NYSE:AZTR

Azitra, Inc. (NYSE:AZTR) is a clinical stage precision dermatology company developing candidates for a variety of rare and serious skin diseases. It is developing genetically engineered bacteria for therapeutic use in dermatology leveraging a microbial library of 1,500 unique bacterial strains that are candidates for a variety of indications.

Azitra’s lead candidate is ATR-12 for Netherton Syndrome (NS), a rare disease. A second candidate is ATR-04 targeting epidermal growth factor receptor inhibitor (EGFRi)-associated rash and a third, ATR-01, ichthyosis vulgaris. All are topically formulated. Preclinical work has shown effective and safe use of ATR-12 as a potentially disease modifying therapy able to colonize the skin and replace a missing protein. An IND has been cleared for ATR-12 and a Phase I study has started. An IND is expected for ATR-04 by year end 2024. Outside of its pipeline, the company has signed a Joint Development Agreement with Bayer Consumer Care AG for consumer health candidates.

We have developed this note to provide a brief introduction to Azitra’s candidates. We start with a review of ATR-12 and discuss the bacteria’s genetic modification to be safe and produce a missing protein fragment implicated in NS. The next segment examines ATR-04 which has been formulated to treat rash related to targeted cancer therapies. ATR-01 employs the same approach as ATR-12, and produces a missing protein using Staphylococcus epidermidis (SE) as the host. This note concludes with a summary of the Bayer agreement.

Pipeline Candidates

ATR-12

Azitra’s lead candidate ATR-12 is a genetically modified strain of SE that has been granted pediatric rare disease status by the FDA.1 It is a lyophilized live biotherapeutic product (LBP) combined into a topical ointment. The candidate is intended to treat the underlying cause of Netherton syndrome by replacing deficient LEKTI with an active segment of the protein called human recombinant LEKTI domain 6 (rhLEKTI-D6). The rhLEKTI-D6 protease inhibitor protein plays an important role in regulating skin barrier function and preventing excessive proteolytic activity in the epidermis. Azitra has determined through its research that full length human LETKI, which is a 15-domain protein, is too large for consistent bacterial expression and secretion and uses domain 6 (D6) in its formulation. This fragment has proven sufficient to block the action of the proteases and restore balanced kallikrein levels.

The ATR-12 strain of SE has been genetically modified to express and secrete an active fragment of the full-length protein called the lympho-epithelial Kazal-type related inhibitor (LEKTI). The LEKTI production counters the dysregulated skin serine protease activity in Netherton syndrome patients. When uncontrolled, the serine protease activity causes a skin barrier defect and the release of pro-inflammatory and pro-allergic mediators by keratinocytes and immune cells. By inhibiting the serine protein activity, interleukin-36γ (IL-36γ), which is associated with several inflammatory skin conditions, is also reduced.

The species of SE has been engineered to be auxotrophic so that it requires an external supply of a nutrient to grow and survive. In this case, the necessary nutrient is amino acid D-alanine which plays a role in the structural integrity of bacterial cell walls. D-alanine is not normally present at significant levels in human tissue; therefore, bacteria must produce it biosynthetically, or it must be supplied exogenously. Knocking out the racemase genes in SE produced an auxotrophic phenotype that is unable to survive in the absence of D-alanine. This provides an additional level of safety against potential systemic infection by ATR-12.

Many strains of SE have the ability to create biofilms that can embed bacteria in an extracellular matrix. The biofilm can protect the bacteria from antibiotics and other insults allowing it to persist. Azitra’s therapeutic strain of Staphylococcus epidermidis is characterized by low virulence and does not form biofilms.

Preclinical Proof of Concept

ATR-12 has demonstrated preclinical proof of concept, successfully inhibiting overactive proteases in human and animal skin. Low levels of drug are able to inhibit kallikrein 5 (KLK5) activity and deliver it to the desired tissue.

SE351, the active drug in ATR-12, achieves nanomolar 50% inhibitory concentration (IC50) of KLK5 activity at 26 nM in vitro. This allows sufficient amounts of the therapeutic bacteria to be combined into the topical ointment and eases application. Above 100 nM of concentration, ATR-12 is able to achieve near 100% suppression of KLK5 activity which was demonstrated in an in vitro enzymatic assay standalone study. Trypsin like activity, which is a measure of protease activity, was also reduced after adding the spent broth2 from ATR-12.

