in markets led Powell to show up fiercely in Jackson Hole, Wyoming. Powell threw the ferocious slider pitch that no one was expecting, which led to a 20% S&P 500 drop from August to the October lows of 3491. He even mentioned economic pain. Next week provides another opportunity for Powell to redeem himself against the backdrop of inflation. Will he throw the old-fashioned Jackson Hole slider, or will he pull a Nascar style, Washington D.C. U-Turn. Will he continue to support the interests of Wall Street, or will he acknowledge that accelerating inflation is painfully damaging to Main Street?

The conditions bring to mind an observation from Paul Volcker, the legendary Fed chair that slayed inflation in the 80s, who opinioned “The real danger comes from encouraging or inadvertently tolerating rising inflation and its close cousin of extreme speculation and risk taking, in effect standing by while bubbles and excesses threaten financial markets. Ironically, the “easy money,” striving for a “little inflation” as a means of forestalling deflation, could, in the end, be what brings it about.

Visit Traders’ Academy to Learn More About Retail Sales and Other Economic Indicators

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.