Key takeaways

January 19 deadline

If Congress doesn’t pass spending bills by the deadline, parts of the government may shut down.

Limited market impact?

Past shutdowns, but not all, led to market volatility, which tended to resolve quickly with minimal to no impact.

Think long-term

Don’t let any short-term market volatility from a government shutdown impact your long-term investing plan.

It’s a new year, and new US government shutdown deadlines are already on the horizon. Some agencies are facing a funding deadline of January 19, and others face a deadline of February 2. While a prolonged period of policy uncertainty typically increases market volatility, past shutdowns have tended to be resolved quickly with minimal to no impact on markets. That’s why it makes sense to stick to a long-term investment plan. Here are three things for investors to keep in mind about government shutdowns.

1. Shutdowns are relatively common and tend to resolve quickly

There have been 21 government shutdowns in US history according to the US Treasury. They’ve been resolved, on average, within eight days. Five only lasted a day. The longest lasted 34 days.1

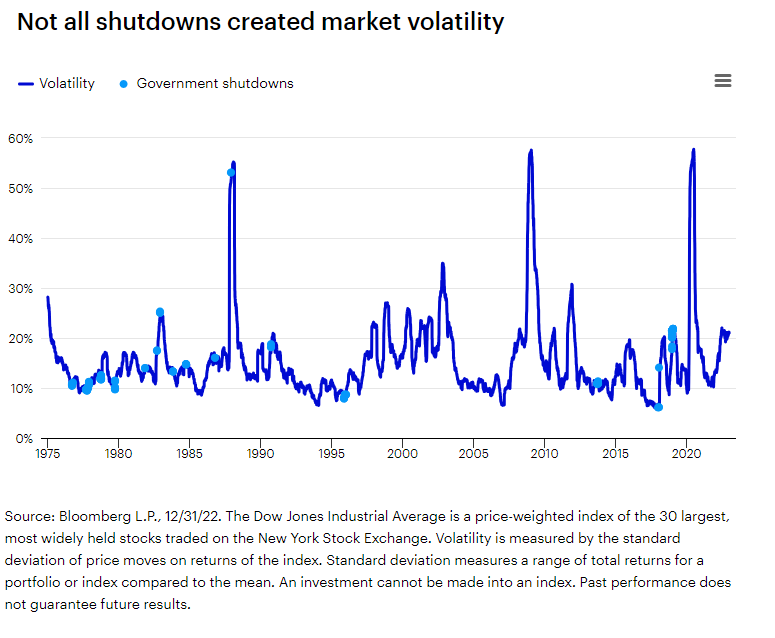

2. Volatility increased in some, but not all, past shutdowns

Market volatility often results from policy uncertainty. While there are examples of heightened volatility, for the most part, it’s been generally benign during past government shutdowns.

3. Stocks, on average, advanced despite shutdowns

While the S&P 500 Index, on average, churned in the days leading up to and during government shutdowns, it advanced in the aftermath.2 The Index also posted positive returns during 12 of the 21 government shutdowns. The average return during the shutdowns is 0.1%.3 (Remember, shutdowns have been resolved, on average, within eight days.) Plus, despite experiencing 21 government shutdowns along the way, a $100,000 investment in the S&P 500 Index in 1957 would be worth $8.3 million today.4

Stick to long-term investing plans

While unnerving, concerns about shutdowns shouldn’t change investors’ long-term investment plans. This isn’t the first government shutdown, and it’s likely not the last. Ultimately, I’d expect the spending bills to pass without incident. As Winston Churchill may have said, “Americans always do the right thing, but only after exhausting all other options.”

Footnotes

- Source: US Treasury, 8/31/23

- Source: Bloomberg L.P., 8/31/2023. An investment cannot be made into an index. Past performance does not guarantee future results.

- Source: Bloomberg, L.P. 12/31/22. An investment cannot be made into an index. Past performance does not guarantee future results.

- Sources: Bloomberg L.P. and US Treasury, 12/31/22. The S&P 500 Index is a market-capitalization-weighted index of the 500 largest domestic US stocks. An investment cannot be made into an index. Past performance does not guarantee future results.

—

Originally Posted January 10, 2024

What investors need to know about government shutdowns by Invesco US

Important Information

NA3313175

Past performance is not a guarantee of future results.

Indexes are unmanaged and cannot be purchased directly by investors. Index performance is shown for illustrative purposes only and does not predict or depict the performance of any investment.

Past performance does not guarantee future results.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions.

All investing involves risk, including the risk of loss.

In general, stock values fluctuate, sometimes widely, in response to activities specific to the company as well as general market, economic and political conditions.

The opinions referenced above are those of the author as of September 18, 2023. These comments should not be construed as recommendations, but as an illustration of broader themes. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

Disclosure: Invesco US

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial advisor/financial consultant before making any investment decisions. Invesco does not provide tax advice. The tax information contained herein is general and is not exhaustive by nature. Federal and state tax laws are complex and constantly changing. Investors should always consult their own legal or tax professional for information concerning their individual situation. The opinions expressed are those of the authors, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

NOT FDIC INSURED

MAY LOSE VALUE

NO BANK GUARANTEE

All data provided by Invesco unless otherwise noted.

Invesco Distributors, Inc. is the US distributor for Invesco Ltd.’s Retail Products and Collective Trust Funds. Institutional Separate Accounts and Separately Managed Accounts are offered by affiliated investment advisers, which provide investment advisory services and do not sell securities. These firms, like Invesco Distributors, Inc., are indirect, wholly owned subsidiaries of Invesco Ltd.

©2022 Invesco Ltd. All rights reserved.

Before investing, carefully read the prospectus and/or summary prospectus and carefully consider the investment objectives, risks, charges and expenses.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Invesco US and is being posted with its permission. The views expressed in this material are solely those of the author and/or Invesco US and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.