Oil is dominating tech … how our oil trades are doing … higher prices are coming to the pump … the dividend yields on leading energy stocks … two reasons oil could soar from here

It’s all about tech today – specifically AI – right?

Nope.

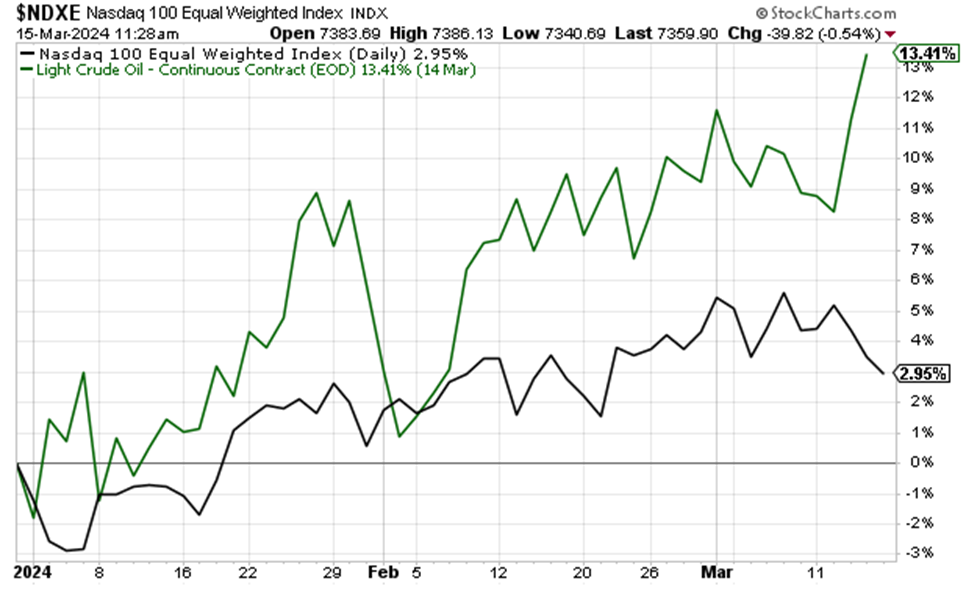

Oil is crushing the Nasdaq 100 here in 2024.

Most investors haven’t been watching, but the price of West Texas Intermediate crude is up 13% on the year, more than doubling the Nasdaq 100’s 6% gain.

Keep in mind, the Nasdaq 100 is a “weight averaged” index. In other words, the bigger the company, the greater the “representation” it has in the index. So, the bigger the stock, the more that the performance of that stock influences the overall Nasdaq 100 return.

Given this, when we look at the Nasdaq 100’s price, we’re not viewing an accurate depiction of how its average stock is performing. We’re getting a skewed conclusion, heavily impacted by the performance of the largest companies in the index (i.e. Microsoft, Apple, Nvidia, Amazon, and Meta).

For a more accurate gauge of the performance of the average Nasdaq 100 stock, we’d analyze the “Equal Weight” Nasdaq 100 index. As the name suggests, this allots an equal weighting to every stock in the Nasdaq 100 so that no single company has outsized influence on the overall reading.

Now, we just saw that oil’s return is crushing that of the Nasdaq 100 by more than 2-to-1 here in 2024. But when we sub in the Nasdaq 100 Equal Weight index, the results are even more jaw-dropping…

As you can see below, oil is more than 4Xing the return of the average Nasdaq 100 stock this year.

To avoid a miscommunication, I’m not disparaging the fantastic long-term investment opportunity in high-quality tech/AI plays

But as Louis Navellier said, which we highlighted in the Digest last week:

You have to expect mean-reversion trading for the next several weeks. What was up … will be down, and what was down … will be up.

There’s definitely some froth in the AI stocks…

So, expect the next few weeks to be bumpy.

When it comes to oil, we expect this mean-reversion trade to last more than just a few weeks. In fact, we’ve already been in it for over a month now.

From our February 9th Digest:

Oil and gas stocks are setting up for another run that’s going to make investors a hefty chunk of change…

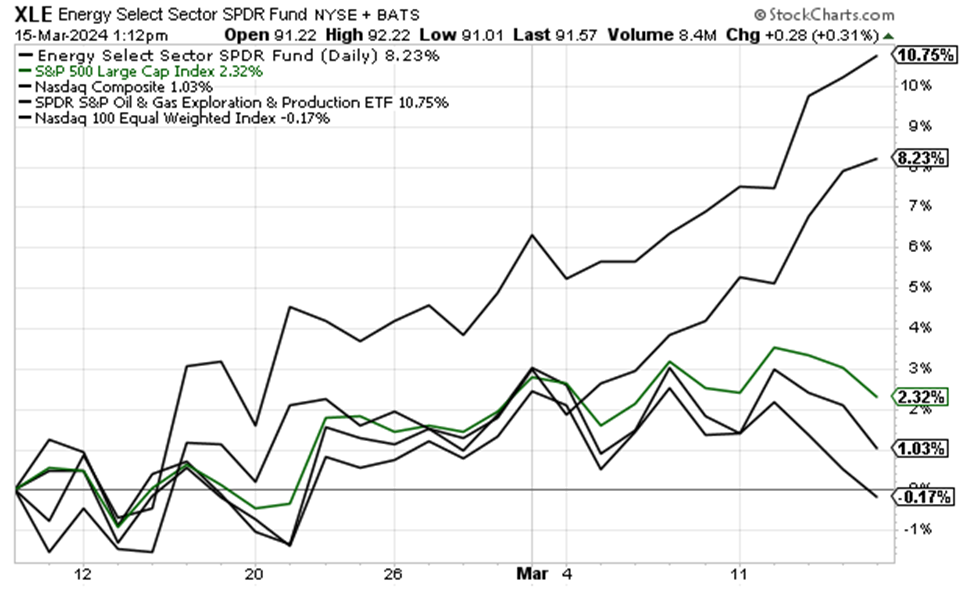

The two simplest [ways to play it] are broad market ETFs.