One of the hurdles to addressing NS is delivering sufficient LEKTI deep enough in the skin so that it can inhibit the kallikreins and reinstate homeostasis. Ex vivo work demonstrated that ATR-12 was able to deliver LEKTI in full thickness human skin to the 26th to 30th layer. SE naturally migrates into the skin layers and along the hair follicles allowing for this deeper delivery of LEKTI compared with the purified formulation.

In NS, the lack of functional LEKTI leads to uncontrolled proteolytic activity, which results in increased processing and activation of pro-inflammatory cytokines, including IL-36γ. When uncontrolled, IL-36γ can initiate and amplify an inflammatory cascade by activating various signaling pathways and inducing the production of other inflammatory mediators which worsen the symptoms of NS. IL-36γ also plays a role in recruiting neutrophils to the skin, further exacerbating the inflammation and potentially contributing to the formation of skin erosions and scaling.3 To examine the impact of Azitra’s therapy on IL-36γ levels, it conducted testing on reconstructed epidermis that received IL-36γ-inducing agents which were then treated with ATR-12.

Azitra’s preclinical work has demonstrated that ATR-12 provides nanomolar IC50 values to inhibit KLK5, delivers functional LEKTI and reduces protease activity to normal levels in an ex vivo NS model of human skin. Azitra has added proprietary features to ATR-12 to facilitate protein delivery by leveraging the natural homing of S. epidermidis to deeper skin layers. This allows ATR-12 to deliver LEKTI more effectively than LEKTI delivery alone. Furthermore, ATR-12 reduces IL-36γ, attenuating the inflammation cascade and delivering therapeutically relevant levels of LEKTI over extended periods.

ATR-04

ATR-04 is derived from the S. epidermidis strain and is administered topically. It was sourced from a healthy volunteer and engineered to be auxotrophic to control growth. The product inhibits IL-36γ and S. aureus both of which can cause and exacerbate inflammatory skin conditions. ATR-04 also increases human beta defensin 2 which provides antimicrobial benefits, maintains skin barrier functions and contributes to the wound healing process by preventing infections and regulating the inflammatory response.

