At the 2024 Consumer Electronics Show (CES), held in Las Vegas in January, automobiles took centre-stage. Some commentators even stated that the event, which allows innovators to showcase the most cutting-edge technologies in the world, almost felt like a motor show.

Cars do have that glitz, that glamour. And, in recent times, it appears that a spark has injected new energy into the sector. But what are some of the key forces helping the automotive sector cruise to triumph, stealing technology shows and delivering noteworthy market performance? Let’s discuss.

Many contributors to performance

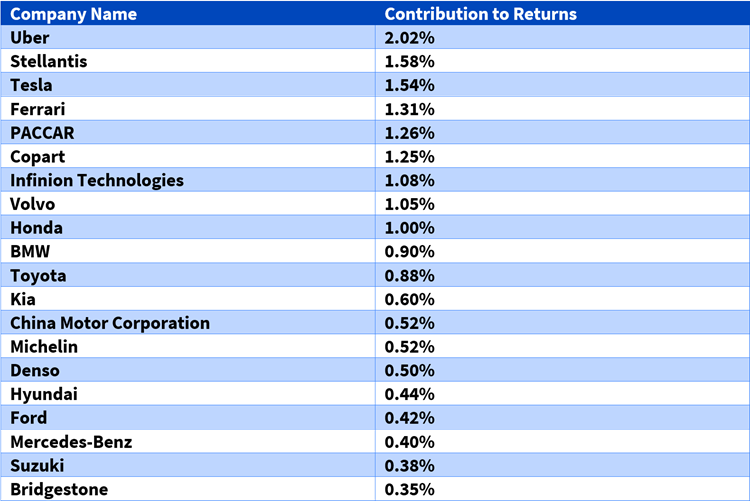

In 2023, there was a lot of talk about how a handful of stocks drove the performance of various market benchmarks. The term ‘magnificent seven’ was coined for the top performers in the NASDAQ 100 and S&P 500. Interestingly, contributions to positive performance in the automotive industry came from a wider range of sources. This is a positive sign and highlights how the wider industry is participating in the upside, not just a handful of companies.

Table 1: Top 20 contributors to returns in 2023 for the WisdomTree Berylls LeanVal Global Automotive Innovators Index

Source: WisdomTree, FactSet, data as of 29 December 2023. Numbers represent the contribution to returns for the net total return index.

Historical performance is not an indication of future performance and any investments may go down in value.

The electrification megatrend

As of the end of November 2023, more than 12 million plug-in electric cars were registered around the world, more than all of 2022 (10 million units). Total sales for 2023, including December, are expected to reach 13.5 million units1.

Electrification has stirred the entire automotive value chain. This includes suppliers, like battery manufacturers, and enablers, such as charging infrastructure providers. Not only has the introduction of a new powertrain induced more competition among automakers to introduce a wider menu of options at different price brackets, but it has also created a race among battery manufacturers to develop more efficient batteries that offer a longer range and charging infrastructure providers to quickly spread their network.

A new wave of innovations

Electrification appears to have catalysed a new wave of innovations within the sector. One example is vehicle-to-grid technology, something we discussed in a recent blog. The idea here is that the battery inside an Electric Vehicle (EV) can be used to power homes when needed or sell surplus energy back to the grid, once bidirectional charging becomes available. Some cars, such as the Kia EV6, already offer this capability helping them stand out against the competition and giving them a head start when regulation permits this technology to be widely used.

Toyota also captivated markets last year by making bold claims about how close it was to commercialising solid-state batteries, a potential game changer technology that could significantly improve EV driving range and reduce charging times.

Such innovations have created a lot of excitement for the automotive sector, driving the share price performance for many companies in 2023. This trend of companies announcing new cutting-edge innovations and markets reacting with enthusiasm could very easily continue in 2024.

New players in the market

Among the top 10 plug-in electric cars sold worldwide in November 2023, eight were made by Chinese brands. Five out of the eight were made by BYD – a company that dethroned Tesla in the fourth quarter of 2023 as the leading seller of EVs worldwide. The FT reported on 2 January 2024 that Tesla had delivered 484,000 cars in the fourth quarter of last year versus BYD’s 526,000 battery-powered car deliveries. BYD, a group Warren Buffett has been investing in since 2008, has redefined itself from being a leading battery manufacturer to also being a leading EV manufacturer over a span of just a few years. And, after dominating the local market, it now has big plans for global expansion.

Nonetheless, Chinese stocks were engulfed in negative sentiment due to macroeconomic reasons last year. Within the WisdomTree Berylls LeanVal Global Automotive Innovators Index, Chinese companies contributed -2.92% to returns, while the index was up over 21.75% overall2. Arguably, if the macro headwinds for Chinese stocks subside, and performance is more in line with the promising underlying story for Chinese automakers, this could become another source of positive performance.

Artificial Intelligence

At CES 2024, leading manufacturers including Volkswagen, Mercedes Benz, and BMW all unveiled how digital assistants powered by generative AI will become mainstream in car infotainment systems3. Voice commands to a generative AI powered assistants will not only enhance the user experience, but also improve safety with the assistant being able to ‘answer’ complex questions about the vehicle.

The new breed of cars, which are often touted to be ‘computers on wheels’, presents itself as a very exciting frontier for the integration of AI tools. And this is not just limited to autonomous driving but across all features of car maintenance and user experience. And we know the AI revolution is only just getting started.

Japan

Japanese exporters received a tailwind from macroeconomic forces last year. Japan was the second highest contributor to returns among all countries last year for the WisdomTree Berylls LeanVal Global Automotive Innovators Index, adding 5.4% to overall performance4. Japan has historically been a behemoth in the automotive industry but is now looking to reinvent itself, considering changing technology and new competition. But, positive momentum for the broader Japanese stock market, supported by rising capital expenditures, increasing wages, and corporate reforms, could continue to fuel Japan’s automotive sector in 2024.

Conclusion

The automotive sector’s journey to market success is marked by a dynamic landscape of contributors, from the electrification megatrend propelling innovation to the emergence of new global players, like BYD. As the industry embraces cutting-edge technologies, such as generative AI – showcased at CES 2024, and Japanese exporters ride the macroeconomic wave, the road to riches in the automotive market is paved with a diverse array of forces driving growth and innovation in 2024.

Sources

1 Inside EVs, as of January 2024.

2 WisdomTree Berylls LeanVal Global Automotive Innovators Net Total Return Index

3 C2A security, January 2024.

4 WisdomTree Berylls LeanVal Global Automotive Innovators Net Total Return Index

—

Originally Posted February 12, 2024 – The Road to Riches: Decoding the Automotive Sector’s Market Success

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.