Old enterprise software provider Oracle (ORCL -0.95%) isn’t a growth stock anymore. Ever since the dot-com era bust, the company has been downright pedestrian.

However, Oracle’s earnings growth is another story. It’s further proof that even many decades into their existence, top software companies can show off the merits of an “infinitely scalable” business model — one in which a software product can be built once and sold over and over again to generate incredibly high profit margins.

These days, Oracle has been layering cloud infrastructure (or OCI from here on out) into its product suite, made famous in the autumn of 2022 with a first-of-its-kind deal with Nvidia for AI training hardware. A follow-up deal in spring 2023 was struck for OCI first-access to Nvidia’s DGX Cloud AI training service.

Oracle may not rank as a top cloud-computing stock for many investors, but it’s time to change that perception.

Oracle Cloud is booming

Oracle CEO Safra Catz explained on the latest earnings call that the company’s big bets on AI infrastructure continue to haul in lots of new customers. Due to some hardware supply constraints, growth was throttled a bit. Nevertheless, OCI infrastructure-as-a-service (IaaS), in which AI training hardware housed in a remote data center is “rented” by customers, grew 49% year over year to $1.8 billion last quarter.

Paired with its older software-as-a-service (SaaS) business — including sales from the Cerner healthcare software business mega-acquisition in summer 2022 — total OCI revenue was up 25% year over year to $5.1 billion.

On an annualized basis, OCI sales topped $20 billion. That still puts Oracle far behind its larger cloud peers, including Amazon AWS ($97 billion in annualized revenue as of Q4 2023), Microsoft ($104 billion in annualized revenue, which consists of Azure Cloud as well as its legacy cloud-based software), and Alphabet‘s Google Cloud ($37 billion on an annualized basis). But OCI’s infrastructure segment in particular is clearly landing big wins thanks to its Nvidia partnership, as it far outpaces the industry average growth rate.

For reference, tech researcher Gartner said IaaS user spending grew at a 20% clip in 2023, and it expects that spending to grow another 26% in 2024.

A relative cloud value or pie-in-the-sky stock?

Of course, Oracle is an old business, so Catz and company making progress in OCI is simply offsetting weakness in its legacy software. As a result, total revenue only expanded 7% year over year last quarter.

However, and this is important, what Oracle lacks in high-growth rates, it more than makes up for in fantastic earnings performance. Earnings per share grew 16% year over year last quarter as Oracle unlocks higher profit margins from its newer business, squeezes synergies from the big Cerner purchase, and returns excess cash to shareholders via a stock repurchase program ($1.1 billion deployed through the first nine months of fiscal 2024, plus an additional $3.3 billion paid out as dividends).

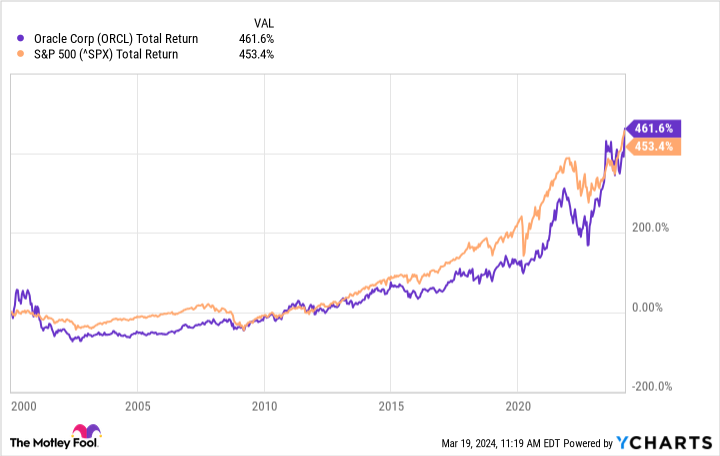

Talk about so-called infinite scalability. This mature tech business can still deliver stellar returns for shareholders long after its heyday. Even when using a less than favorable timeline dated back to Jan. 1, 2000 (not long before the dot-com bubble popped and Oracle and friends got clobbered), the stock has actually been a solid long-term buy-and-hold.

Data by YCharts.

As of this writing, Oracle stock trades for 34 times trailing-12-month earnings per share, or just under 30 times free cash flow. As it continues to scoop up business in this new era of AI and crank out even faster profit growth, investors should at least keep this one on their radar.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Nicholas Rossolillo and his clients have positions in Alphabet, Amazon, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, Nvidia, and Oracle. The Motley Fool recommends Gartner and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.