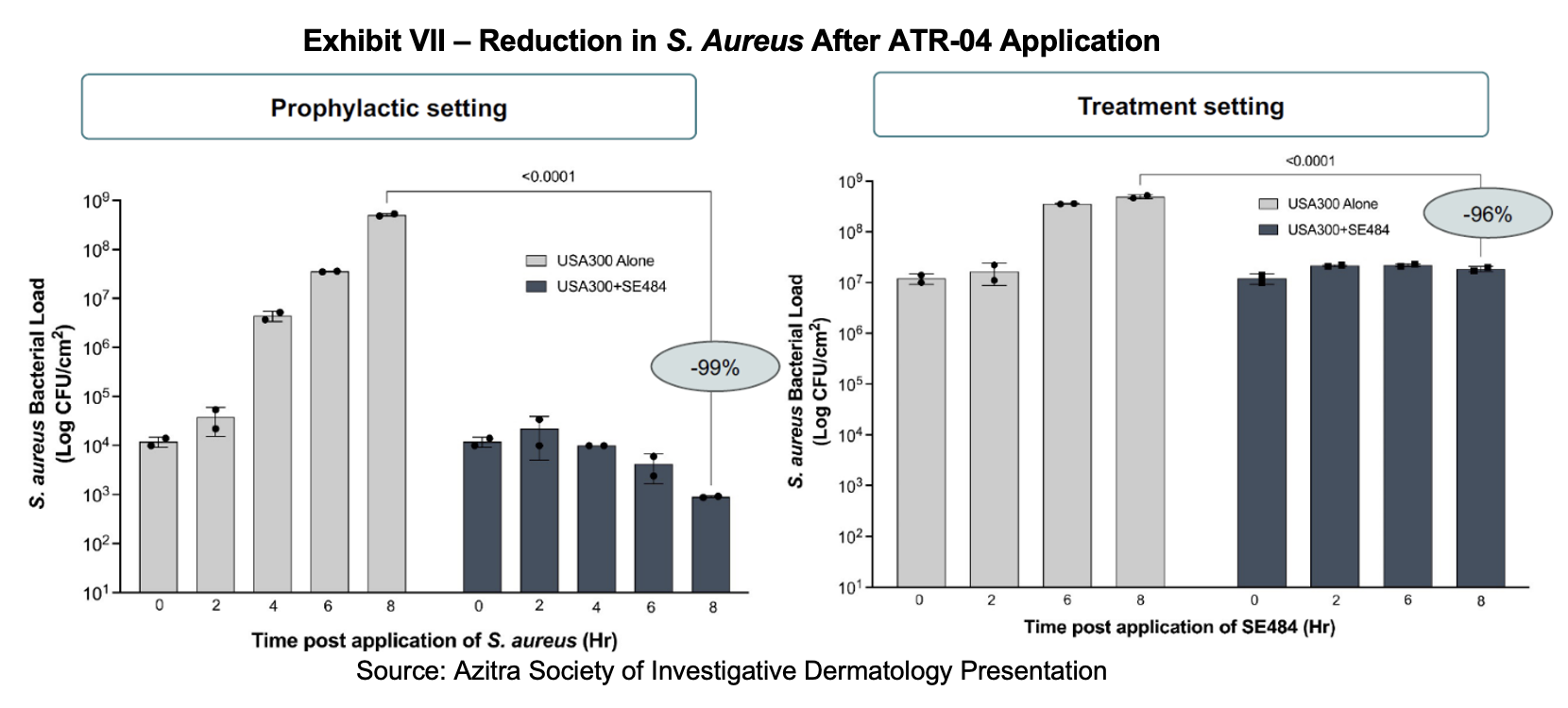

Preclinical work has shown that ATR-04 (via its active component SE448) is able to substantially reduce the S. aureus bacterial load in both the prophylactic and treatment setting. In reconstructed human epidermis models, methicillin-resistant S. aureus (MRSA) was reduced by more than 99% in the prophylactic setting (pretreated with SE484 then MRSA added) and by 96% in the treatment setting (pretreated with MRSA then SE484 added).

ATR-01

ATR-01 is an engineered S. epidermidis strain that secretes recombinant human filaggrin protein being developed as a topical application for treating ichthyosis vulgaris (IV). IV is a chronic scaly skin disease with an estimated prevalence of 1 in 100 to 1 in 250, with higher prevalence in those of European descent. It is caused by loss-of-function mutations in the gene encoding filaggrin. Azitra has used synthetic biology to engineer a protein by attaching a cell penetrating peptide to filaggrin, which helps facilitate deeper skin delivery for the structural protein. This is designed to overcome the impenetrability of the skin barrier, which would otherwise limit topical protein delivery. Azitra is planning to complete lead optimization and IND-enabling studies in 2024 to support an IND filing targeted for the second half of 2025.

Bayer Collaboration

Azitra entered into a Joint Development Agreement (JDA) with Bayer in December 2019 to jointly develop several strains of microbes in Azitra’s library. The efforts will identify and characterize these strains for topical formulations. Azitra received an upfront upon signing of the JDA and was reimbursed for development costs. Additional payments were made over the following years and an option was granted to Bayer to acquire a royalty bearing license for up to six strains. The majority of the contracted work was completed in 1Q:24. The products in development are intended for the consumer health space.

Success here could provide much needed capital to support Azitra’s pipeline. However, Bayer is in the throes of a reorganization which has slowed interactions with the large pharmaceutical company. Bayer has trimmed its executive team to eight people, down from 14, as part of a major operating overhaul announced in January. Among those out of work are Anne-Grethe Mortensen, head of global marketing; Gerd Krüger, head of radiology; and Heiko Schipper, president of the company’s consumer health division. CMO Michael Devoy will retain his role but will no longer be part of the leadership team. Azitra management has noted that none of the executives involved in the microbial program have left the company.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives quarterly payments totaling a maximum fee of up to $40,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.

________________________

1. The designation for Azitra’s genetically engineered strain of S. epidermidis was SE351 during the preclinical development stage.

2. Spent broth from bacterial protein production refers to the liquid medium or culture that remains after bacteria have been grown and the desired protein product has been extracted or harvested. In biotechnology and biopharmaceutical manufacturing processes, bacteria are often used as host organisms for the production of recombinant proteins. These bacteria are typically grown in fermentation systems, where they are cultured in a nutrient-rich liquid medium or broth. During the fermentation process, the bacteria consume the nutrients in the broth and produce the desired protein product. After the fermentation process is complete, the bacterial cells are separated from the broth, and the protein product is extracted or purified from the culture medium. The remaining liquid, which is depleted of nutrients and contains various metabolic byproducts and waste materials produced by the bacteria during growth and protein production, is referred to as the spent broth.

3. Sachen, K.L., et al. Role of IL-36 cytokines in psoriasis and other inflammatory skin conditions. Cytokine, August 2022.