There’s XLE, which is the SPDR Energy Select Sector ETF (XLE). It holds energy heavyweights including Exxon, Chevron, Conoco, Hess, and Phillips 66.

There’s also XOP, which is the S&P Oil & Gas Exploration & Production ETF. Its top 10 holdings include Antero Resources, Hess, Valero, Southwestern Energy, and Callon Petroleum.

Since then, while the S&P has climbed less than 1%, the Nasdaq is up barely 2%, and the Nasdaq 100 Equal Weight is negative, XLE has jumped 8% while XOP is up double-digits at 11%.

Better yet, plenty more gains likely are on the way. For just one reason why, check out prices at your local pump.

“Higher prices are ahead for consumers”

That comes from Andy Lipow of Lipow Oil Associates in a note to clients last Wednesday.

Here’s more from that note:

[Last] week, Gulf Coast refiners, which account for nearly 50% of the nation’s refining capacity began to transition to the more expensive summer grade gasoline blends.

That means that higher prices are ahead for consumer. I expect further increases of another 10 to 15 cents per gallon over the next two weeks.

Those higher prices are in addition to the higher prices that have already begun to hit drivers.

Let’s go to OilPrice.com:

The national average price for a gallon of gasoline in the United States is currently sitting at $3.412… up a hearty $0.156 per gallon (4.8%) from $3.256 per gallon just a month ago…

It couldn’t have come at a worse time. Refinery outages in the United States are colliding with the beginning of driving season, and analysts are warning that drivers could see a spike in prices at the pump.

…Prices are set to climb even higher, according to some analysts. “There is every reason to believe gasoline prices will screech even higher going forward,” Tom Kloza, head of energy analysis at Oil Price Information Service, said according to Reuters.

The reason for the higher trend is higher summer travel demand which is about to kick off, declining gasoline inventories, and refinery outages.

Keep in mind that the oil trade is paying you while you wait for additional price gains. Check out some of the dividend yields on top oil/gas/pipeline stocks:

- Chevron – 4.21%

- Shell – 4.82%

- Kinder Morgan – 6.40%

- Hess Midstream – 6.87%

- Enterprise Partners – 7.02%

Better still, when hopping into the oil trade, you get a built-in call option for free

The base case for an oil trade today mostly rests on seasonality and supply cuts engineered by OPEC to prop up global oil prices.

But there are two wildcards that could send oil prices screaming higher: Ukrainian drone attacks on Russian oil refineries, and an escalation of Houthi attacks in the Red Sea and the resulting impact on global shipping routes.

Here’s CNBC last week on the Ukrainian attacks:

Ukrainian drones hit a Rosneft refinery in the Ryazan region about 130 miles from Moscow and the Novoshakhtinsk refinery in the Rostov region, according to Reuters. The strikes came one day after Ukraine hit a Lukoil refinery in Nizhny Novgorod, about 265 miles from Moscow.

Ukraine has repeatedly struck Russian oil infrastructure since January in a campaign to hurt the country’s economy…

The campaign of Ukrainian attacks this year has hit refineries representing 25% of Russia’s total refining capacity of 6.8 million barrels per day.

The attacks continued over the weekend. Yesterday, Reuters reported that Ukraine launched 35 drones at Russian targets, sparking a fire at an oil refinery that disrupted electricity supplies to various border areas.

The longer these Ukrainian attacks go on, the more likely that the oil market will price in supply disruptions. And what happens if the Ukrainians do significant damage in one of the attacks and millions of barrels of Russian oil go offline indefinitely?

As to the Houthi attacks and their impact on oil prices, here’s Al Jazeera from last Thursday:

Global oil demand is forecast to grow more than expected due to the rising fuel needs of ships rerouted away from the Red Sea amid attacks by Yemen’s Houthi rebels and a brighter economic outlook in the United States, the International Energy Agency (IEA) has said.

In its monthly oil report released on Thursday, the Paris-based agency made a 110,000 barrels per day (bpd) upward revision of global oil demand from its previous forecast as attacks by Yemen’s Iran-aligned Houthis in the Red Sea delay supplies.

The IEA said world oil demand is now forecast to increase by 1.3 million bpd this year.

“Disruptions to international trade routes in the wake of turmoil in the Red Sea are lengthening shipping distances and leading to faster vessel speeds, increasing bunker demand,” the agency said, using a term for the fuel needs of ships.

We’re not rooting for geopolitical conflict, but if there’s going to be a black swan hitting the oil sector, that swan would be bullish.

The power of a diversified portfolio

As noted earlier, we’re not down on tech/AI stocks. We believe they’re going to create enormous wealth this decade.

But today’s Digest is a reminder that a balanced, holistic portfolio is one of the best ways to grow your wealth during turbulent markets. You want to avoid the temptation to go all-in on the latest hot sector, neglecting other sectors that offer lower valuations and greater potential for mean-reversion gains.

On that note, let’s return to a quote from Louis that we featured over one month ago in that February Digest. This is why he’s one of the best in the business:

…It’s very important that you have stocks that zig when others zag, which is why we still have our Big Energy Bet.

Energy stocks benefit in the spring because as people get out-and-about more, demand rises. There have also been many refineries that have shut down for maintenance, so inventory for refined products is pretty tight right now.

So, I like my best energy stocks.

If you’d like more on Louis’ favorite energy picks as a Growth Investor subscriber, click here to learn more.

Have a good evening,

Jeff Remsburg